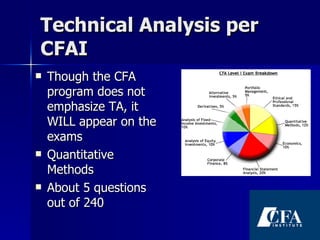

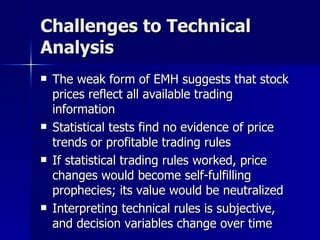

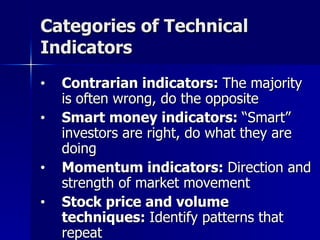

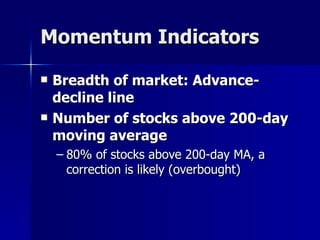

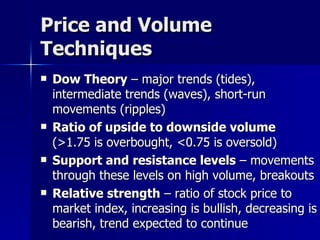

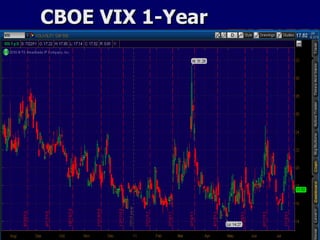

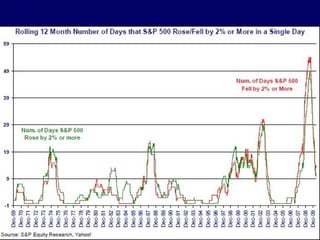

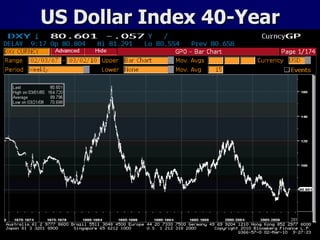

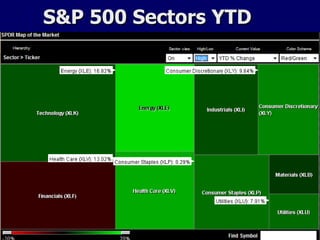

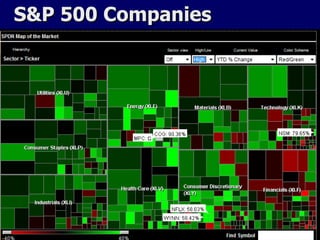

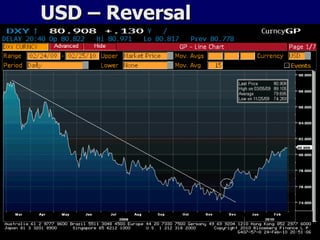

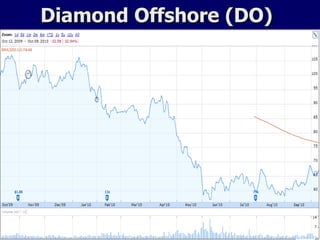

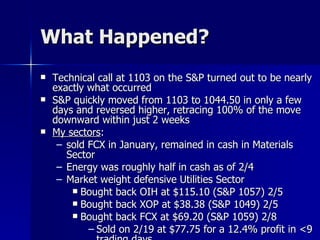

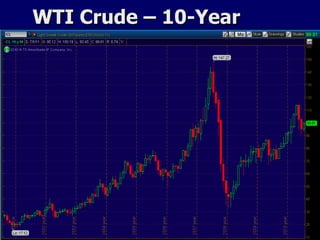

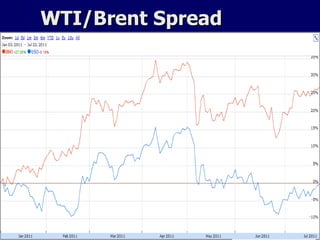

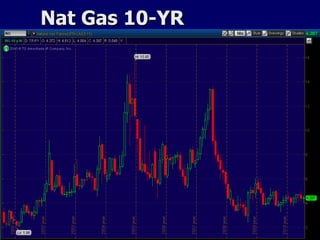

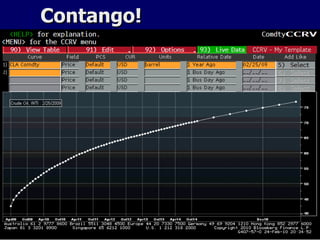

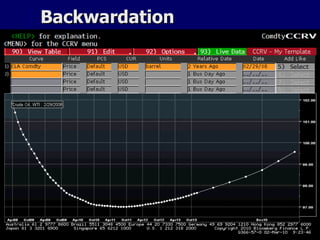

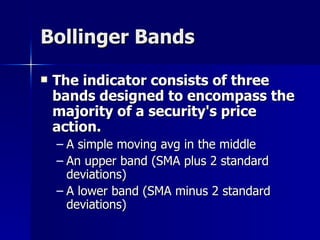

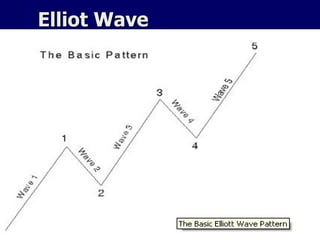

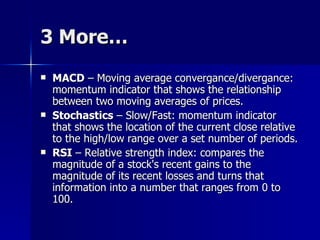

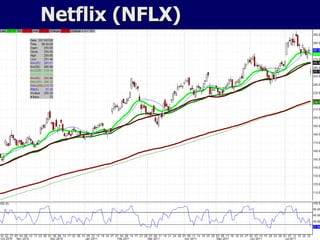

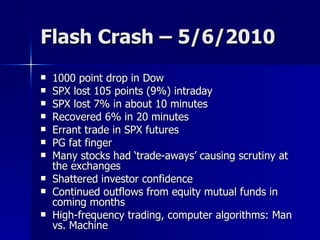

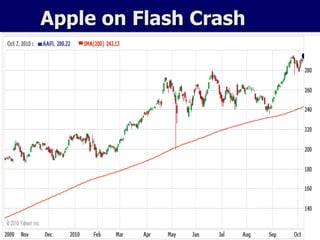

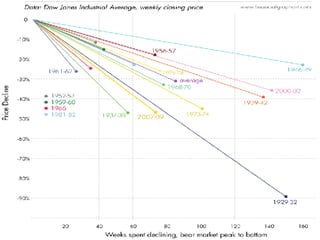

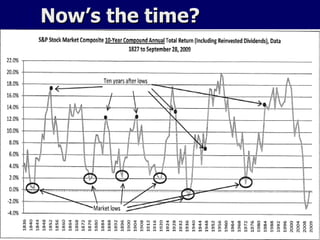

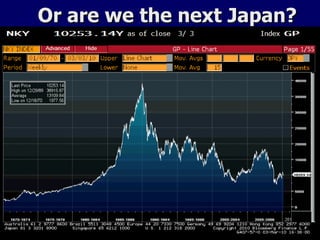

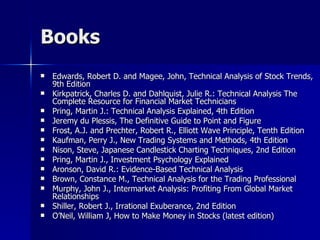

The document provides a summary of a technical and market analysis presentation by Mike Zaccardi. It defines technical analysis and its key assumptions. It outlines different categories of technical indicators like momentum, contrarian, and smart money indicators. It then analyzes current market conditions and provides charts and analysis of different indexes, commodities, sectors, and individual stocks. It concludes with a discussion of other technical analysis tools and resources for learning technical analysis.