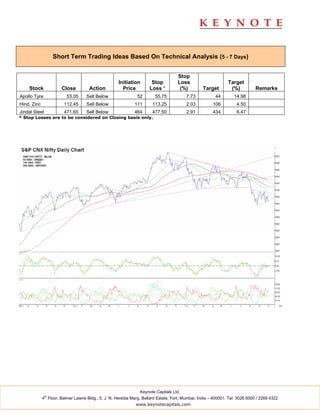

The domestic Indian markets witnessed declines of around 1.8-1.9% on October 4th, mirroring negative global market cues. The markets opened lower but recovered slightly from the lows, though lack of buying support led to further losses by the end of the day. Most sectoral indices ended in the red. Technically, indicators suggest further downside pressure for the markets. The Nifty is expected to test support at 4,757 unless it moves back above resistance at 4,987. Global cues and upcoming earnings will continue guiding the markets.