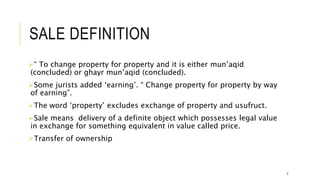

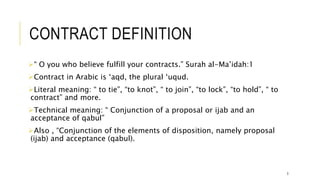

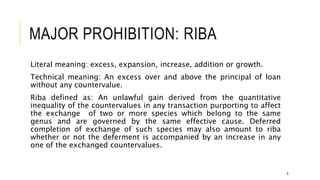

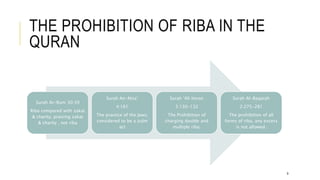

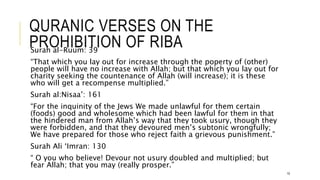

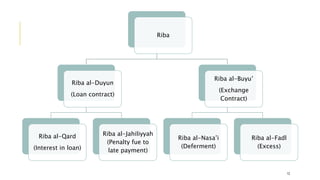

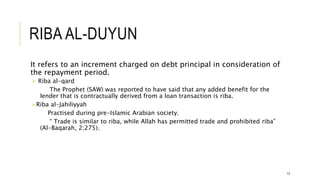

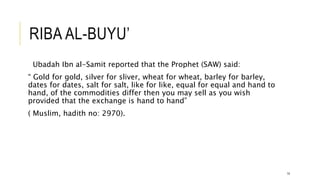

The document discusses the principles of Islamic finance, focusing on key concepts such as sale, contracts, and major prohibitions like riba (usury). It elaborates on the importance of fulfilling contracts as stipulated in the Quran and emphasizes that riba is strictly forbidden due to its unethical implications in financial transactions. Additionally, it touches on various Islamic financial contracts such as mudarabah, musharakah, and ijarah, as well as the importance of ethical conduct in business practices.