This document provides information about a lecture on the Prevention of Money Laundering Act (PMLA) and Know Your Customer (KYC) norms given by Ms. A. Revathy at SRI KRISHNA ARTS & SCIENCE COLLEGE. The key points covered include:

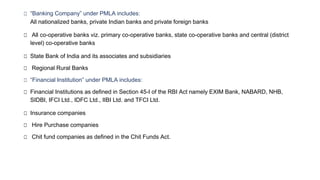

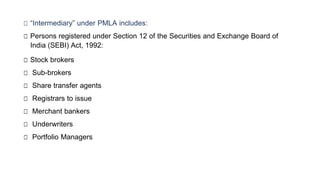

1) PMLA came into force in 2005 to prevent money laundering and seize illegally obtained property. It applies to banks, financial institutions, securities brokers and other intermediaries.

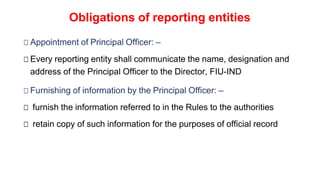

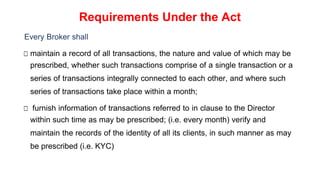

2) KYC norms require these entities to identify customers, monitor transactions, and report suspicious activities to authorities. Maintaining proper records for 10 years is mandatory.

3) Suspicious transactions include large or unusual transactions

![SRI KRISHNA ARTS & SCIENCE COLLEGE

[An Autonomous Institution]

Ranked 29th in NIRF; MHRD: 1st in Institutional Swachh bharat Ranking

Coimbatore – 641 008

BANKING THEORY AND PRACTICE

I B.Com CA A, IT A

Topic : PMLA Act, KYC Norms

Unit 2 – Lecture 4

Facilitator

Ms.A. Revathy.

Assistant Professor

Department of Commerce CA

SKASC](https://image.slidesharecdn.com/btp2-230817092548-d761b8dc/85/BTP-2-5-docx-1-320.jpg)