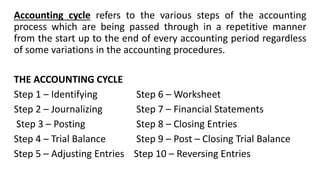

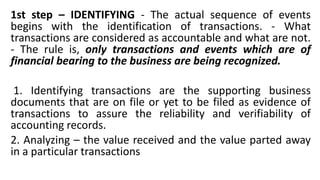

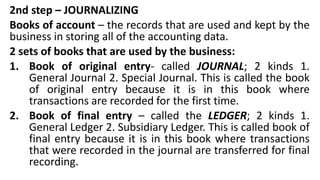

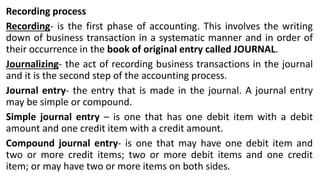

The document discusses the accounting cycle and journalizing process. It describes the 10 steps in the accounting cycle from identifying transactions to reversing entries. It then explains the steps of journalizing which includes recording transactions in journals, transferring entries to ledgers, and preparing T-accounts. Transaction types like purchases, payments, and receipts are discussed. The journal format and rules for journal entries are also covered in detail.