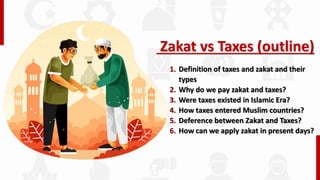

The document outlines the differences between zakat and taxes, including definitions, purposes, and historical context. It discusses how zakat serves as a religious duty for Muslims while taxes are secular government-imposed contributions. Additionally, it explores the potential of replacing the current tax system with zakat through the application of Islamic law.