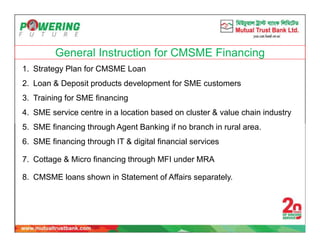

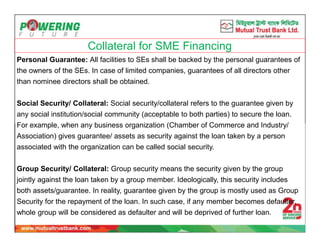

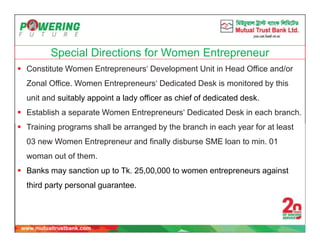

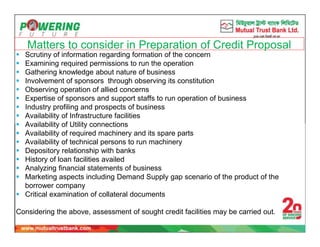

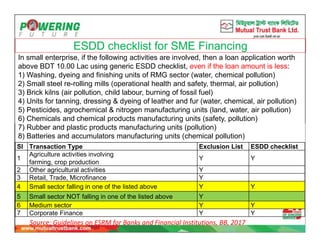

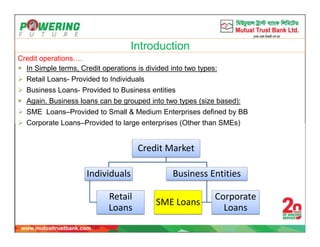

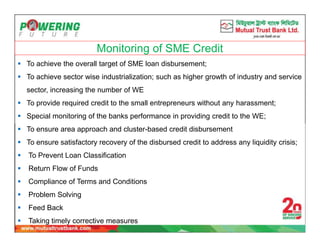

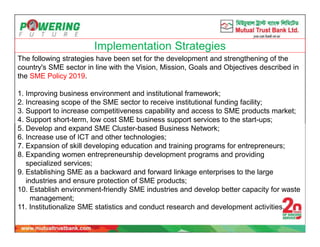

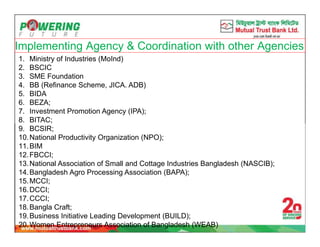

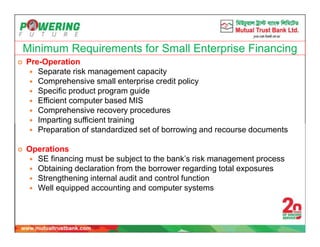

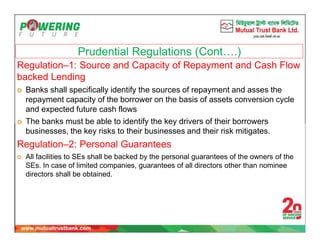

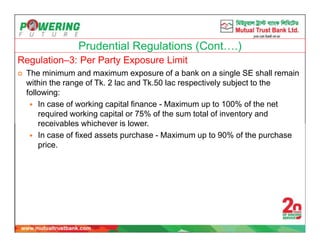

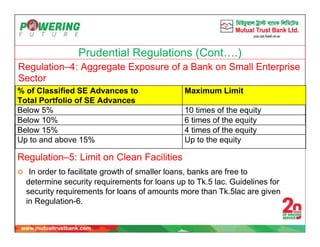

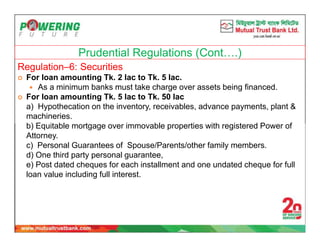

The document discusses small and medium enterprise (SME) financing policies and programs in Bangladesh. It provides an overview of SME credit operations and definitions. The Bangladesh Bank (BB) has introduced several programmes to expand SMEs, including priority lending to small entrepreneurs and women entrepreneurs. BB monitors SME credit disbursement and recovery. Regulations for SME financing include requiring cash flow analysis, personal guarantees, exposure limits, and security requirements that vary based on loan size. The implementation of strategies aims to improve access to finance, technology, markets and training to develop Bangladesh's SME sector.

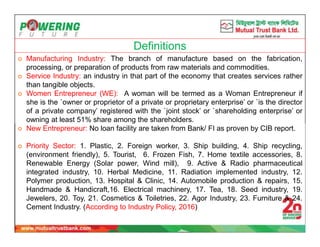

![Definition of CMSME (as per National Industrial Policy, 2016)

Industry/

Enterprise

Industry/

Enterprise

Type

Fixed Assets

(Excluding Land

& Building)

[Million]

Employees Annual

Turnover

[ Million]

Loan

Limit

[Million]

Product

Cottage - Less than 1.00 15 Max - 1.50 Property Loan

Purpose: To purchase/

construct/renovate

house/Flat/commercial

space

Term loan

Purpose: For expansion

of business,

procurement of

machinery and other

fixed assets, seasonal

requirement, any valid

business requirement

Cash Credit

Purpose : For Working

capital requirement

Micro

Manufacturing 1.00 - 7.50 16-30 or less - 10.00

Service Less than 1.00 15 Max - 2.50

Small

Manufacturing 7.50-150.00 31-120 - 200.00

Service 1.00-20.00 16-50 - 50.00

Medium

Manufacturing 150.00 - 500.00

121-300

(Garments

1,000 Max) - 750.00

Service 20.00-300.00 51-120 - 500.00

Business/

Trading

Sector

Micro

Enterprise Less than 1.00 15 Max

20.00

max 5.00

Small

Enterprise 1.00-20.00 16-50

20.00

Min -

200.00

Max 50.00](https://image.slidesharecdn.com/smefinancing-200429141311/85/SME-Financing-28-320.jpg)