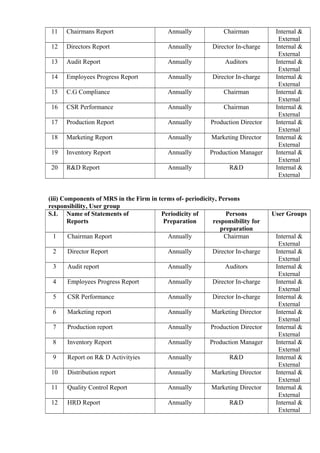

The document is an assignment on corporate reporting systems, focusing on Jamuna Bank Limited in Bangladesh. It provides an organizational profile, including history, mission, vision, products, and a SWOT analysis, alongside theoretical concepts of financial and management reporting systems. The study aims to evaluate and analyze the bank's reporting system and identify areas for improvement and recommendations.