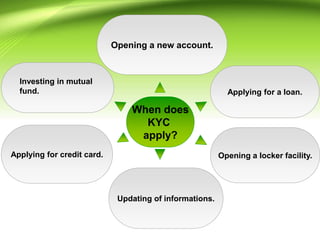

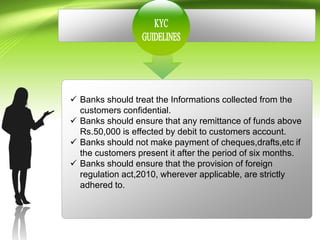

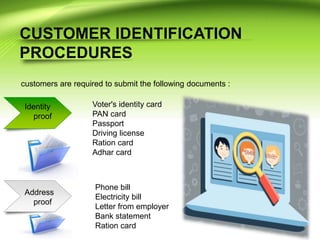

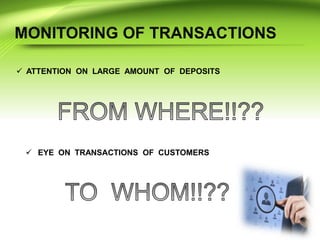

KYC enables banks to understand their customers and financial dealings to serve them better. Under banking law, KYC helps banks establish customer identity, obtain information on business/funds, and prevent money laundering. KYC applies when opening accounts, updating information, applying for loans/credit cards/lockers, or investing in mutual funds. Banks must keep customer information confidential, ensure large remittances are from customer accounts, and not pay old checks. Banks must follow risk management policies including customer risk profiles, identification procedures, transaction monitoring, and implement controls like reporting suspicious transactions and record keeping. KYC implementation is mandatory and banks can face penalties for non-compliance.