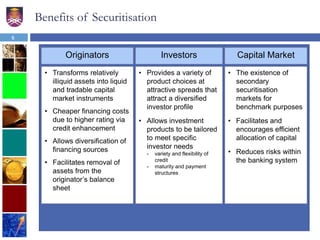

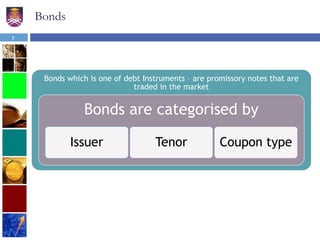

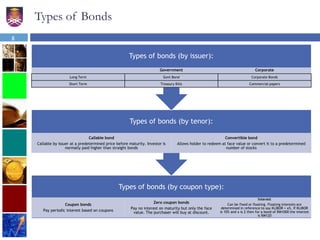

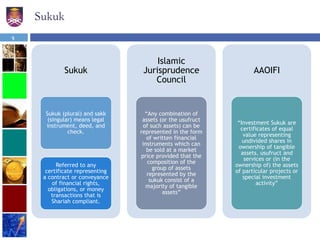

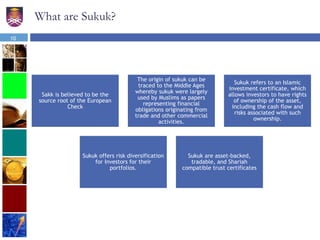

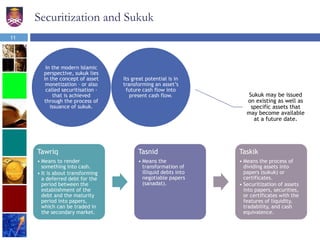

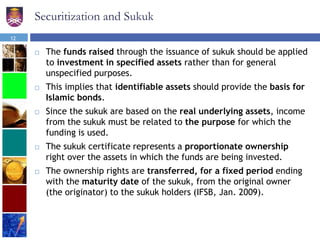

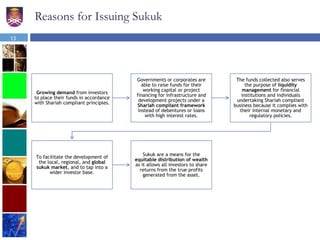

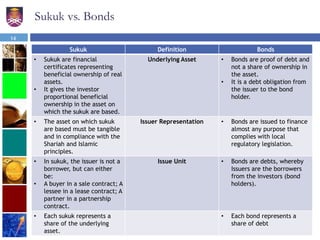

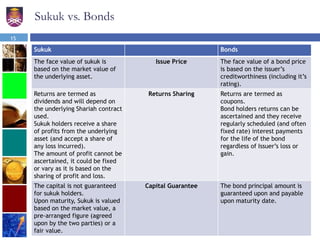

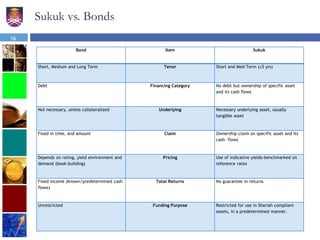

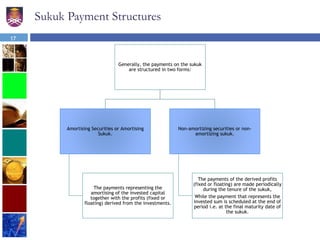

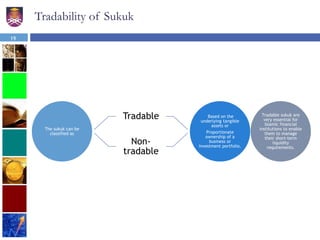

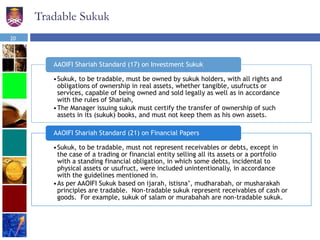

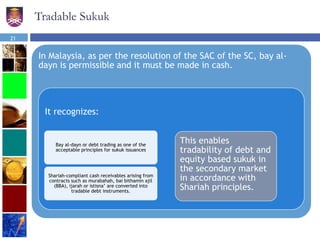

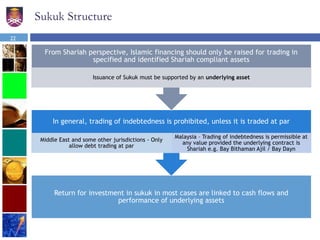

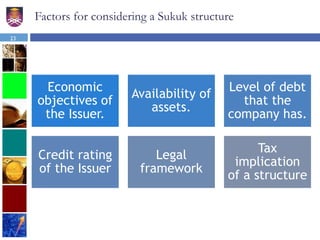

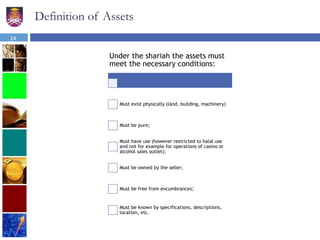

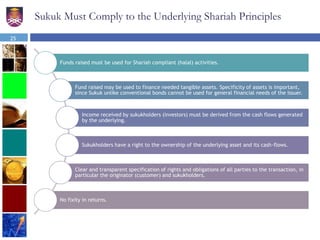

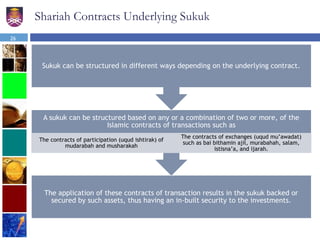

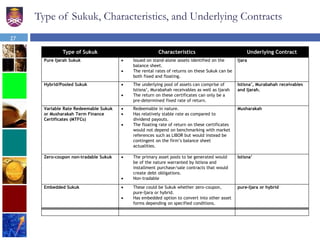

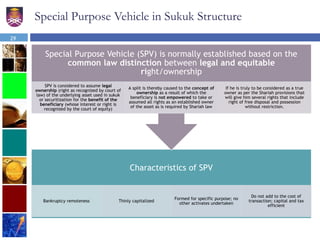

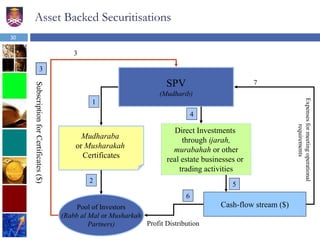

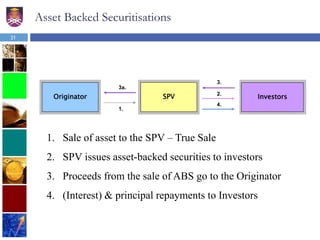

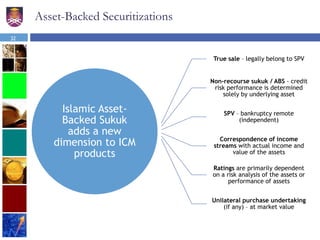

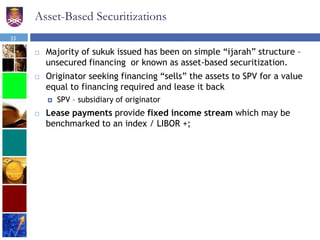

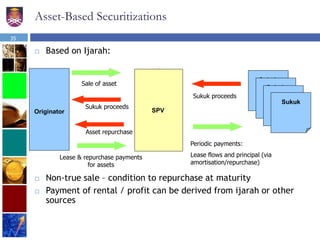

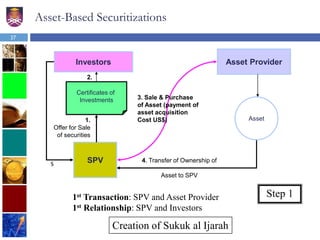

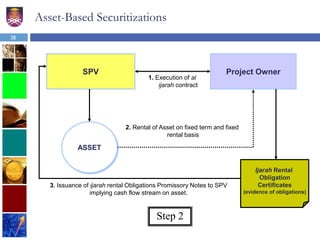

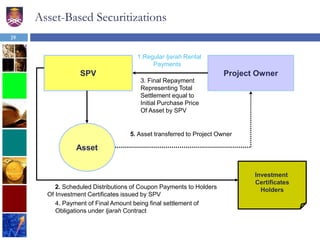

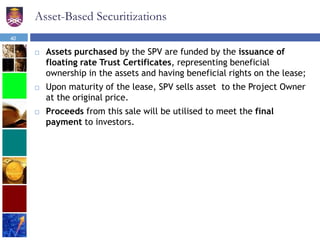

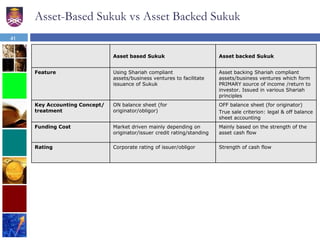

This document discusses Islamic investment concepts related to securitization and sukuk. It begins by defining securitization as issuing certificates of ownership against an asset or investment pool. It then discusses various types of conventional bonds and introduces the concept of sukuk, which are defined as Sharia-compliant certificates representing ownership in an underlying asset. The document outlines various Shariah-compliant structures for sukuk based on contracts like ijarah, murabahah, and musharakah. It also compares key differences between conventional bonds and sukuk. Overall, the document provides an overview of securitization and various Islamic finance instruments like sukuk from a Shariah perspective.