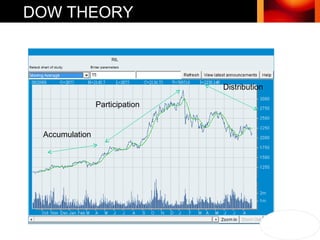

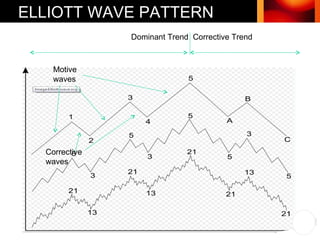

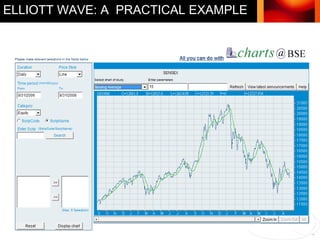

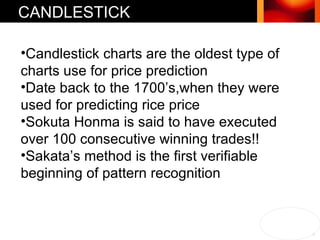

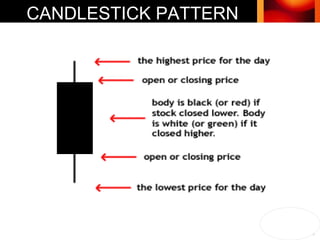

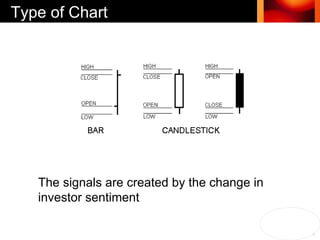

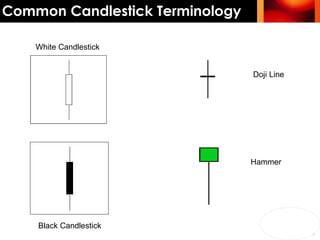

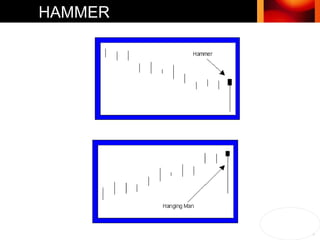

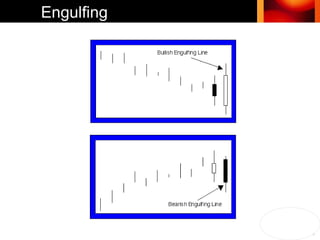

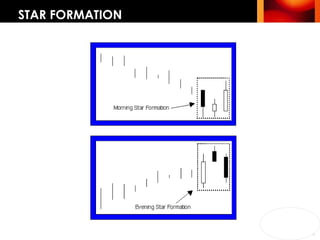

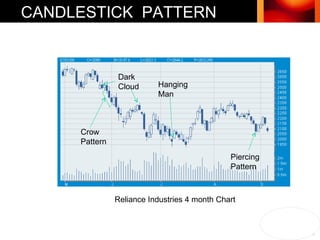

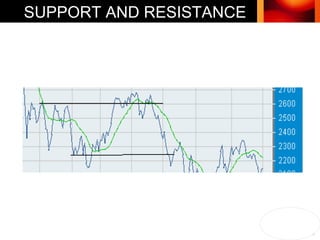

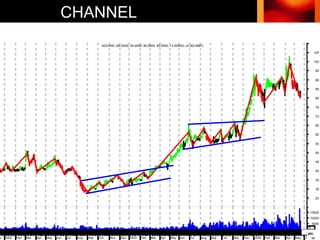

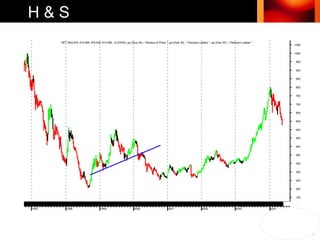

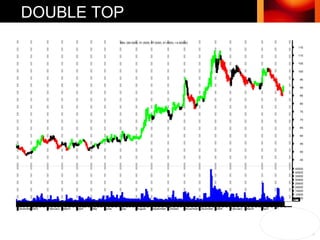

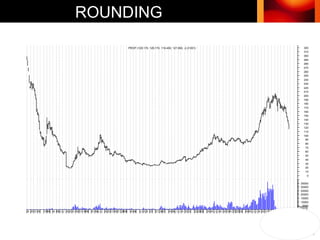

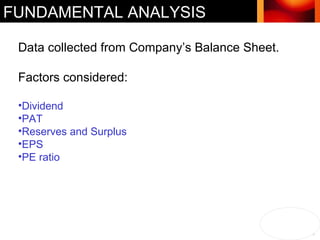

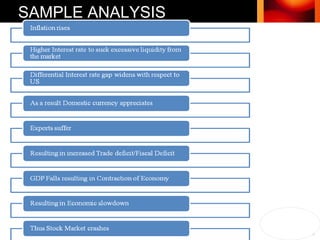

The document discusses various techniques for analyzing stocks and selecting companies to invest in, including fundamental analysis and technical analysis. It describes Dow Theory, Elliott Wave Theory, and candlestick patterns as technical analysis methods. It also covers the types of stock market participants, online trading mechanisms, and order placing on stock exchanges.