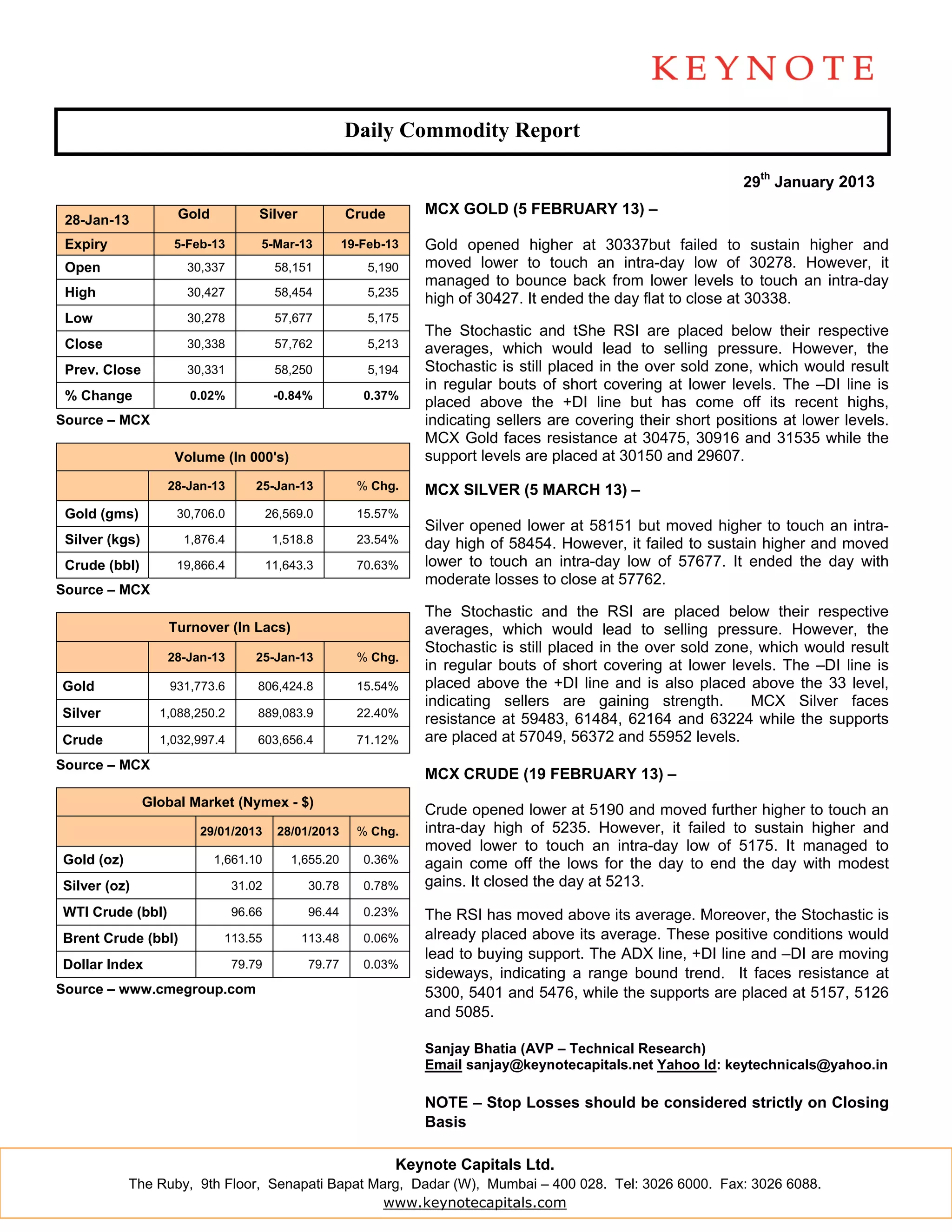

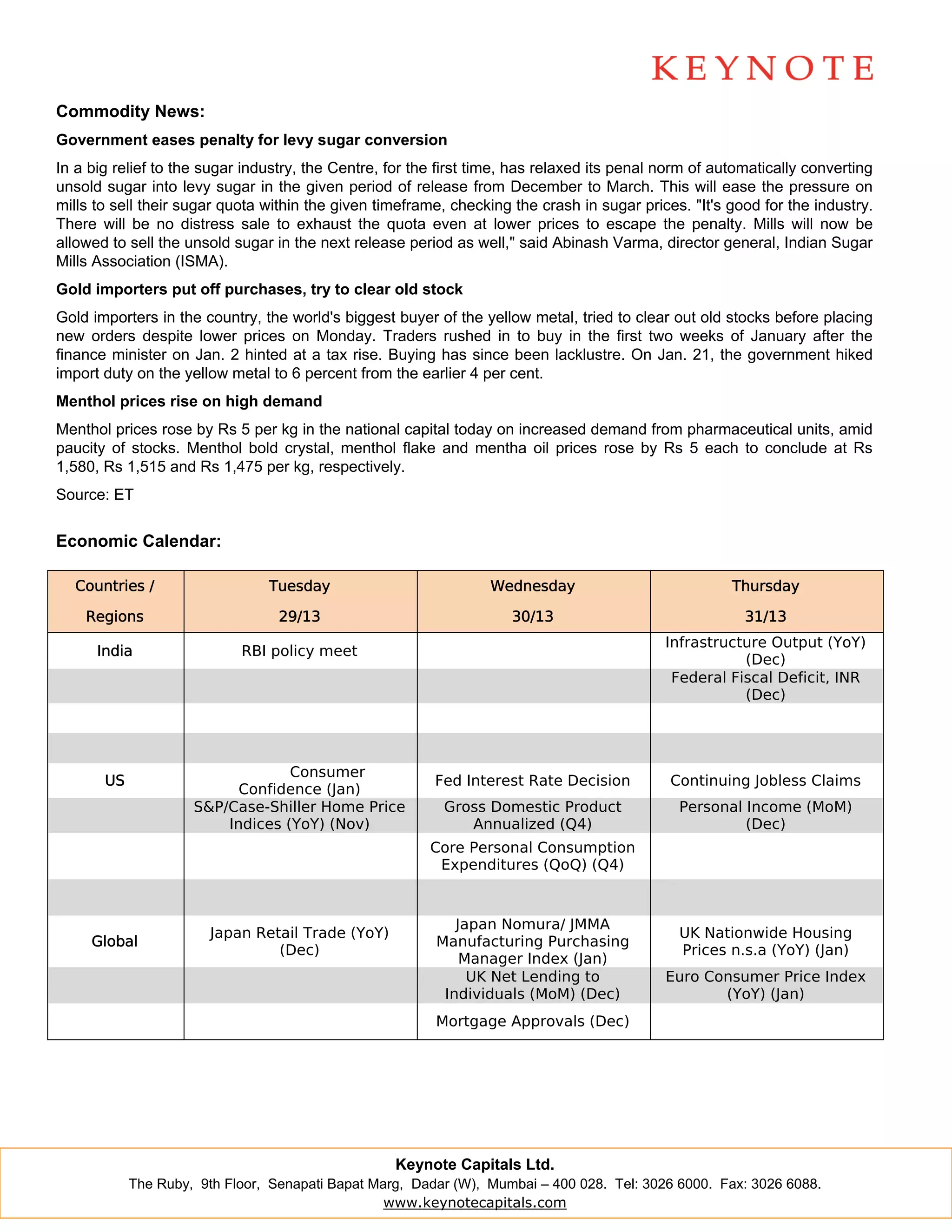

The daily commodity report recaps the movement of gold, silver, and crude prices on the MCX exchange. Gold and crude prices closed nearly flat, while silver closed with moderate losses. Technical indicators suggest sellers are covering positions at lower price levels for gold and silver. Crude is supported by positive technical indicators. The report also provides international commodity prices and highlights recent news about changes to sugar regulations in India and gold import trends.