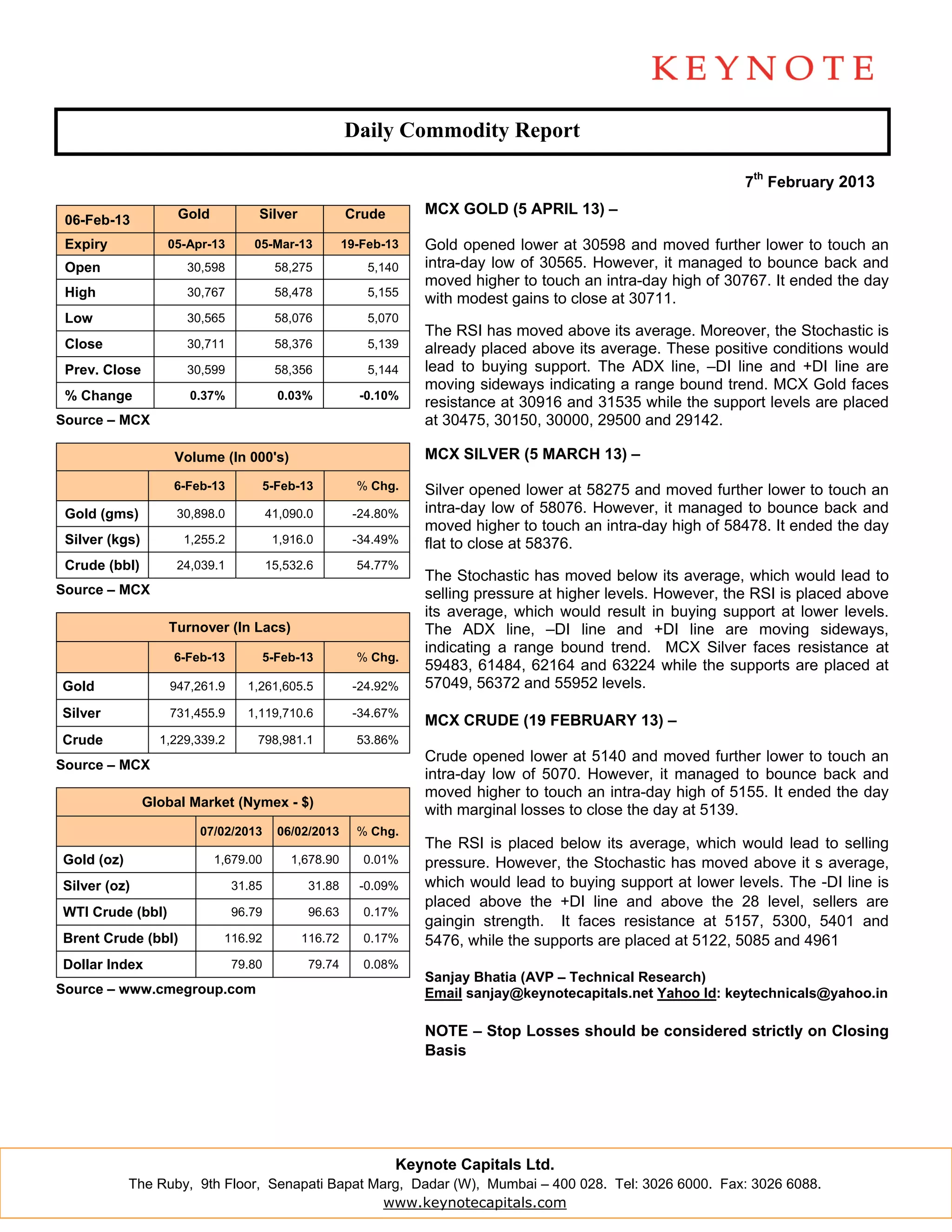

- The daily commodity report summarizes the performance of gold, silver, and crude oil on the MCX exchange on February 7th, 2013.

- Gold prices closed slightly higher at 30711 after falling to an intra-day low of 30565. Silver prices closed flat at 58376 after falling to 58076 intra-day. Crude oil prices closed marginally lower at 5139 after touching an intra-day low of 5070.

- Technical indicators for gold, silver, and crude oil suggest range-bound trading in the near future.