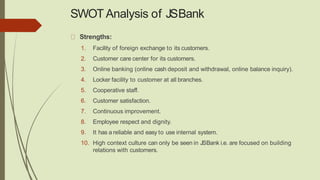

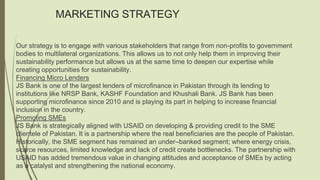

JSBank is a majority-owned subsidiary of Jahangir Siddiqui & Co. Ltd. operating 323 branches in 161 cities. It commenced operations in Pakistan in 2006 as a fully scheduled bank and has grown rapidly since. JSBank offers various consumer and commercial banking services and products, including loans to microfinance institutions, SMEs, and individuals for vehicles, homes, and gold financing. Through strategic partnerships and alliances, an expanding branch network, and innovative products tailored to customer needs, JSBank aims to be the preferred financial partner for customers and generate sustainable returns.