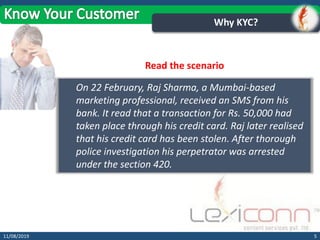

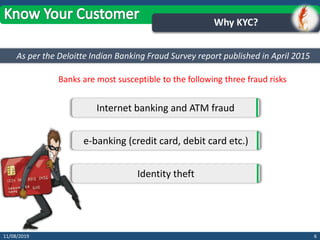

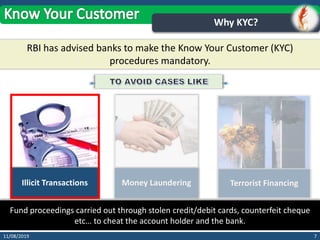

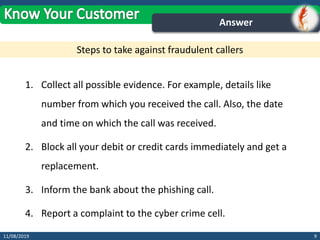

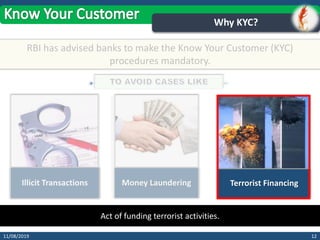

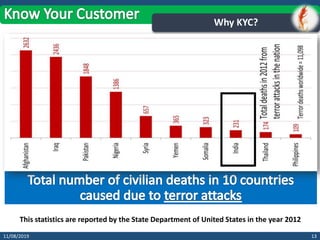

The document discusses Know Your Customer (KYC) norms and their importance. It begins by stating the session objectives of explaining the significance of KYC norms and why banks need to comply with them. It then provides examples of identity theft, credit card fraud, and money laundering to illustrate the risks banks face and why KYC procedures are necessary to prevent illicit transactions, money laundering, and terrorist financing. The document emphasizes that KYC norms issued by the Reserve Bank of India are aimed at arresting these criminal activities. It also notes exceptions for "no frills" accounts that have stricter limits on balances and credit amounts.