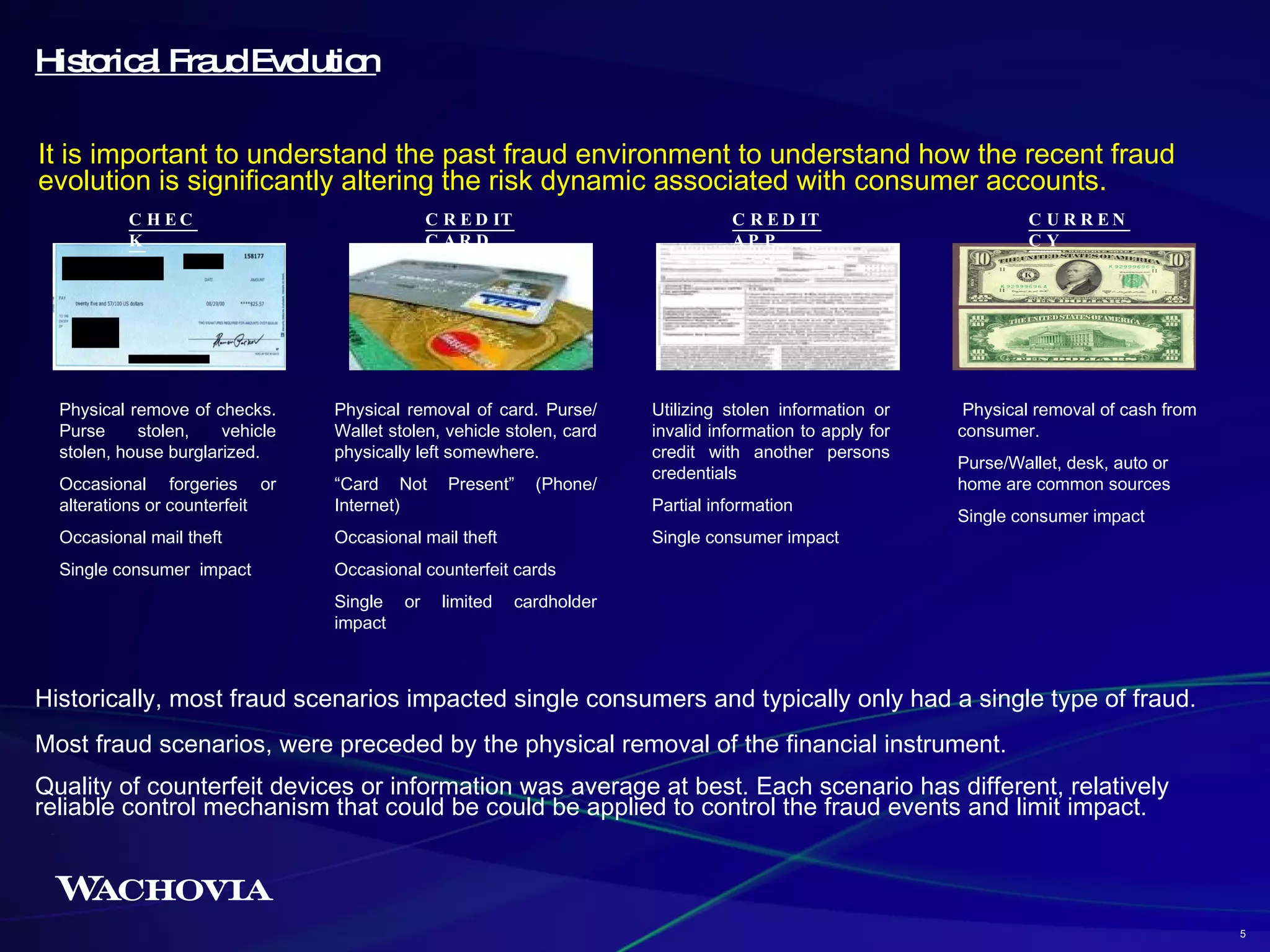

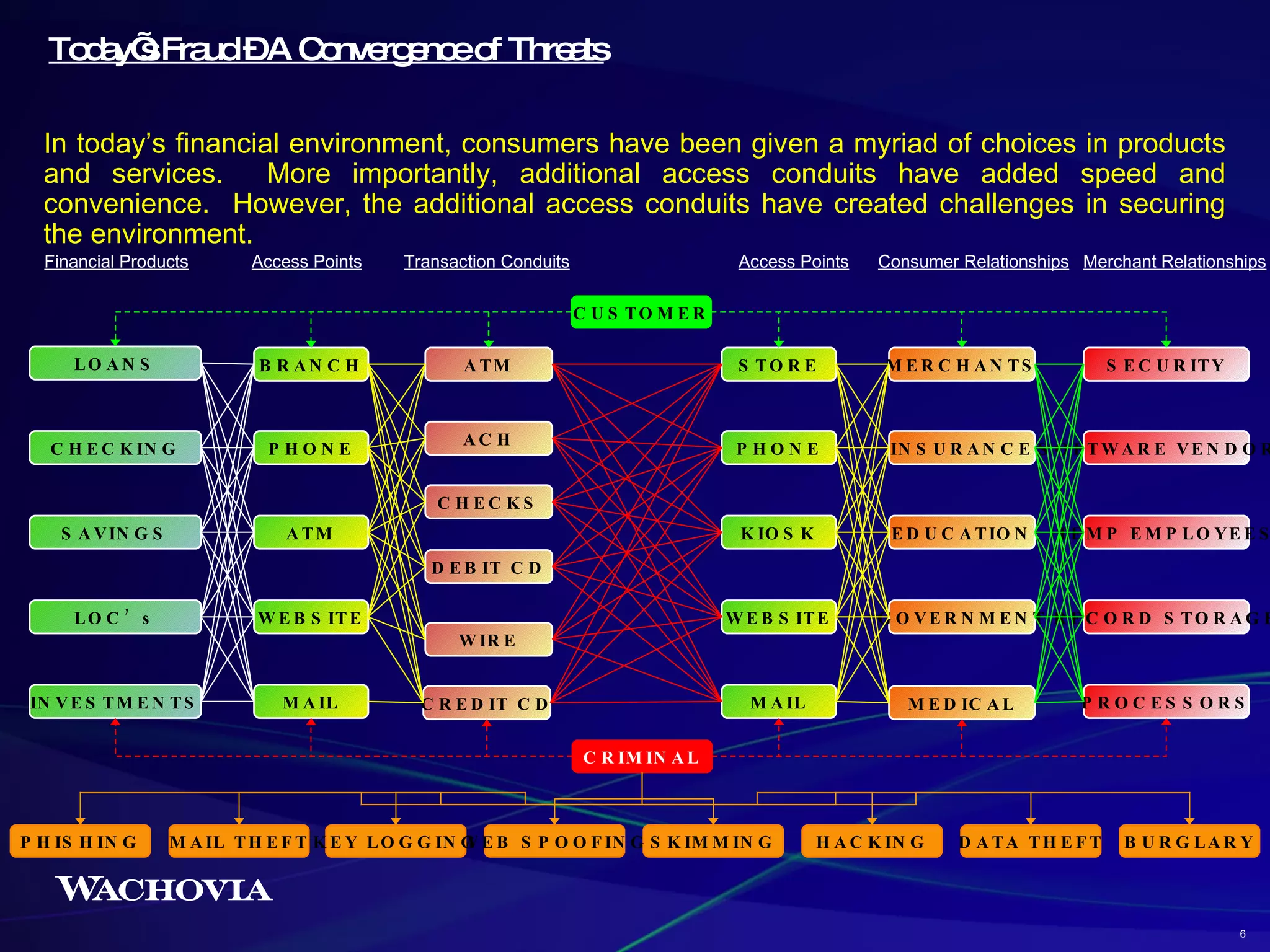

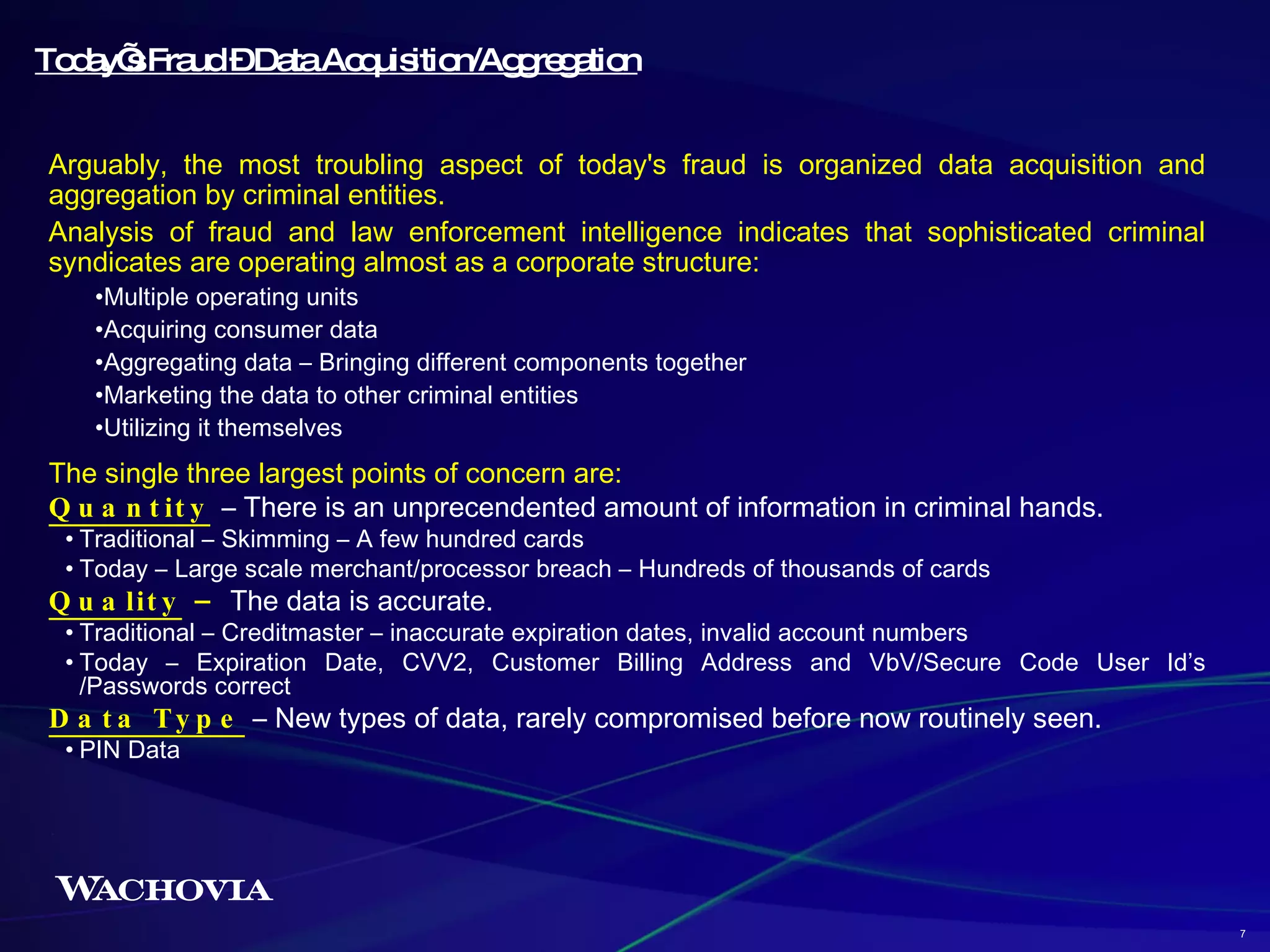

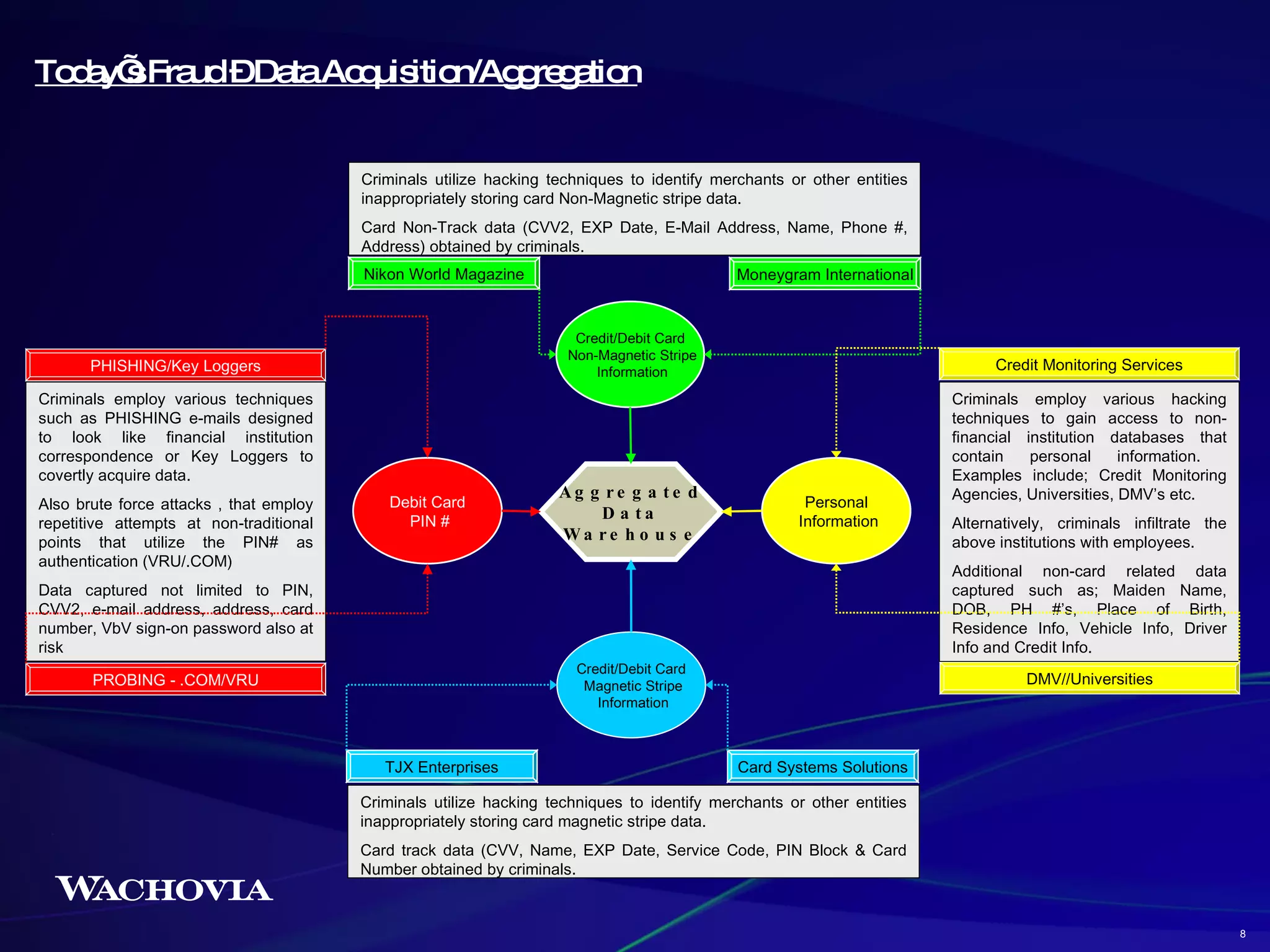

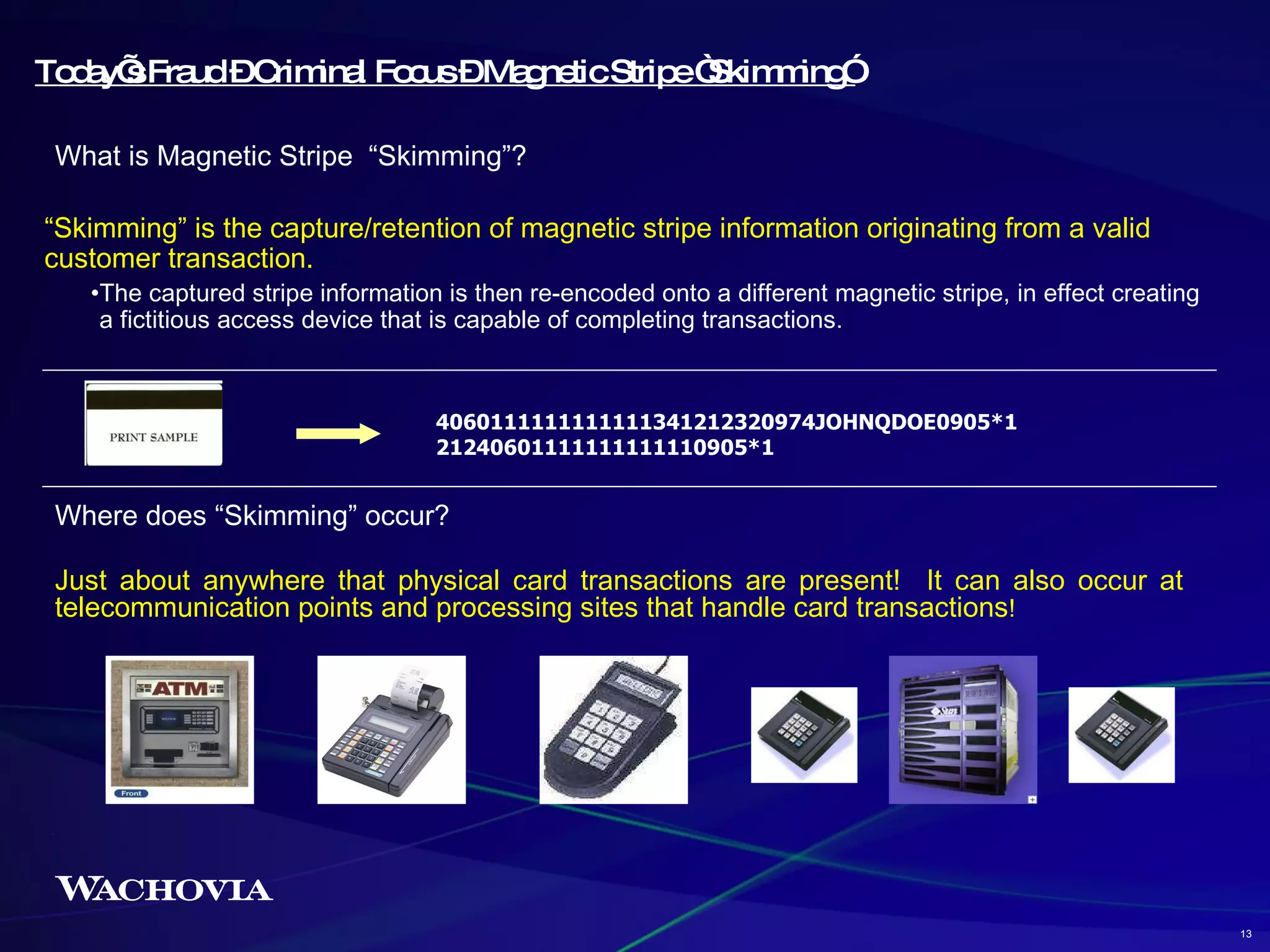

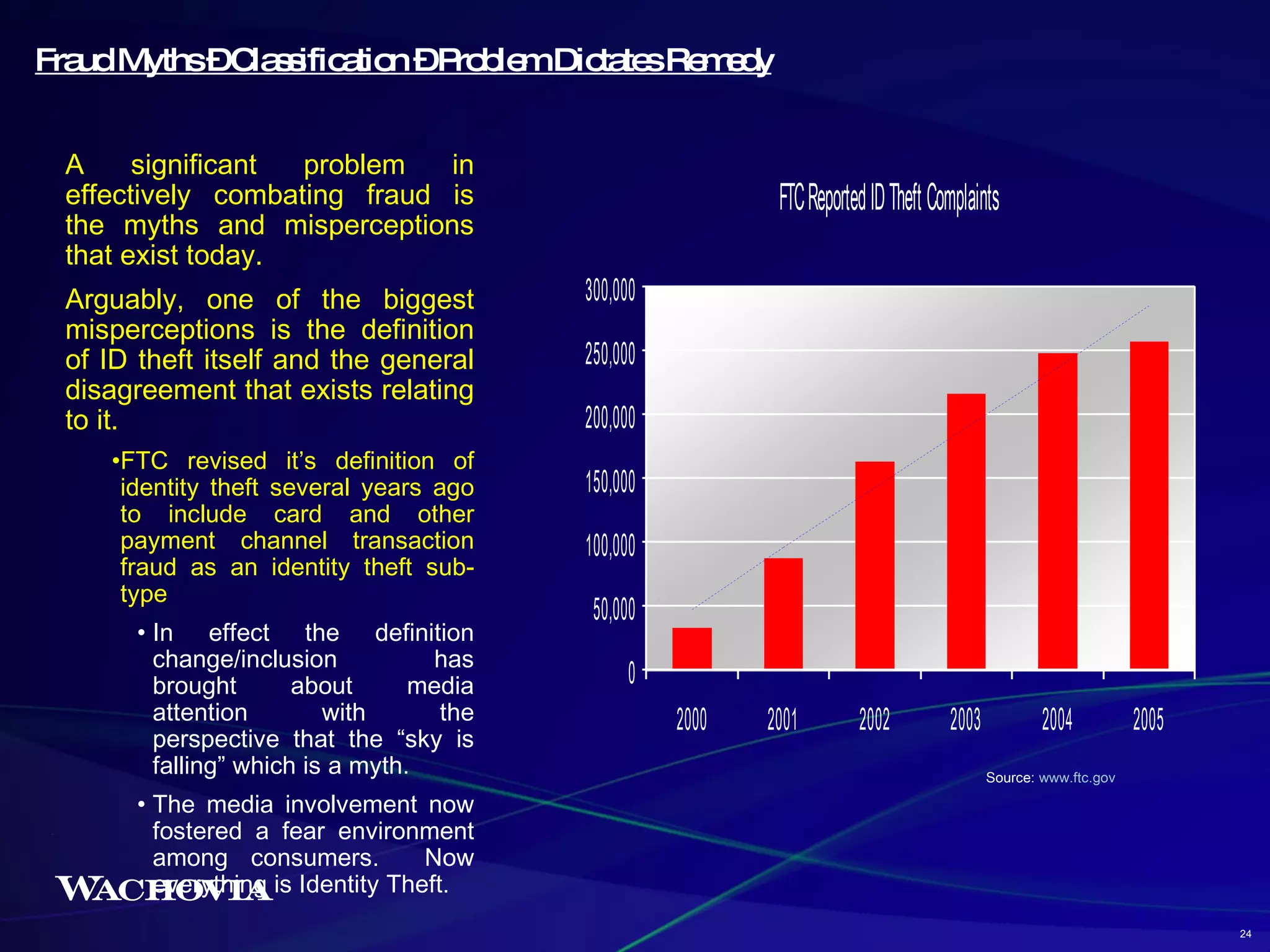

The document discusses the evolving landscape of card and identity fraud, noting that:

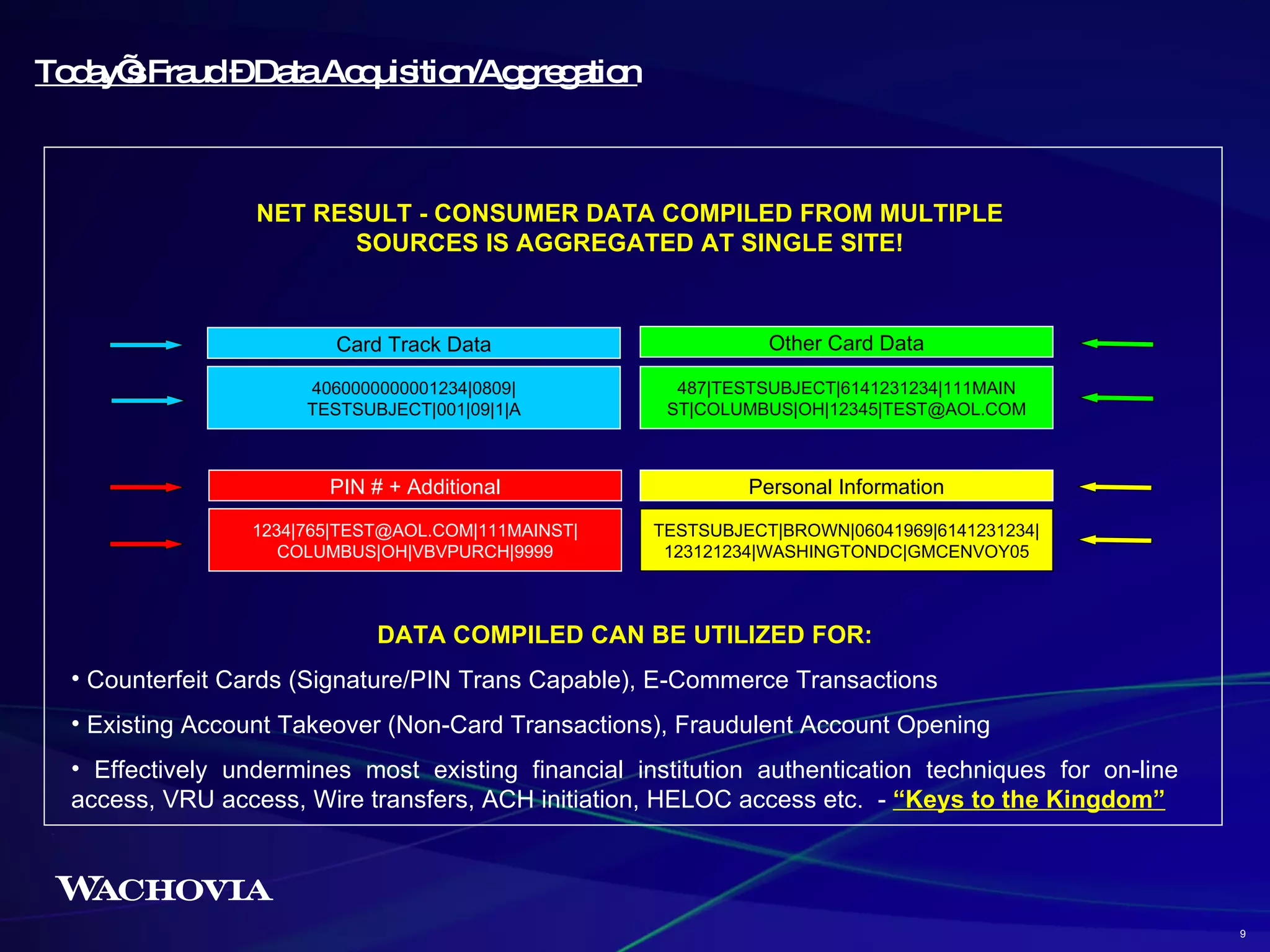

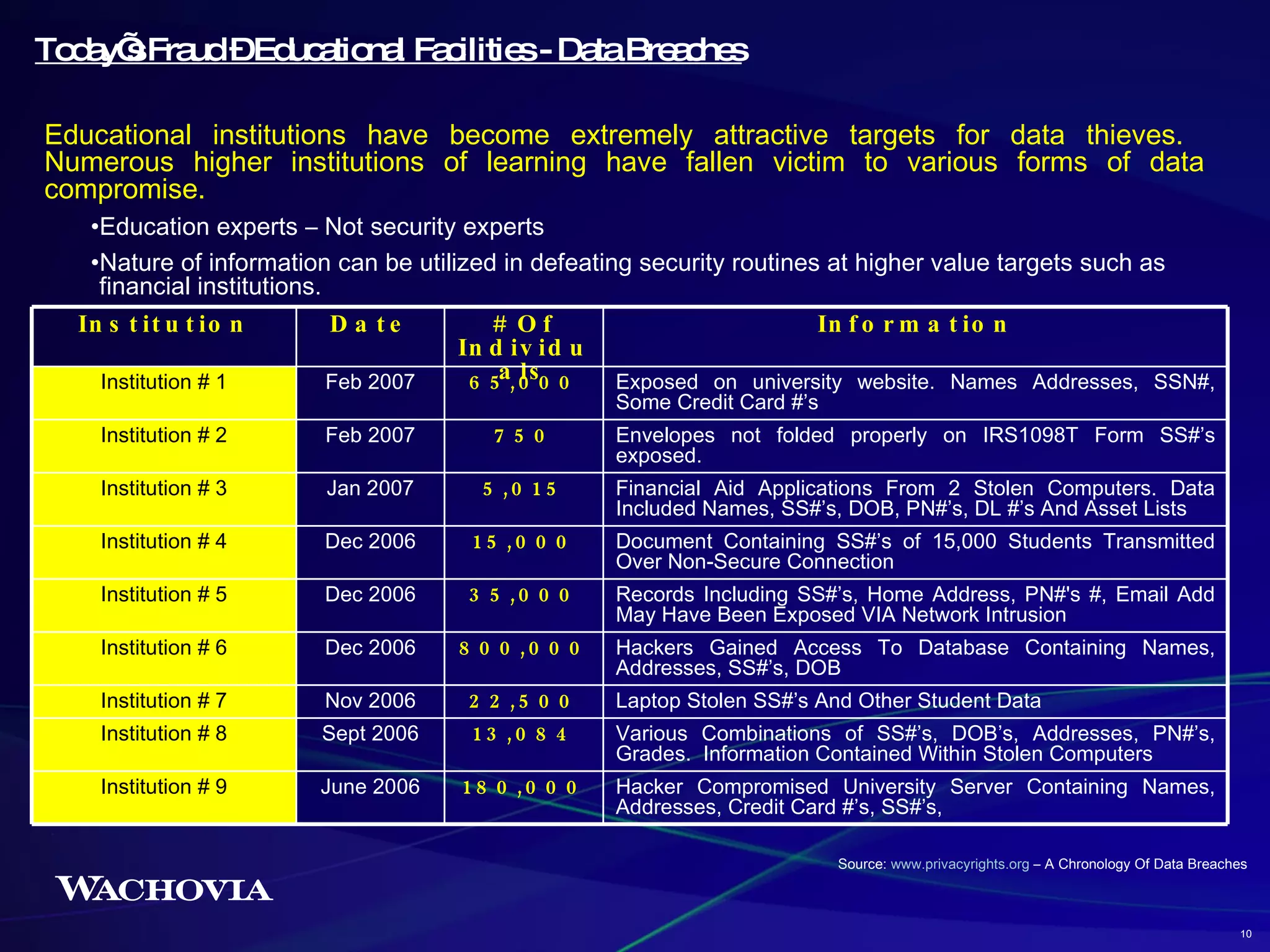

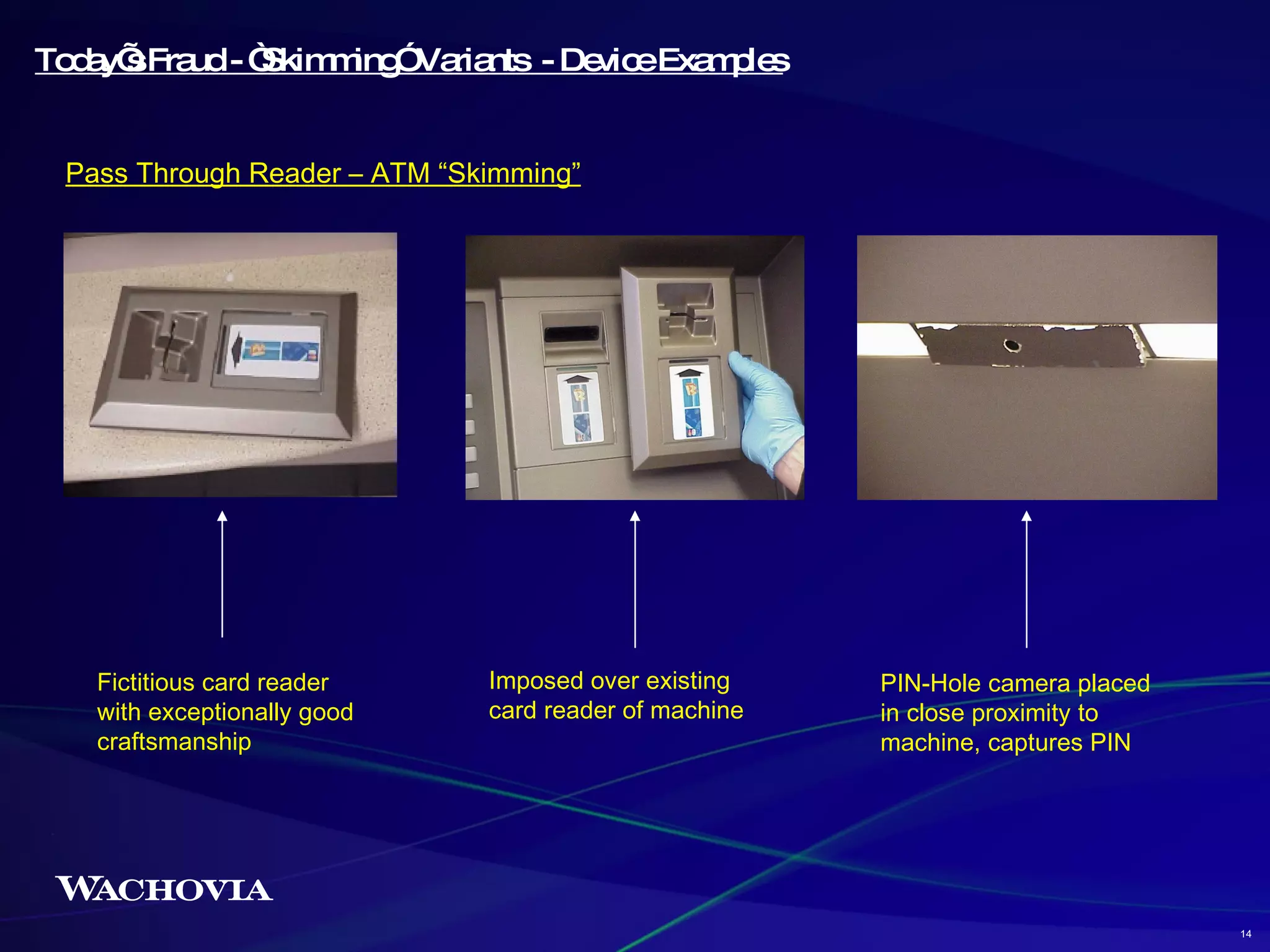

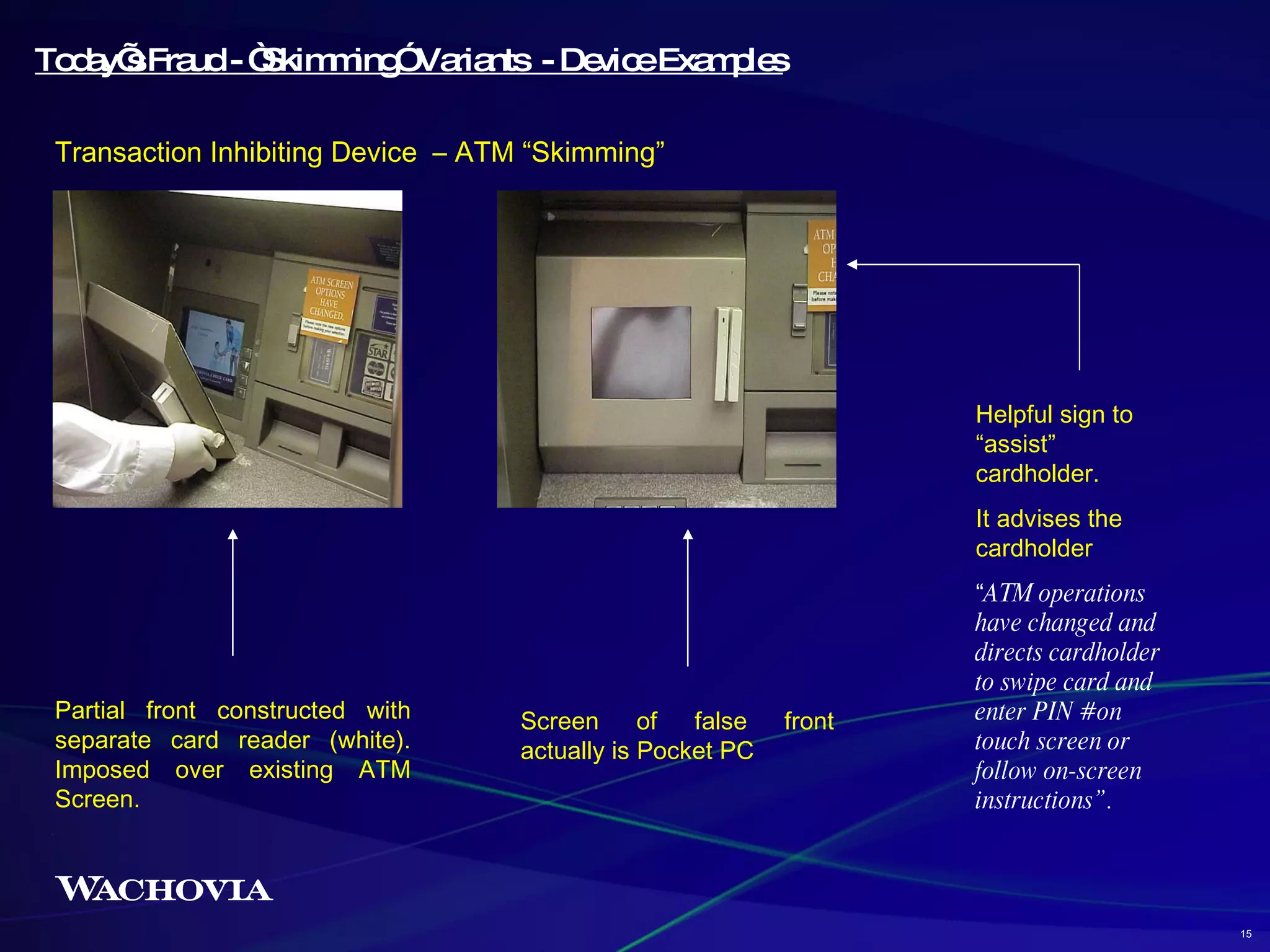

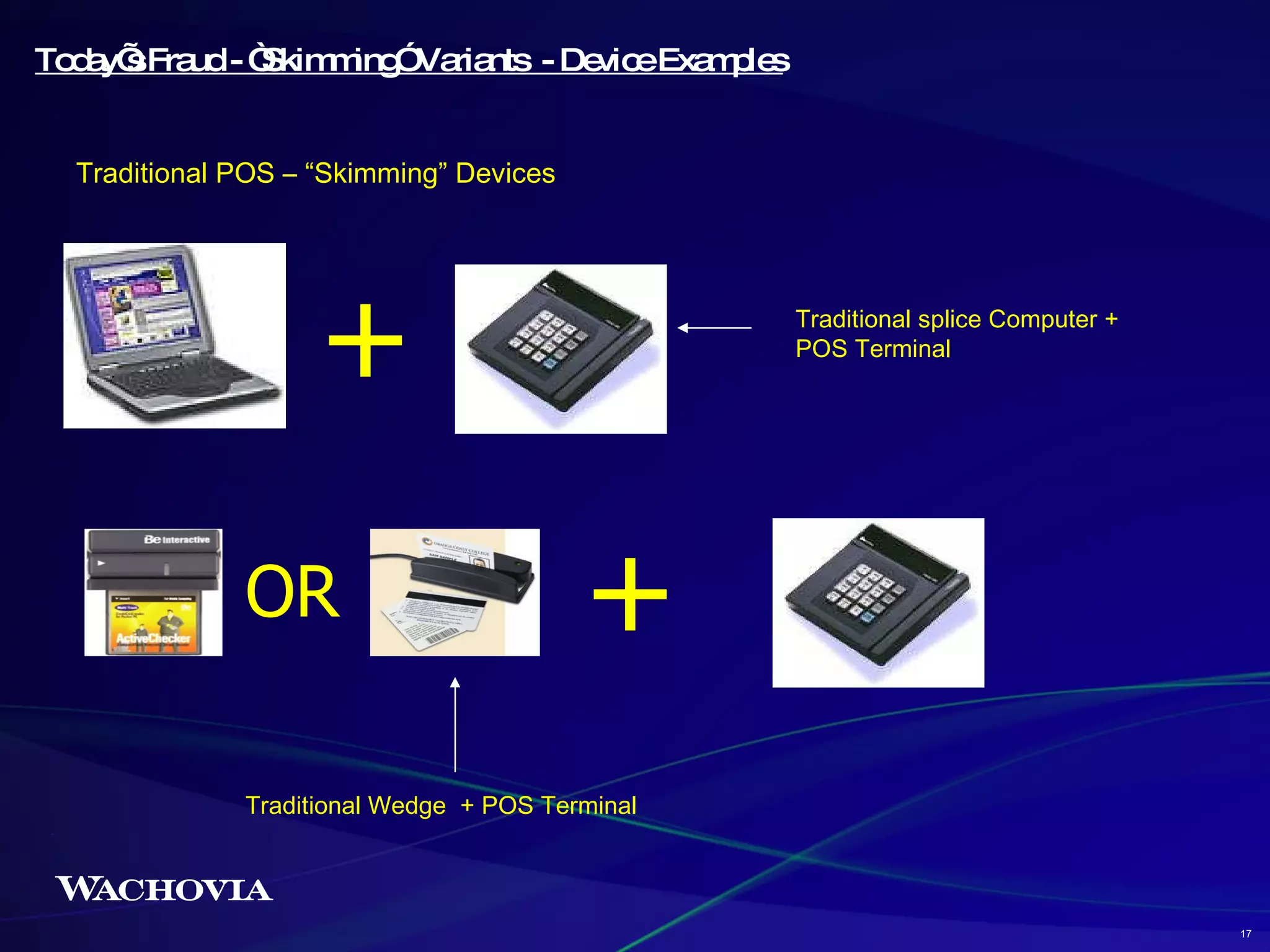

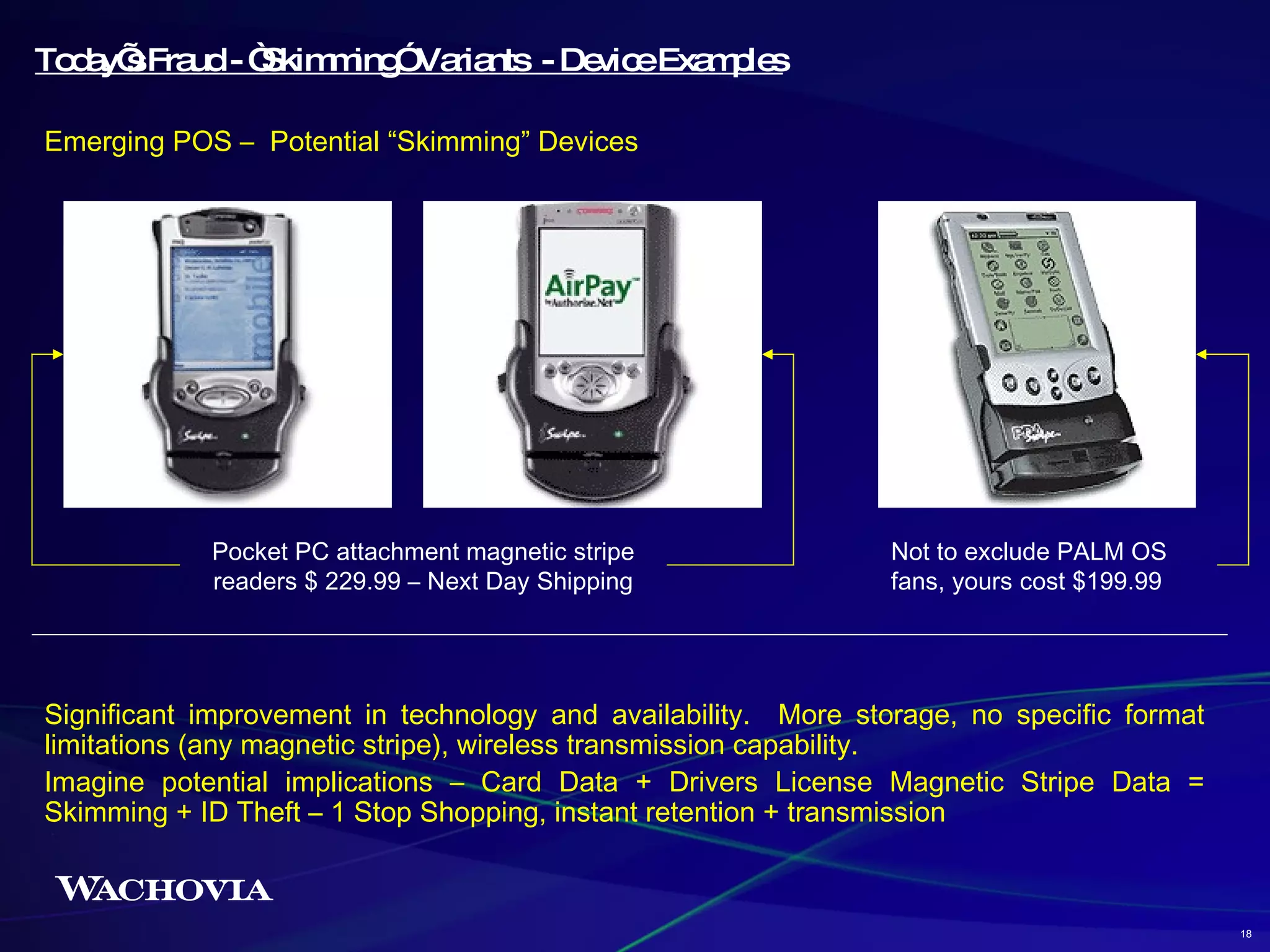

1) Today's fraud is more sophisticated, complex, and organized than historical fraud, with criminal groups acquiring large volumes of consumer data from multiple sources and using it for various fraud schemes.

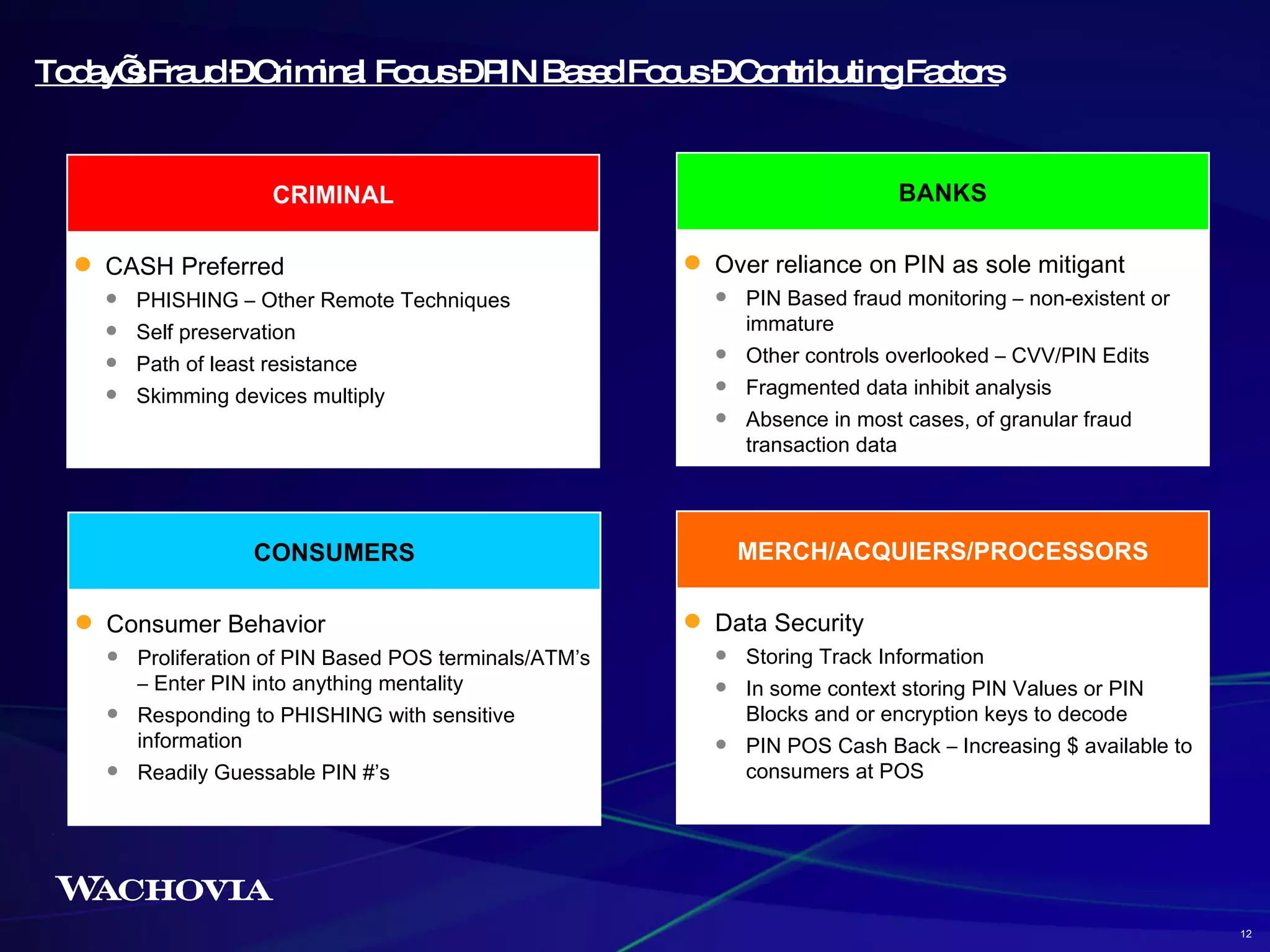

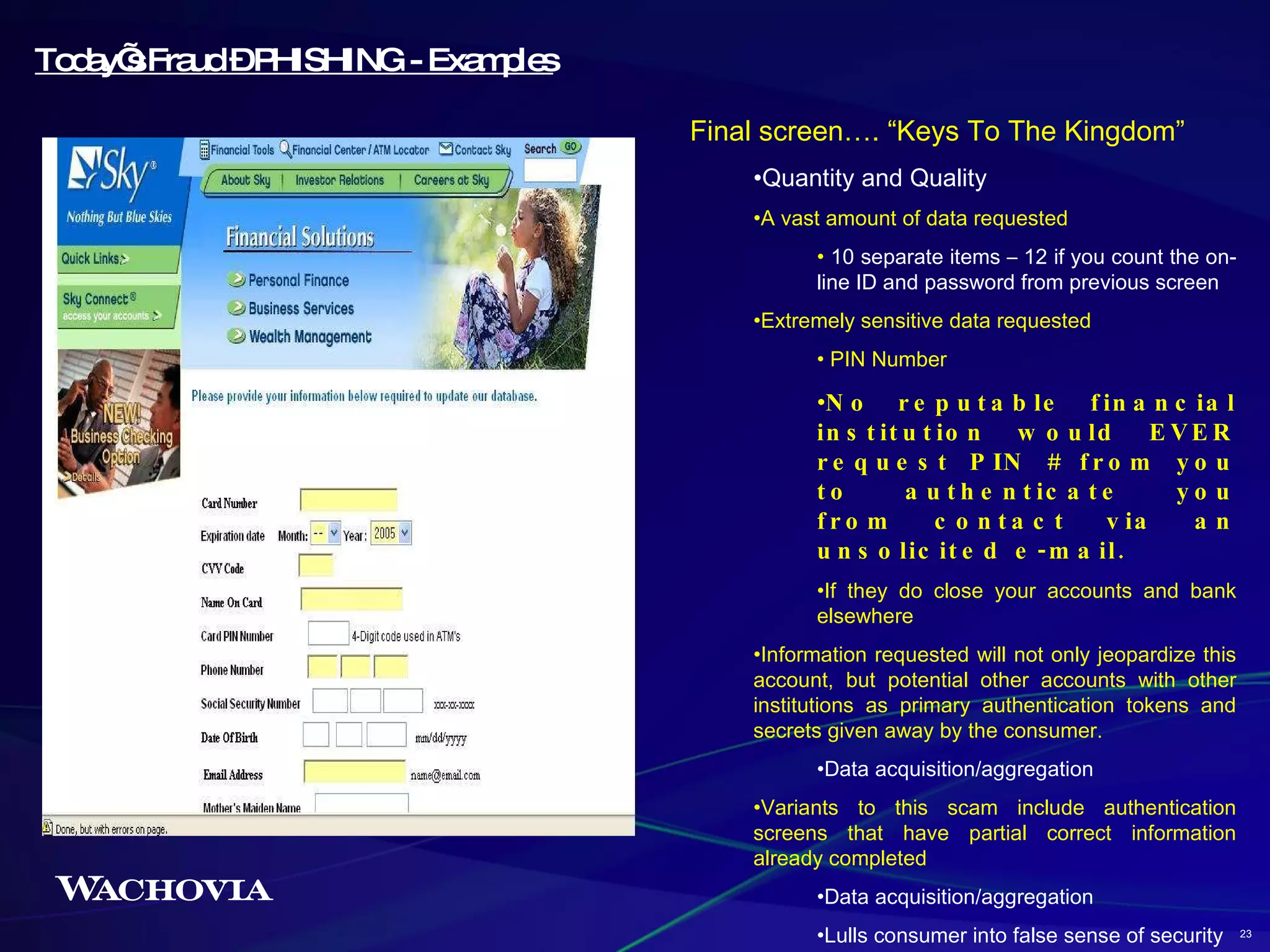

2) A key development is the targeting of PIN data, allowing criminals to withdraw cash directly from ATMs or make PIN debit purchases.

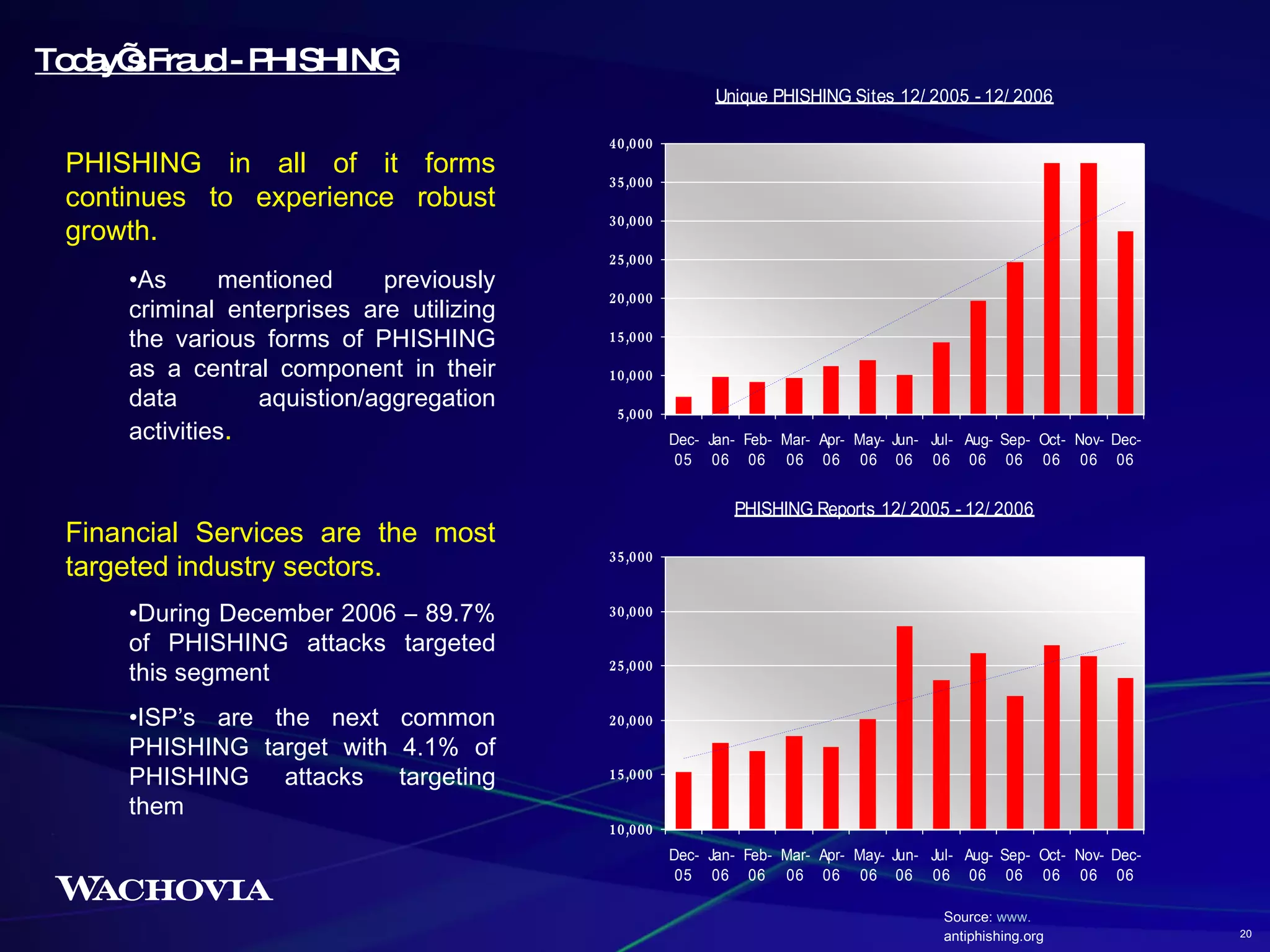

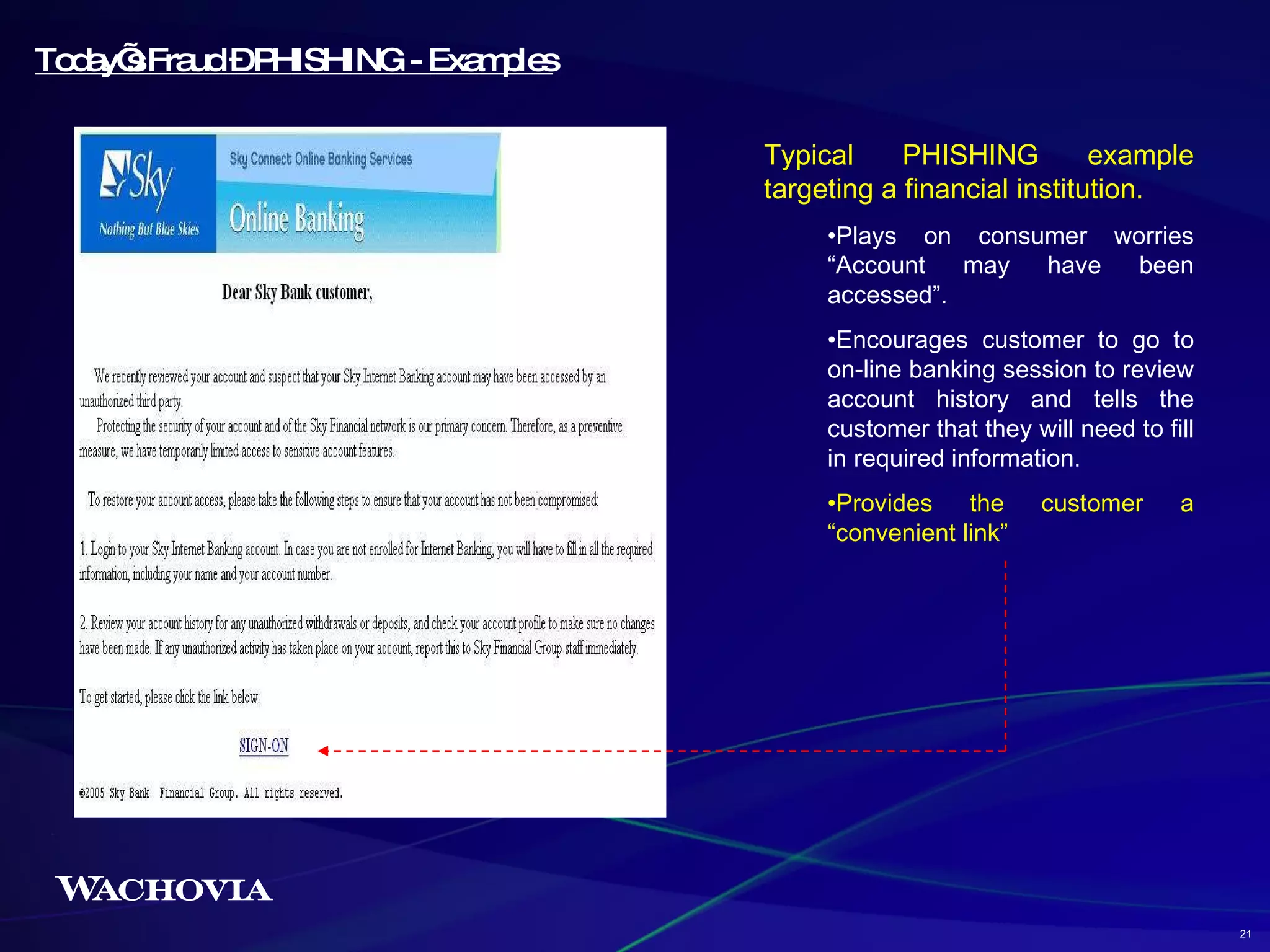

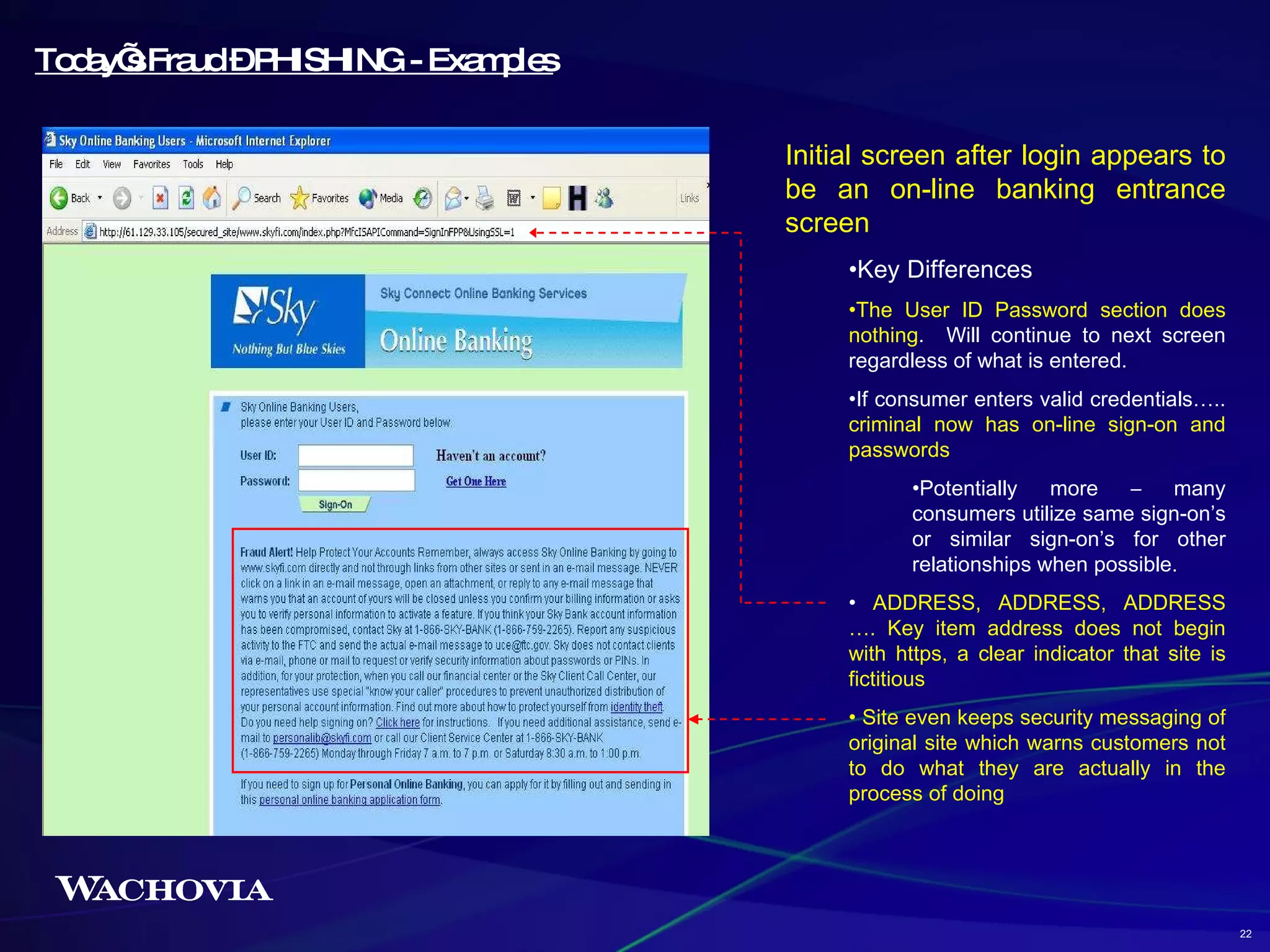

3) "Phishing" scams, where consumers are tricked into providing sensitive details, have become a major data acquisition method for criminals. Financial institutions are the most common phishing targets.