The document provides an overview of the foreign currency market (forex), including:

- Forex is the world's largest financial market, with over $2 trillion traded daily.

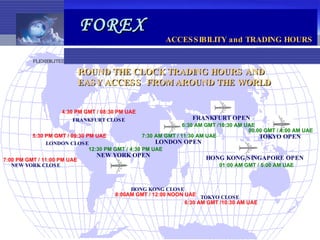

- It offers benefits like 24/7 accessibility, leverage, and competitive exchange rates.

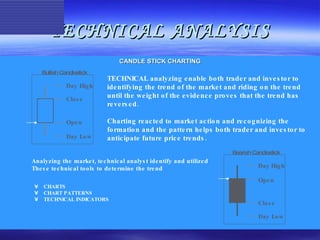

- Technical analysis and fundamental analysis are used to understand market trends and factors influencing currency values.

- Various trading strategies are described, like locking in profits, averaging positions, and reacting to breaks of support/resistance levels.

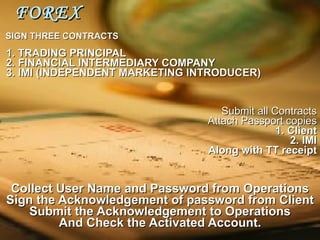

- The document outlines forex market participants, trading procedures, and the global accessibility of forex trading.