Md. Fariduddin Ahmed is a former managing director and CEO of Islami Bank Bangladesh Limited and Export Import Bank of Bangladesh Ltd. He also served as advisor to Export Import Bank of Bangladesh Ltd. and head of Islamic banking at AB Bank Limited.

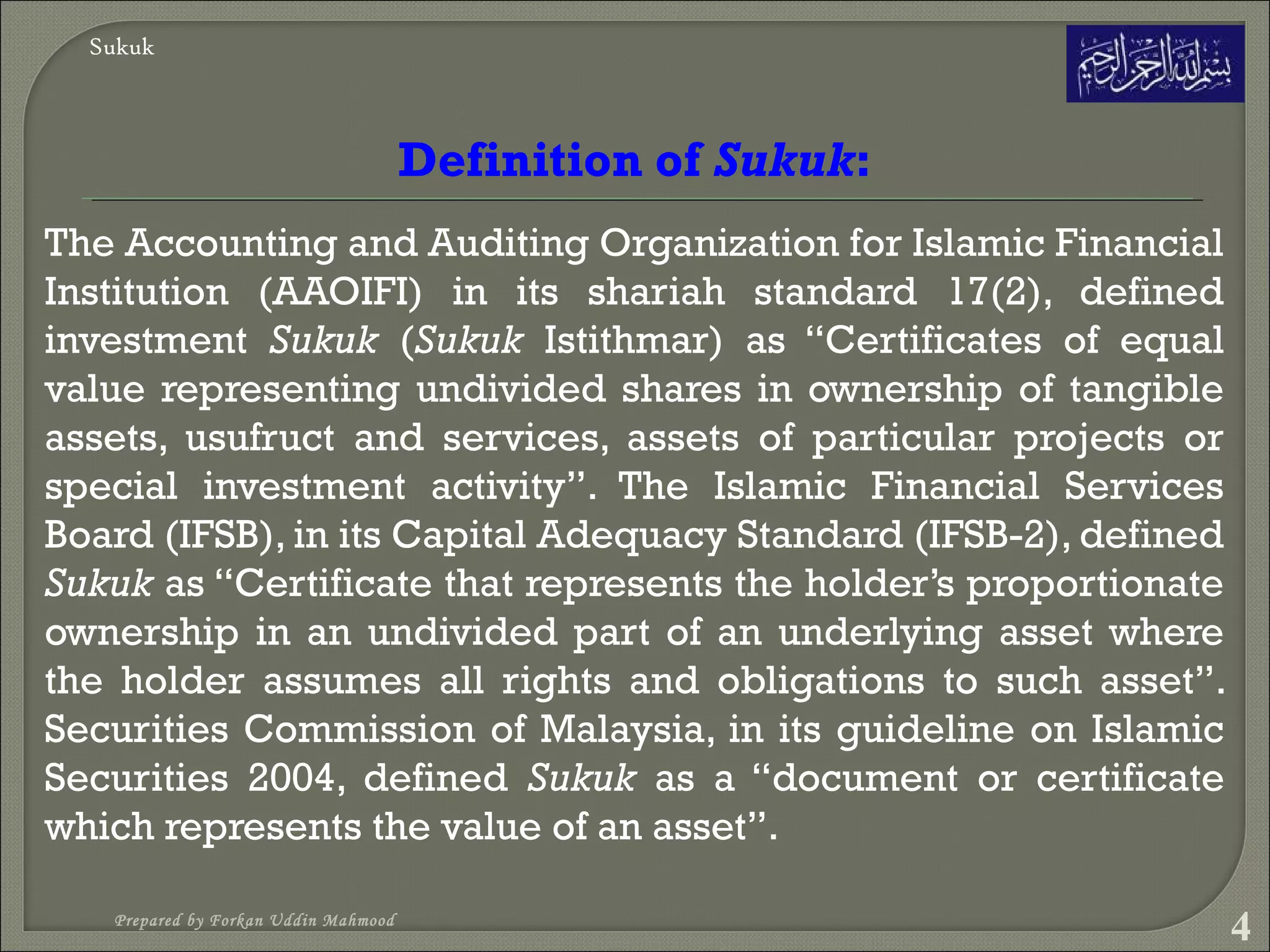

The document discusses Sukuk, which are defined as certificates representing ownership in tangible assets or financial obligations from commercial activities. It describes different structures of Sukuk based on Shariah contracts and classifications based on function. The document also compares Sukuk to bonds and asset-backed securities, and discusses some issues, opportunities, and challenges in the Sukuk market.

The following slides discuss Islamic equity markets, including the concepts of risk sharing, types