Embed presentation

Downloaded 239 times

![Commercial banks supporting

entrepreneurship development

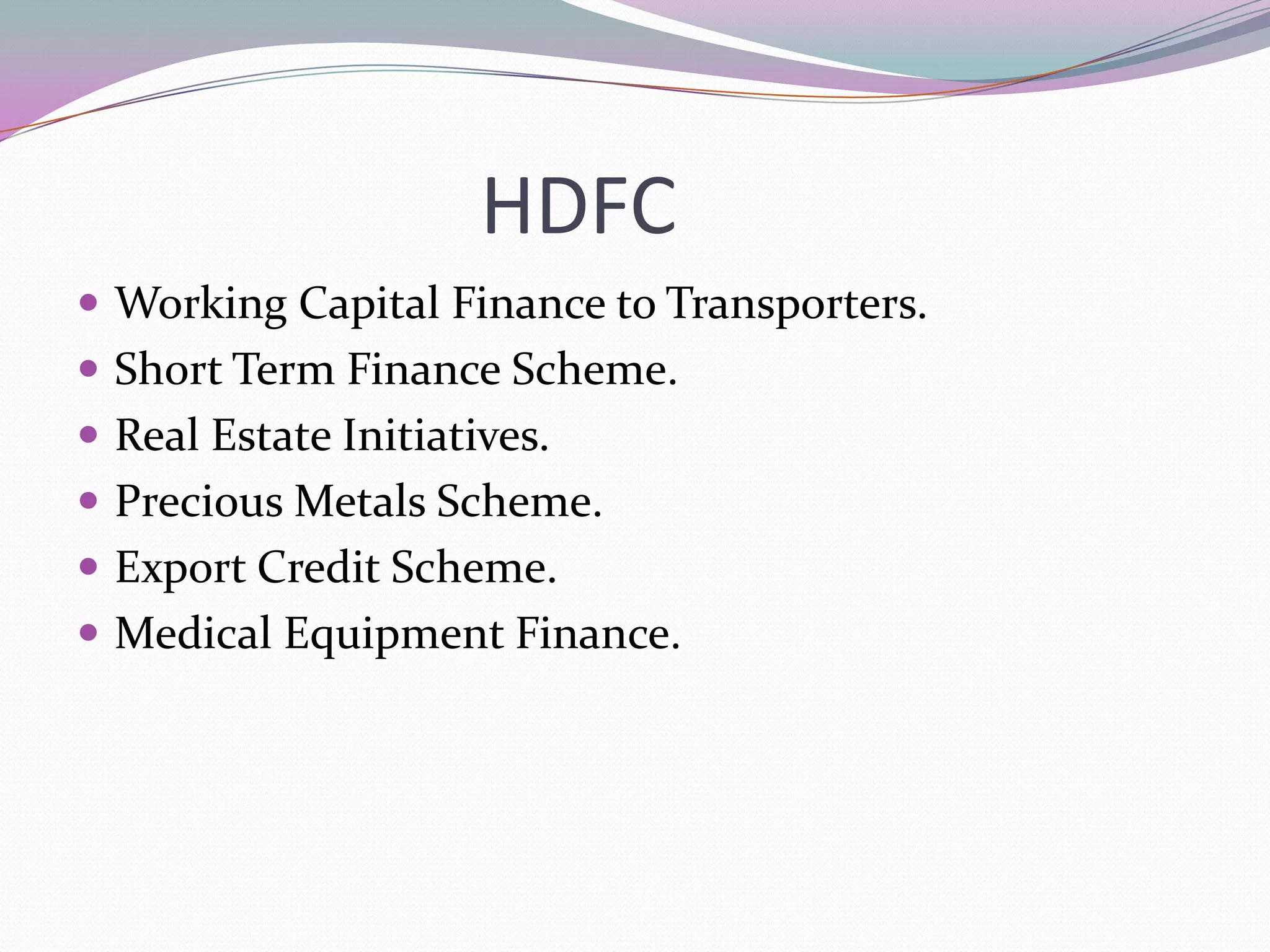

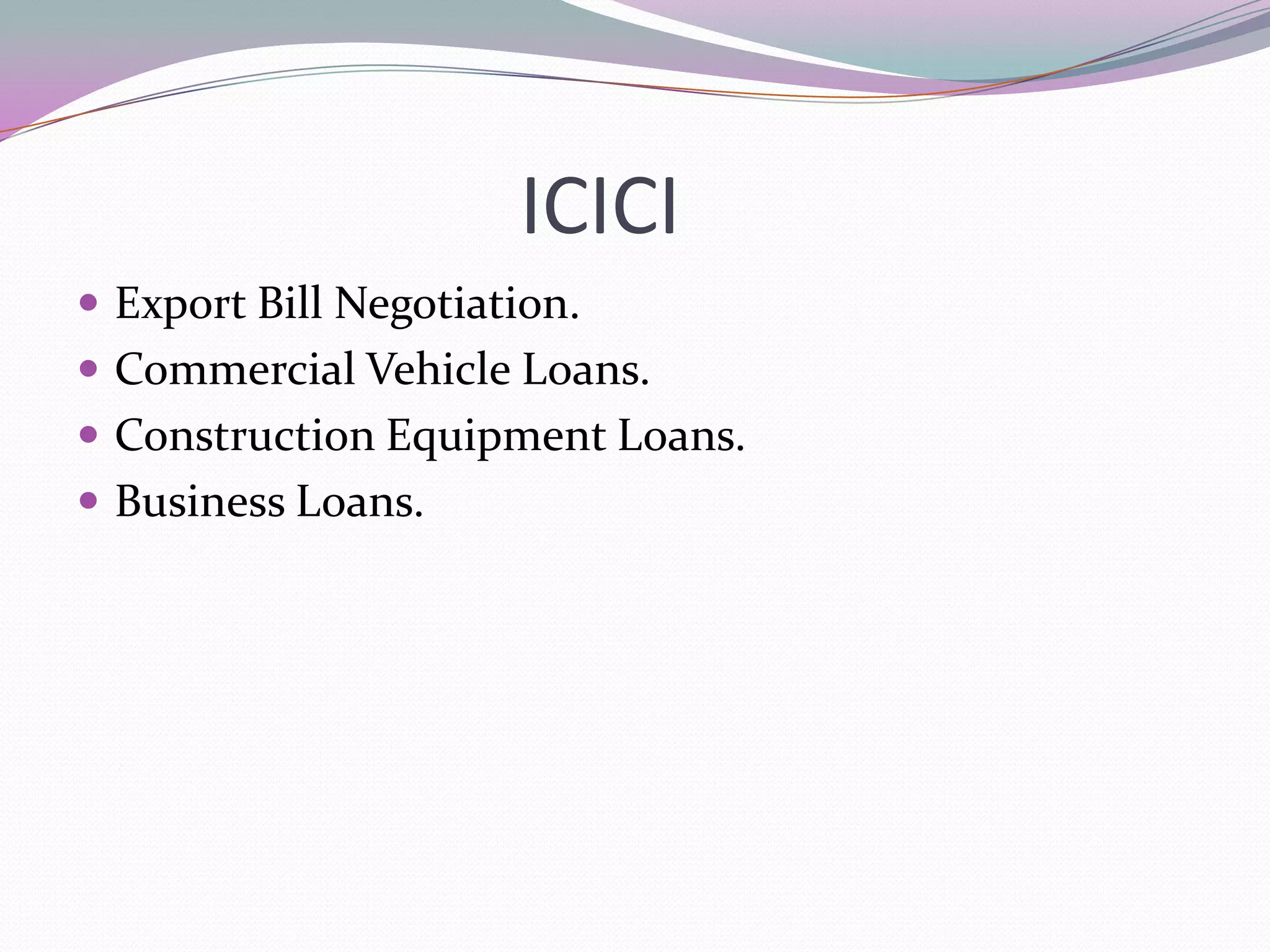

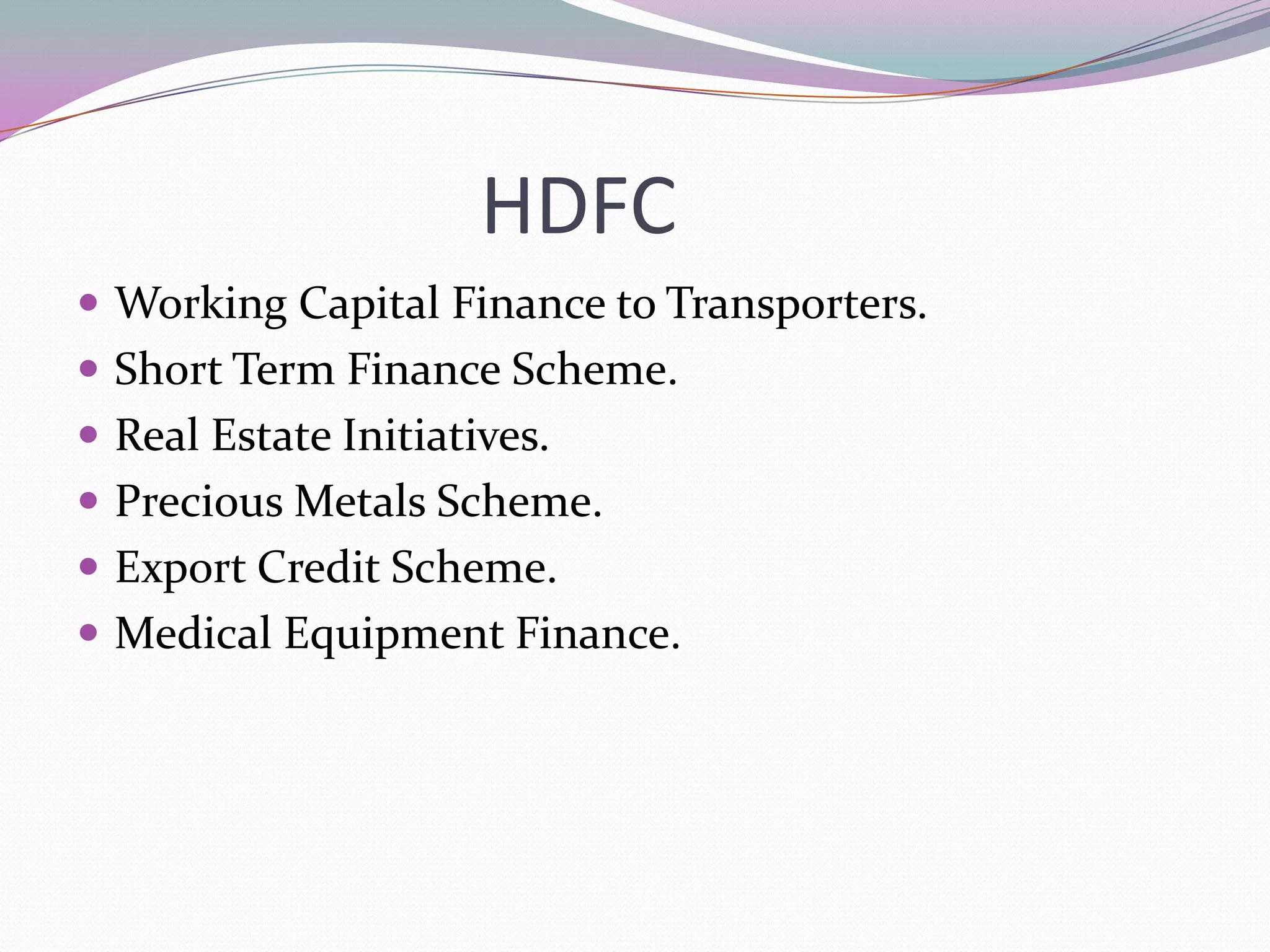

SIDBI [Small industries development bank of India].

HDFC [Housing development finance corporation]

ICICI [Industrial credit investment corp. of India]

IDBI [Industrial development bank of India].

Allahabad bank.

State bank of India.](https://image.slidesharecdn.com/schemesofferedbycommercialbanks-130925115741-phpapp02/75/Schemes-offered-by-commercial-banks-2-2048.jpg)

This document lists various entrepreneurship support programs offered by major commercial banks in India, including the Small Industries Development Bank of India (SIDBI), Housing Development Finance Corporation (HDFC), Industrial Credit and Investment Corporation of India (ICICI), Industrial Development Bank of India (IDBI), Allahabad Bank, and State Bank of India. It provides brief descriptions of financing schemes, loans, and other initiatives supported by each bank to promote small and medium enterprises.

![Commercial banks supporting

entrepreneurship development

SIDBI [Small industries development bank of India].

HDFC [Housing development finance corporation]

ICICI [Industrial credit investment corp. of India]

IDBI [Industrial development bank of India].

Allahabad bank.

State bank of India.](https://image.slidesharecdn.com/schemesofferedbycommercialbanks-130925115741-phpapp02/75/Schemes-offered-by-commercial-banks-2-2048.jpg)