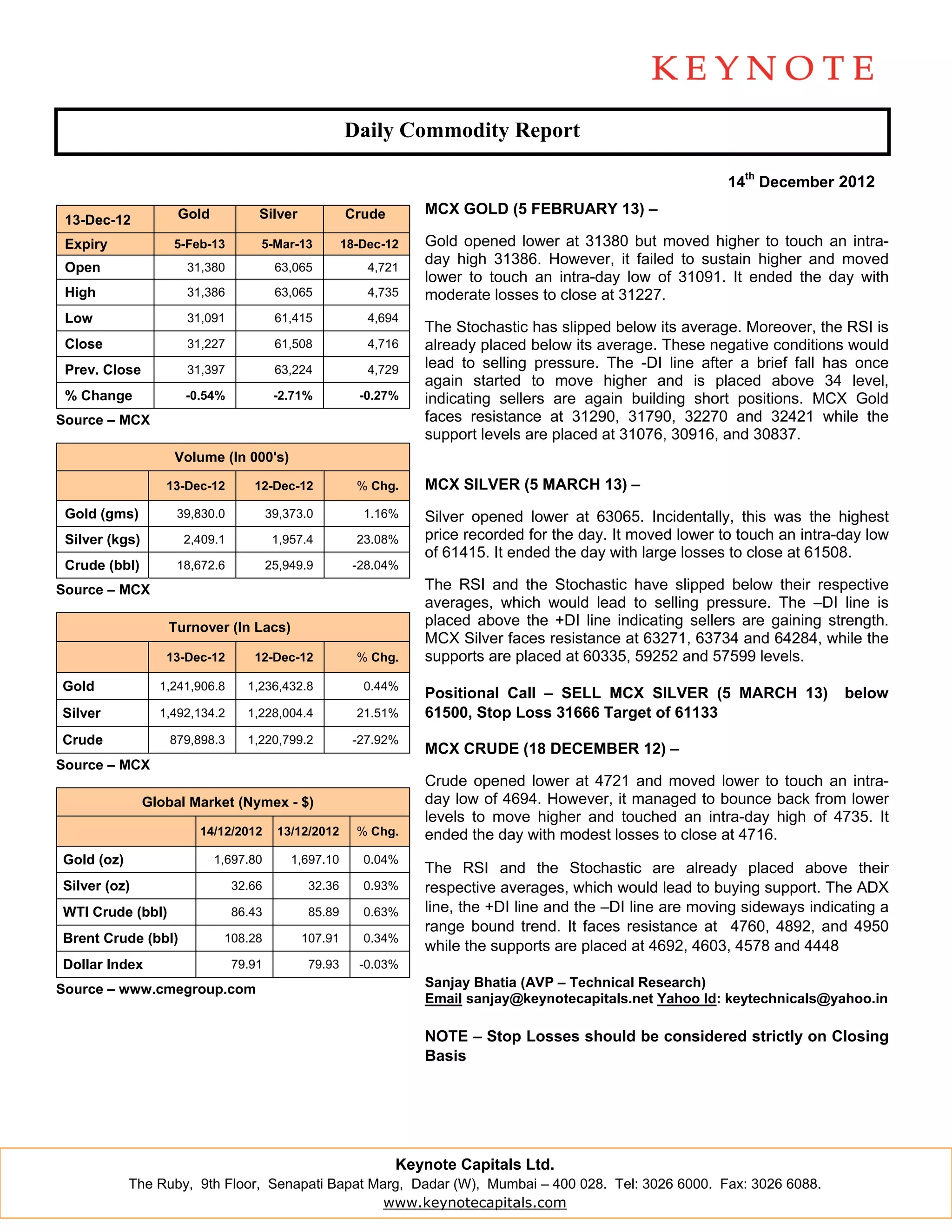

The daily commodity report summarizes the movement of gold, silver, and crude oil futures on the MCX exchange on December 14, 2012. Gold prices opened lower but later increased, though failed to sustain the gains and closed with moderate losses. Silver prices opened lower and fell further to close with large losses. Crude oil opened lower as well but recovered some losses to close with modest losses. Technical indicators for gold, silver and crude oil signal further downward pressure.