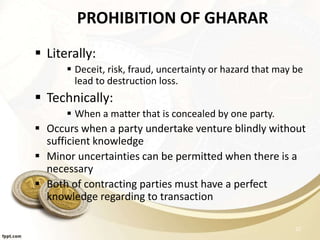

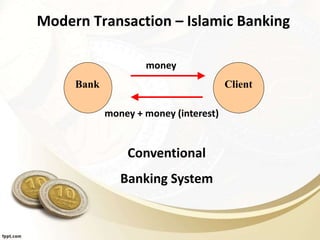

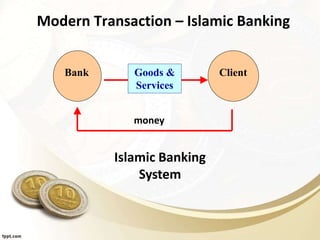

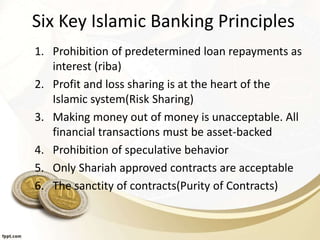

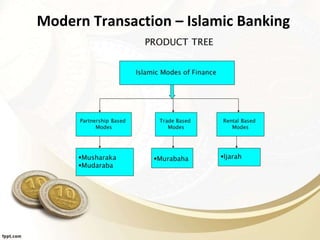

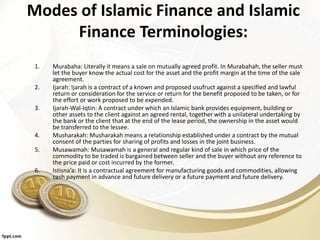

The document provides an overview of Islamic finance principles. It discusses the primary and secondary sources of shariah law and covers proofs for the permissibility of trade in Islam. The key pillars of Islamic business contracts are explained as well as conditions and options within contracts. Forbidden transactions like riba (interest), gharar (uncertainty), and maisir (gambling) are defined. Modern financial instruments and banking concepts are analyzed through an Islamic lens. Common Islamic finance contracts involving murabaha, musharaka, mudaraba and ijarah are also defined.

![Proofs for the permissibility of Trade

… And Allah has permitted trade but forbidden

riba[AlBaqarah : 275]

O you who have believed, do not consume one

another's wealth unjustly but only [in lawful]

business by mutual consent. [An Nisaa: 29]

O you who have believed, when [the adhan] is called

for the prayer on the day of Jumu'ah [Friday], then

proceed to the remembrance of Allah and leave

trade. [Al Jum'ah: 9]

There is no blame upon you for seeking bounty from

your Lord [AlBaqarah :198].](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-3-320.jpg)

![Conditions of Business Transactions

O You who believed! Honor your contracts

[AlMa’idah: 1]

O you who have believed, do not consume one

another's wealth unjustly but only [in lawful]

business by mutual consent.[AnNisaa:29]

The Muslims are upon their conditions, except a

condition that makes a prohibited permissible or a

permissible prohibited[Abu Dawud]](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-6-320.jpg)

![Choice or Options in Contracts

• Option of cancellation within the trading session

• Option of cancellation within a defined period of

time

Ref:

The buyer and seller have the choice to conclude or

repeal the transactions as long as they have not

separated [ Agreed Upon]](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-7-320.jpg)

![Quran on Riba

There are 12 verses in quran dealing with Riba. The word riba itself occurs eight times, there

times in 2:275 and one time each in 2:276; 2:278; 3:130; 4:161 and 30:394

• 1st Verse: In Makkan Period: Allah says: And that which you give in Riba in order that it may increase

from other people's property, has no increase with Allah; but that which you give in Zakah seeking

Allah's Face, then those they shall have manifold increase.[Surah Rum: 39].

– In One Opinion, Allah meant Interest but Majority of the scholar in Opinion This means, that

which is given as a gift to others in the hope that they will give back more than they were

given(Wrong Intention). There is no reward for this with Allah.

• Prophet (saw) said: No person gives in charity the equivalent of a date which was earned in a lawful

manner, but the Most Merciful takes it in His Right Hand and takes care of it for its owner, just as any one

of you takes care of his foal or young camel, until the date becomes the size of Mount Uhud

• 2nd Verse: And their taking of Riba though they were forbidden from taking it, and their devouring

men's substance wrongfully. And We have prepared for the disbelievers among them a painful

torment.[An Nisa:161]

– Revealed 1st Year in Madina. This Ayah regarding Jews, Allah prohibited them from taking Riba',

yet they did so using various kinds of tricks, ploys and cons, thus devouring people's property

unjustly

– The message in this verse that Allah is not pleased with them to deal with Riba/Interest and Yet

they are dealing with Riba. This verse is not directed to Muslim rather it was hint and

preparation for later rulings.](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-12-320.jpg)

![Quran on Riba

3rd Verse: As per the Ulama It was revealed 3rd Year of hijra before battle of Uhud.

Allah says: O you who believe! Do not consume Riba doubled and multiplied, but fear Allah that you

may be successful. [Surah Al-Imran: 130] And: Allah says: And fear the Fire, which is prepared for the

disbelievers. And obey Allah and the Messenger that you may obtain mercy [Al Imran: 131-132]

Prevented Muslims from usurious loans to equip their armies in response to the action of the pagans,

Explicit prohibition of compound interest

4th Verse:

Those who eat Riba will not stand (on the Day of Resurrection) except like the standing of a person beaten by

Shaytan leading him to insanity. That is because they say: "Trading is only like Riba,'' whereas Allah has permitted

trading and forbidden Riba. So whosoever receives an admonition from his Lord and stops eating Riba, shall not be

punished for the past; his case is for Allah (to judge); but whoever returns (to Riba), such are the dwellers of the

Fire, they will Abide therein

Allah will destroy Riba and will give increase for Sadaqat. And Allah likes not the disbelievers, sinners.

Truly, those who believe, and do deeds of righteousness, and perform the Salah and give Zakah, they will have their

reward with their Lord. On them shall be no fear, nor shall they grieve,

O you who believe! Have Taqwa of Allah and give up what remains from Riba, if you are (really) believers.

And if you do not do it, then take a notice of war from Allah and His Messenger but if you repent, you shall have

your capital sums. Deal not unjustly, and you shall not be dealt with unjustly.

And if the debtor is having a hard time, then grant him time till it is easy for him to repay; but if you remit it by way

of charity, that is better for you if you did but know.

And have Taqwa the Day when you shall be brought back to Allah. Then every person shall be paid what he earned,

and they shall not be dealt with unjustly. [Surah Bakarah: 275-281]](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-13-320.jpg)

![Hadith on Riba

Allah has cursed the one who

consumes Riba, The one who gives

it, the two witnesses and the one

who writes down the

transactions[Muslim]](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-15-320.jpg)

![Employment in Financial Institutions or LCBO

And cooperate in righteousness and piety, but do not

cooperate in sin and aggression. [AlMaidah: 2]

Jaabir said: The Messenger of Allah (blessings and peace

of Allah be upon him) cursed the one who consumes riba

and the one who pays it, the one who writes it down and

the two who witness it, and he said: they are all the

same. [muslim]

Ali and Ibn Mas`ud narrated that the Messenger of Allah

said: May Allah curse whoever consumes Riba, whoever

pays Riba, the two who are witnesses to it, and the

scribe who records it(tafsir ibn kathir)](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-25-320.jpg)

![Summary

Can we avoid the Riba from our daily life ? Abu Huraira reported: The Messenger of Allah, peace and

blessings be upon him, said, “A time will come upon people when they will consume usury.” They said to

him, “Is that all of the people?” The Prophet said, “Whoever does not take from it will be afflicted by its

dust.”[Musnad Ahmad 10191]

Prophet(saw)said: Both lawful and unlawful things are evident, but in between them there are matters

that are not clear. So whoever saves himself from these unclear matters, he saves his religion and his

honor. And whoever indulges in these unclear matters, he will have fallen into the prohibitions, just like a

shepherd who grazes (his animals) near a private pasture, at any moment he is liable to enter it.

Another famous hadith narrated by Al-Hasan bin `Ali said that he heard the Messenger of Allah say : Leave

that which makes you doubt for that which does not make you doubt

Allaah says: “Have you seen he who took his desire for a god? With knowledge, Allah has led him astray,

setting a seal upon his hearing and heart, and has made a veil over his eyes, who then shall guide him

after Allah? Will you not then remember!” (al-Jaathia:23)](https://image.slidesharecdn.com/islamicfinance101-161220041256/85/Islamic-finance-101-38-320.jpg)