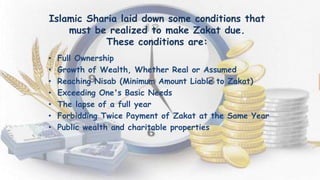

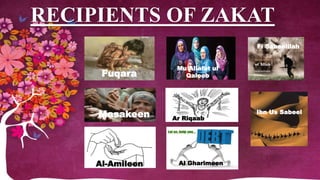

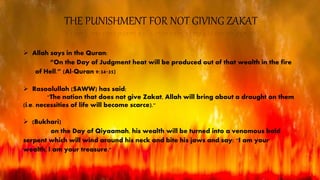

Zakat is the fourth pillar of Islam that involves paying mandatory charitable contributions on certain possessions. It has been a practice in Islam since the time of Prophet Muhammad. The Quran and hadiths emphasize the importance of zakat for spiritual and social benefits. Zakat must be paid on wealth such as gold, silver, cash, and agricultural products if they meet the minimum threshold and have been owned for at least one year. It is to be distributed to the poor, needy, debtors, administrators of zakat funds, and those whose hearts are to be reconciled. Failure to pay zakat is punishable and it is meant to purify wealth and hearts as well as promote social welfare

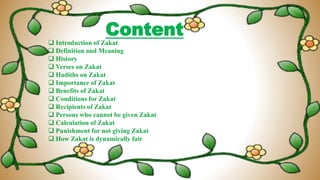

![Meanings???

to be clean [Al-Quran Chapter 24: Verse 21,

Chapter 23: Verse 4]

to pay the obligatory charity [Al-Quran 2:43]

to be better in purity [Al-Quran 18:81, 19:13]](https://image.slidesharecdn.com/zakatpresentations-160114162136/85/Zakat-presentations-pptx3-8-320.jpg)

![ Zakat relates to one of the pillars of Islam

While reading the Quran you would have come across a

number of times the command:

“Be steadfast in prayer; practice regular Charity.”

"Take alms from their wealth in order to

purify them and sanctify them with it."

[Surah at-Tauba 103]

Messenger of Allah (peace be upon him) was ordered to fight

the people until they made the established prayer and paid

zakat](https://image.slidesharecdn.com/zakatpresentations-160114162136/85/Zakat-presentations-pptx3-16-320.jpg)