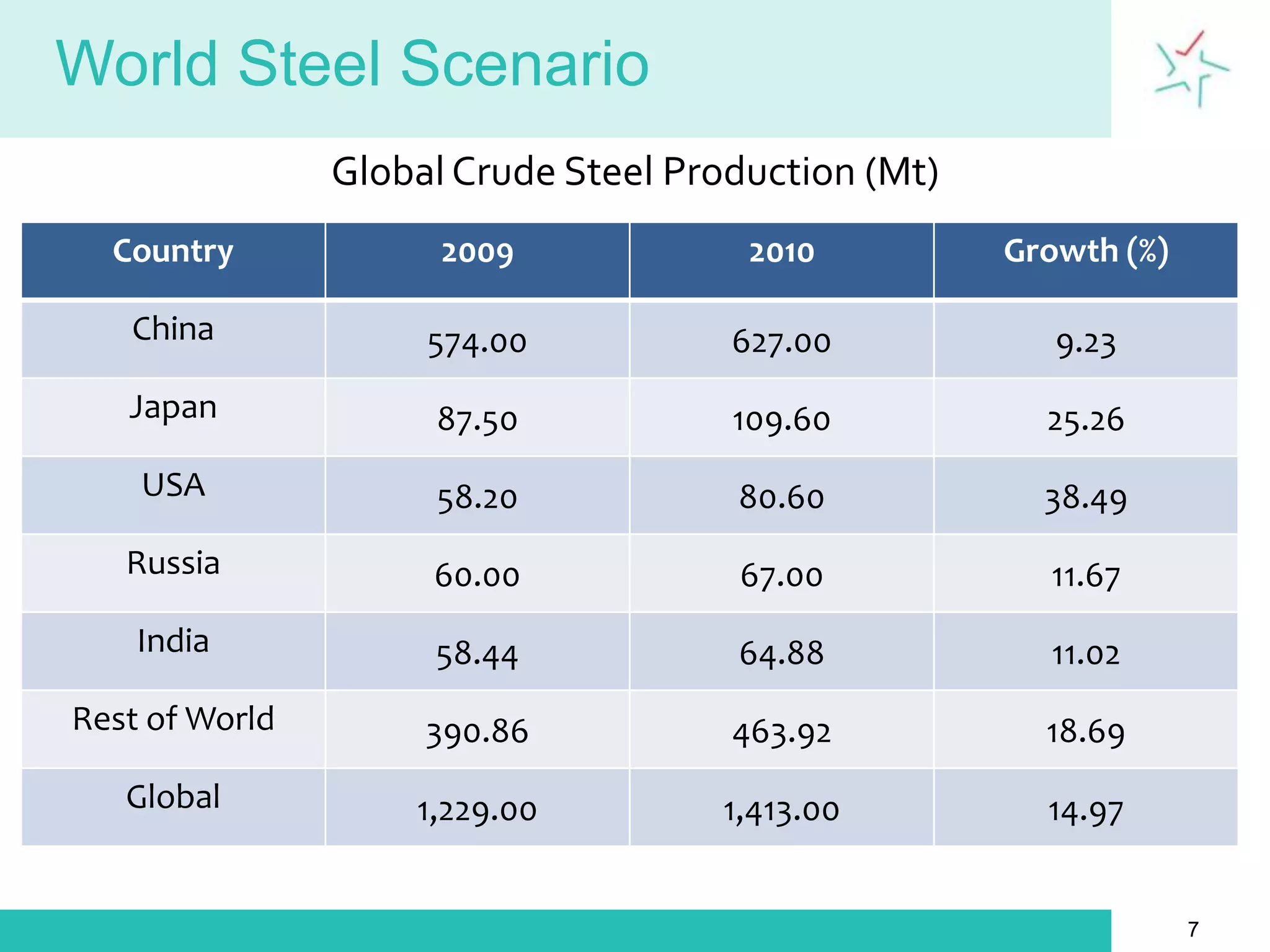

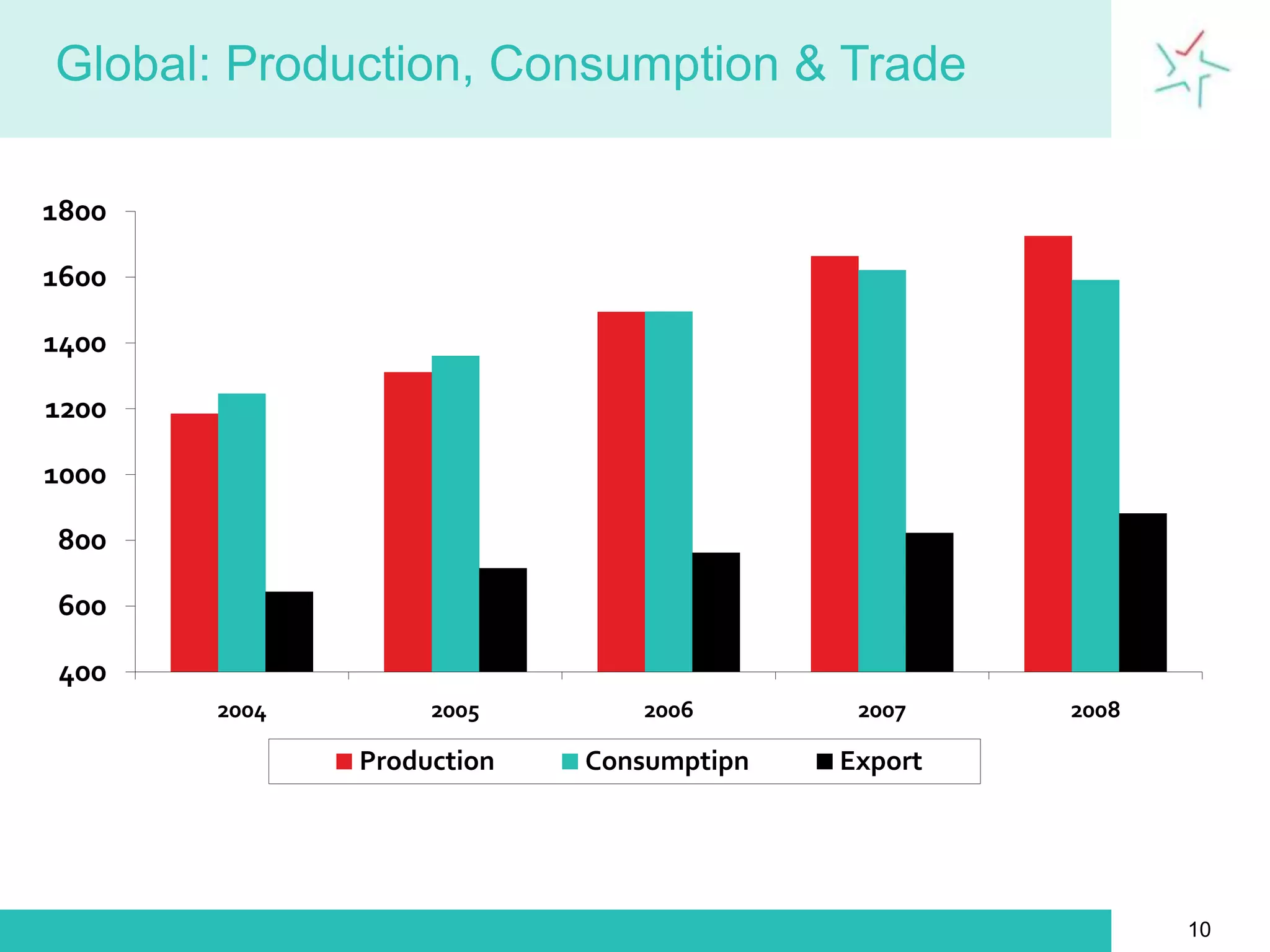

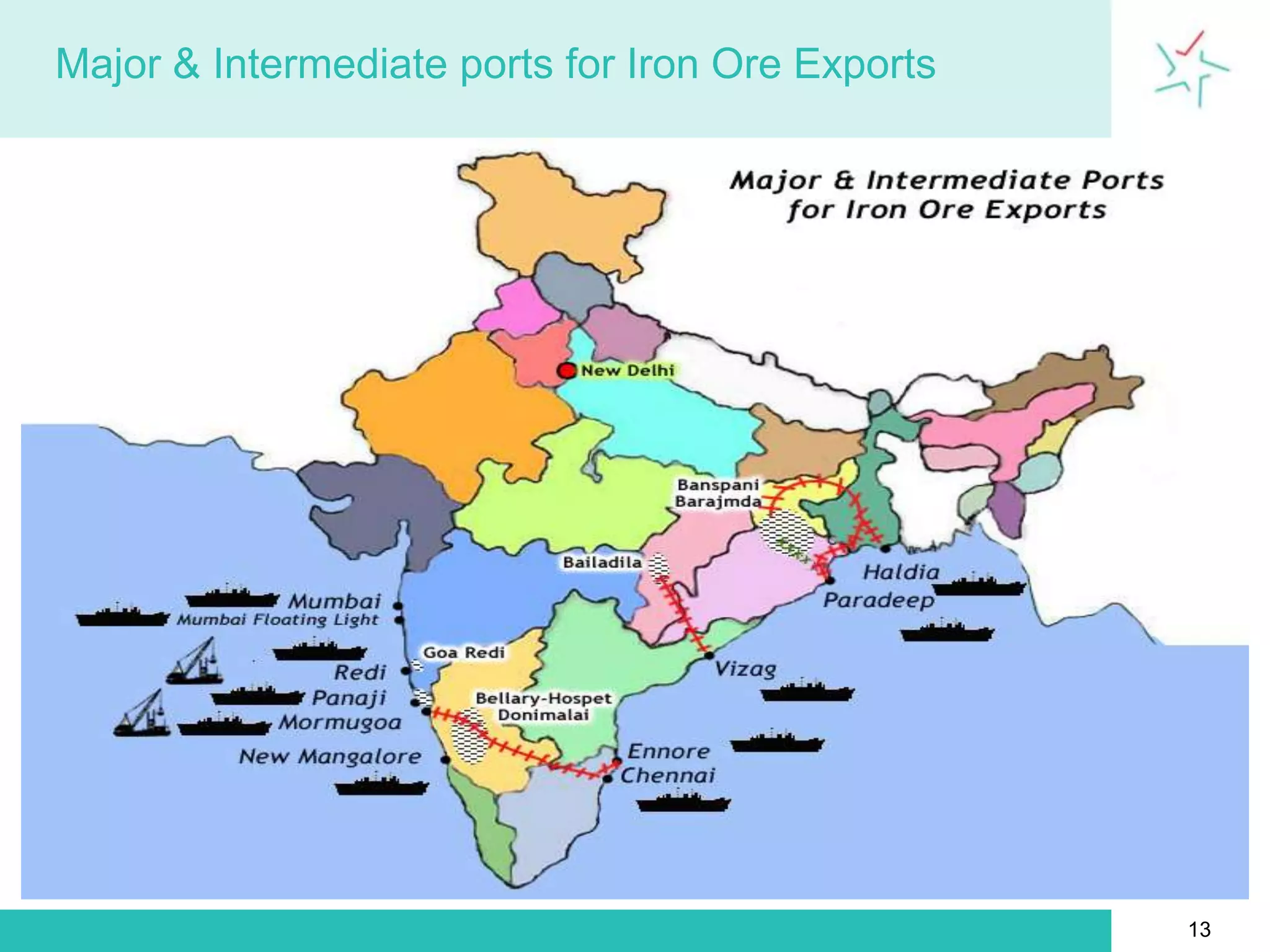

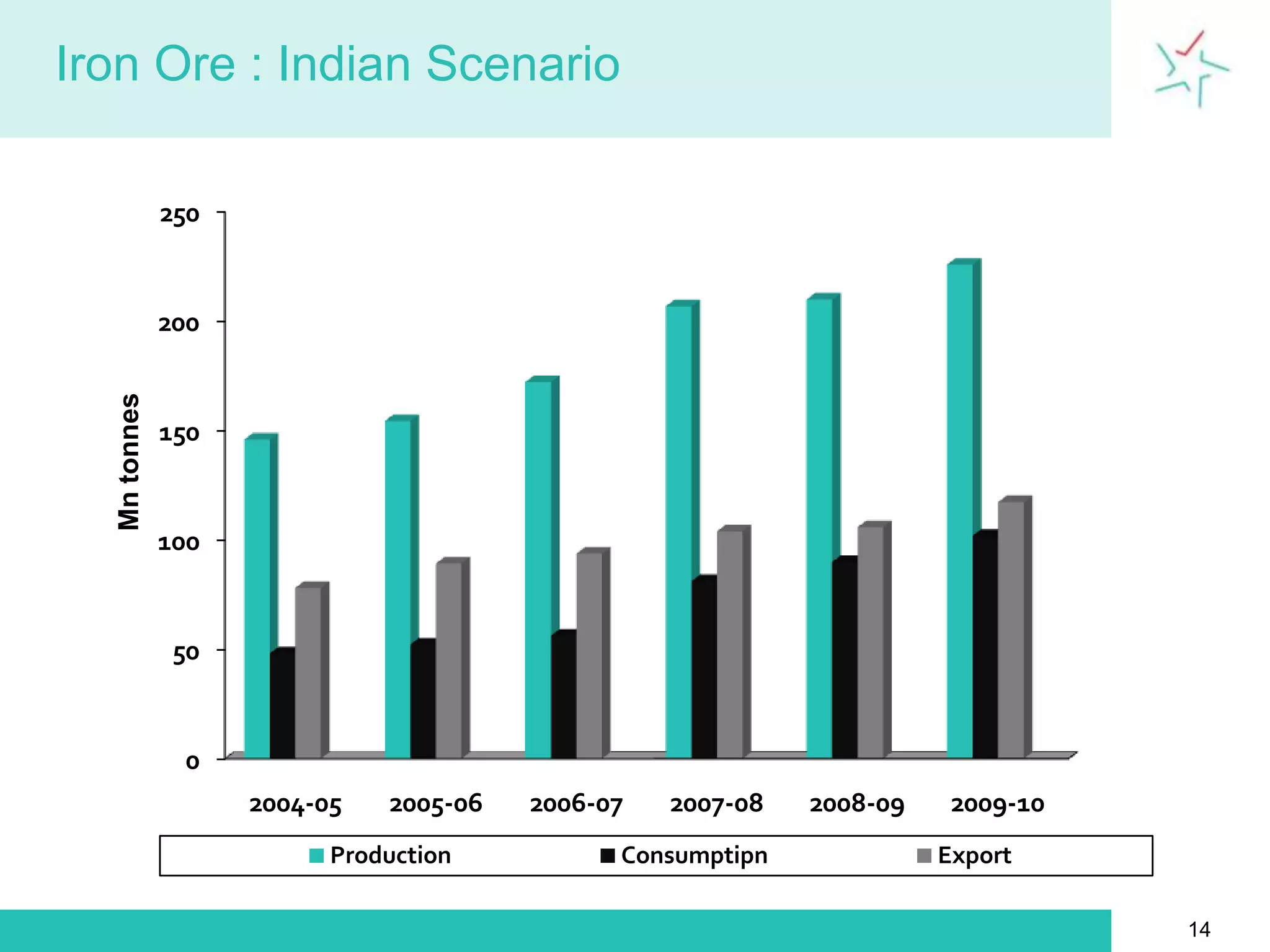

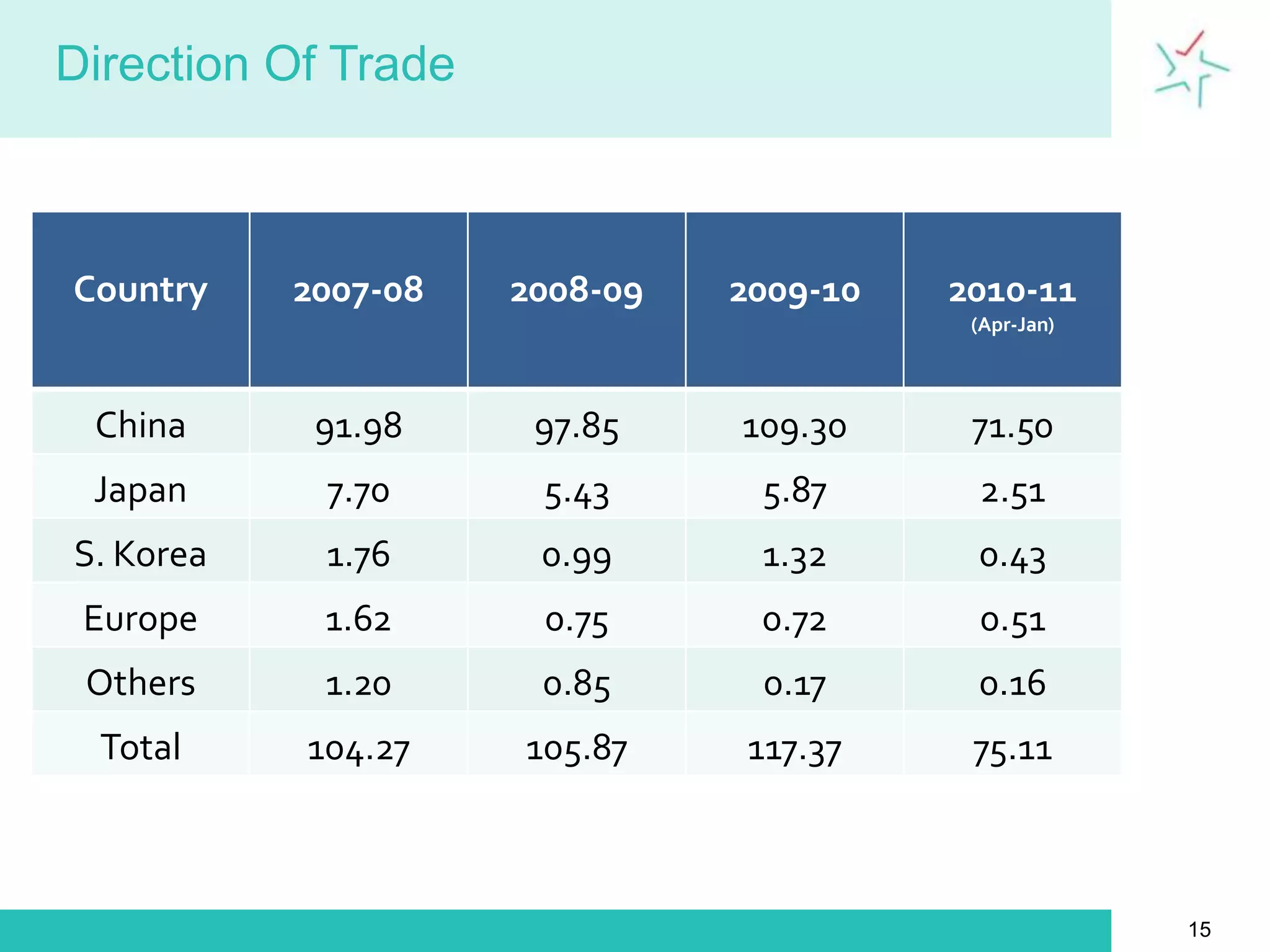

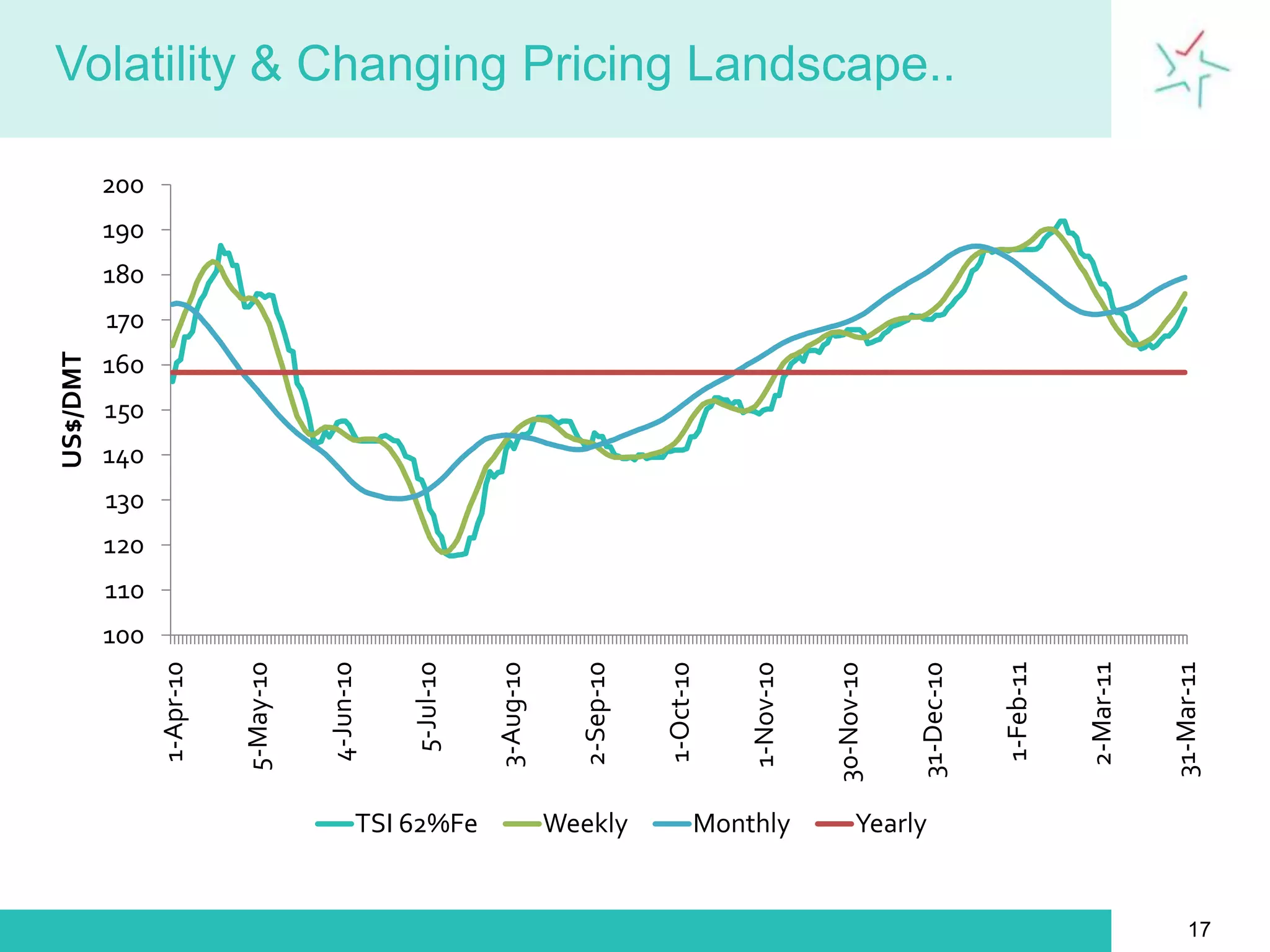

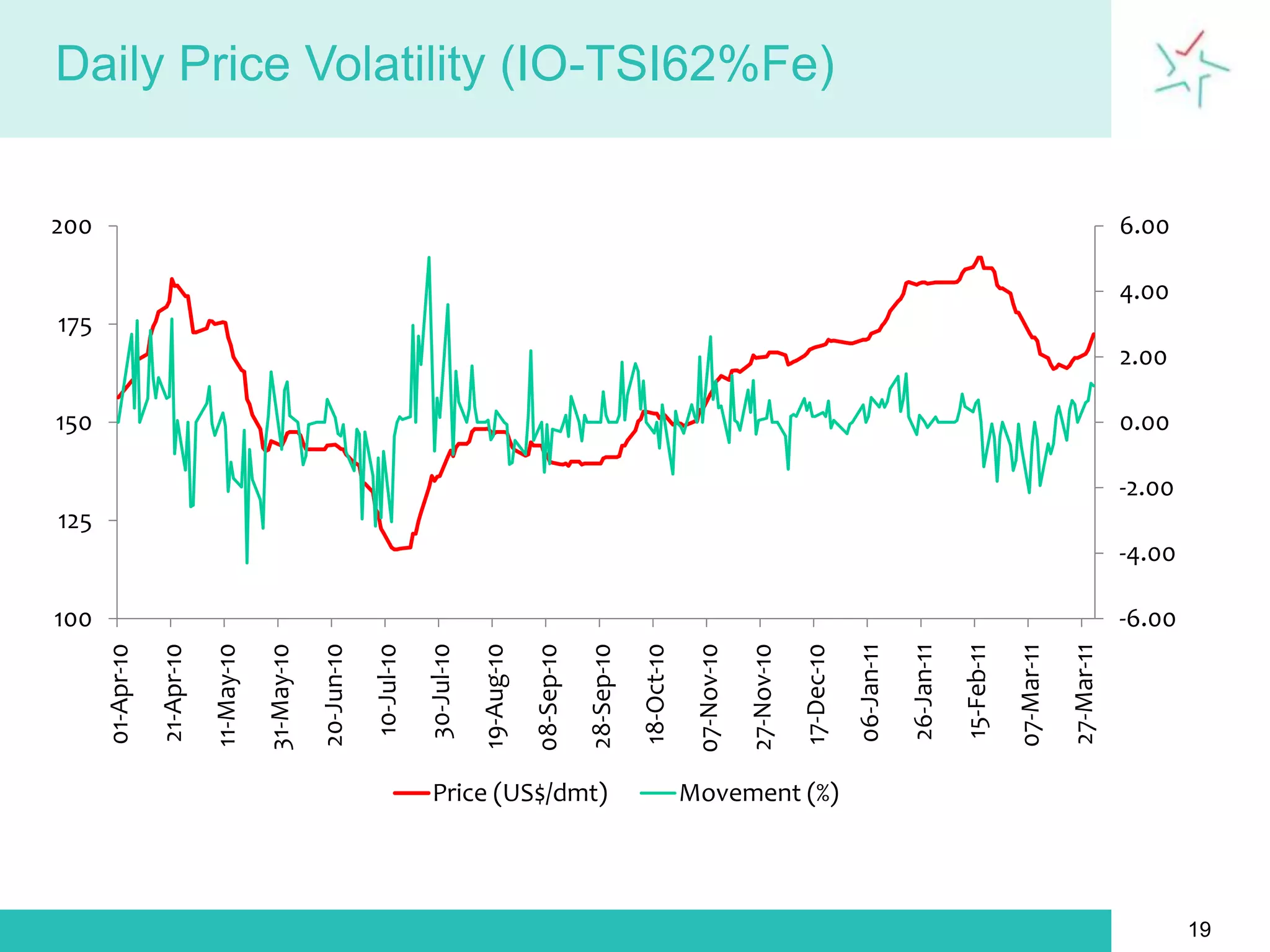

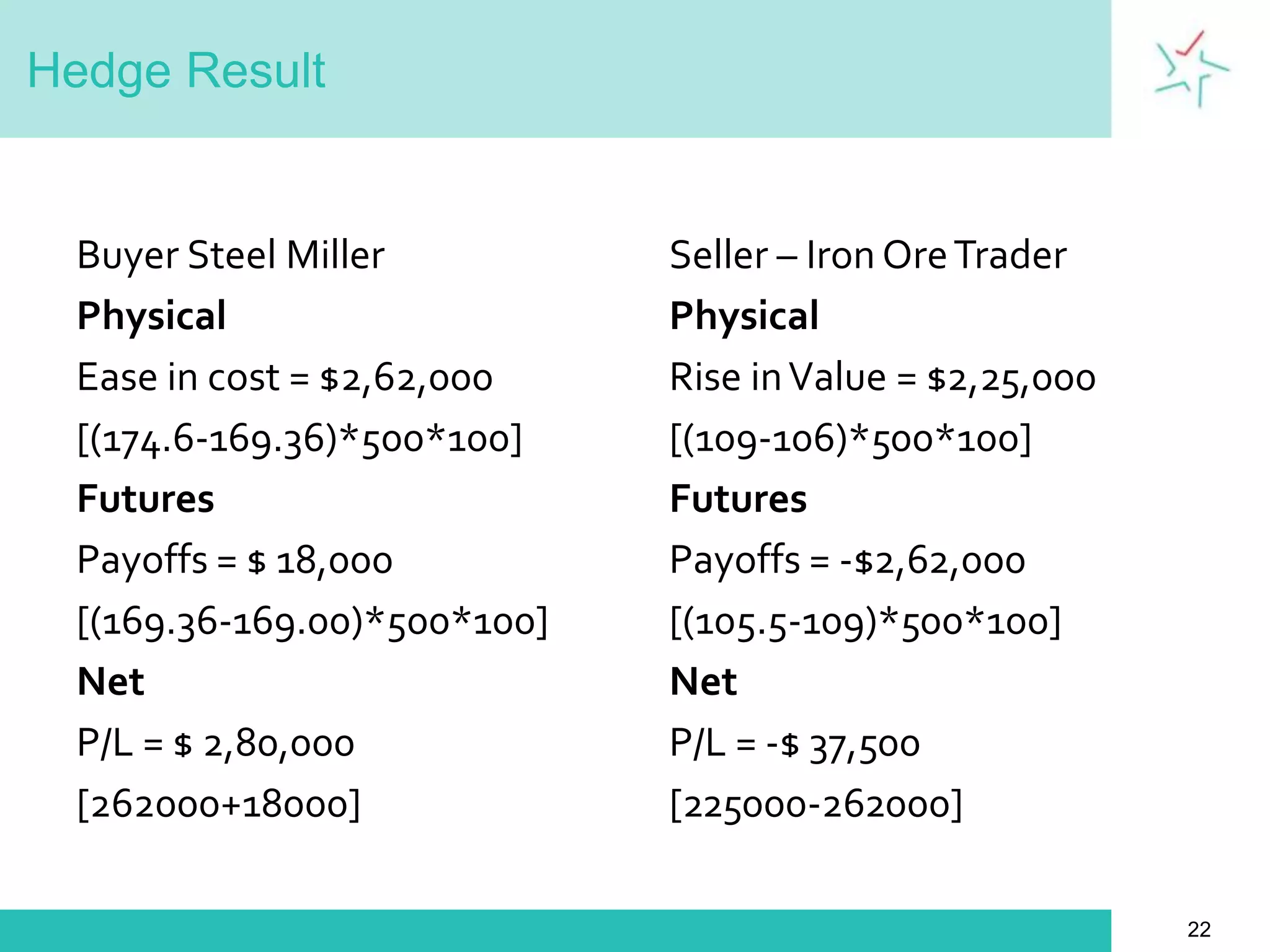

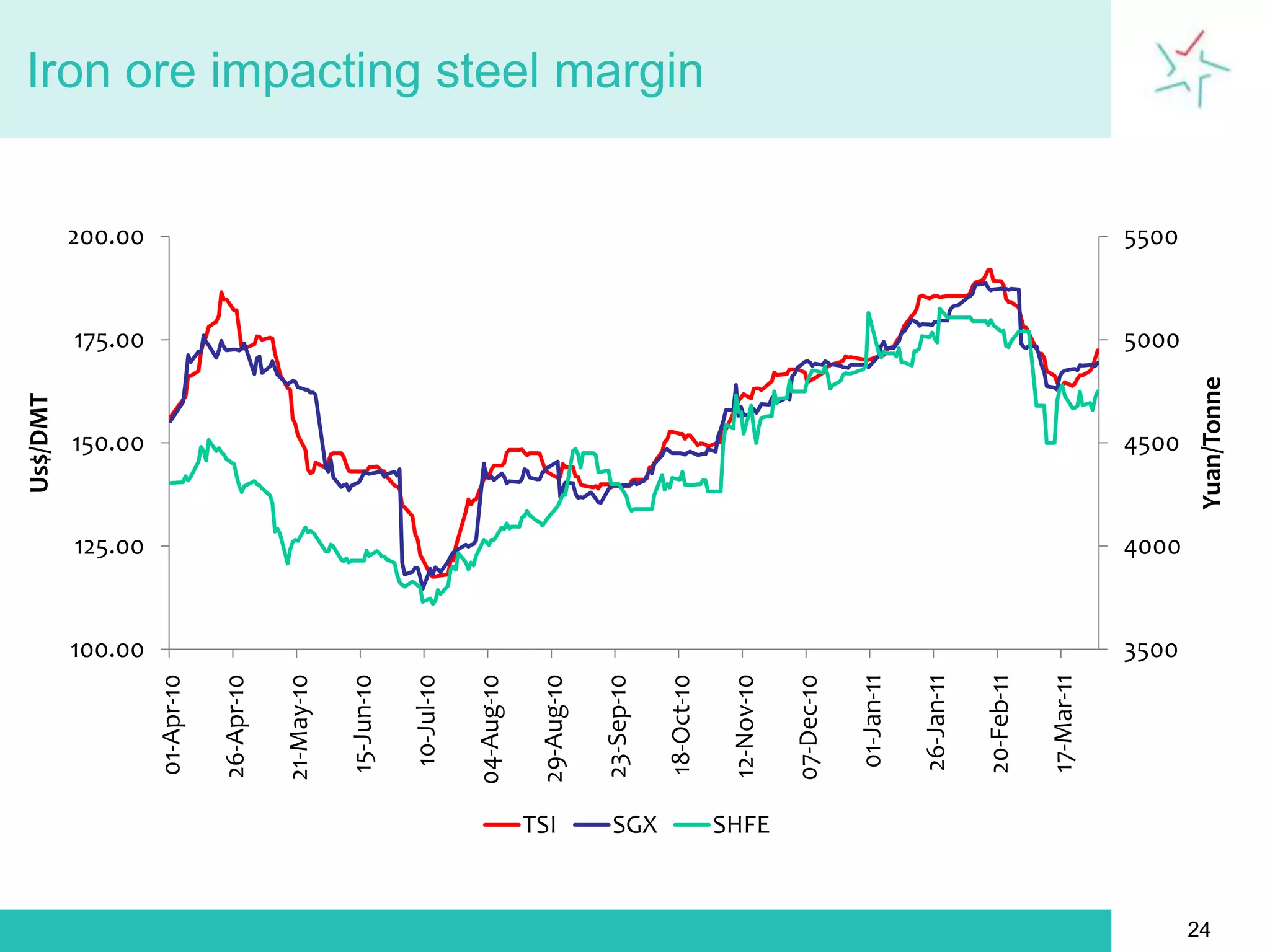

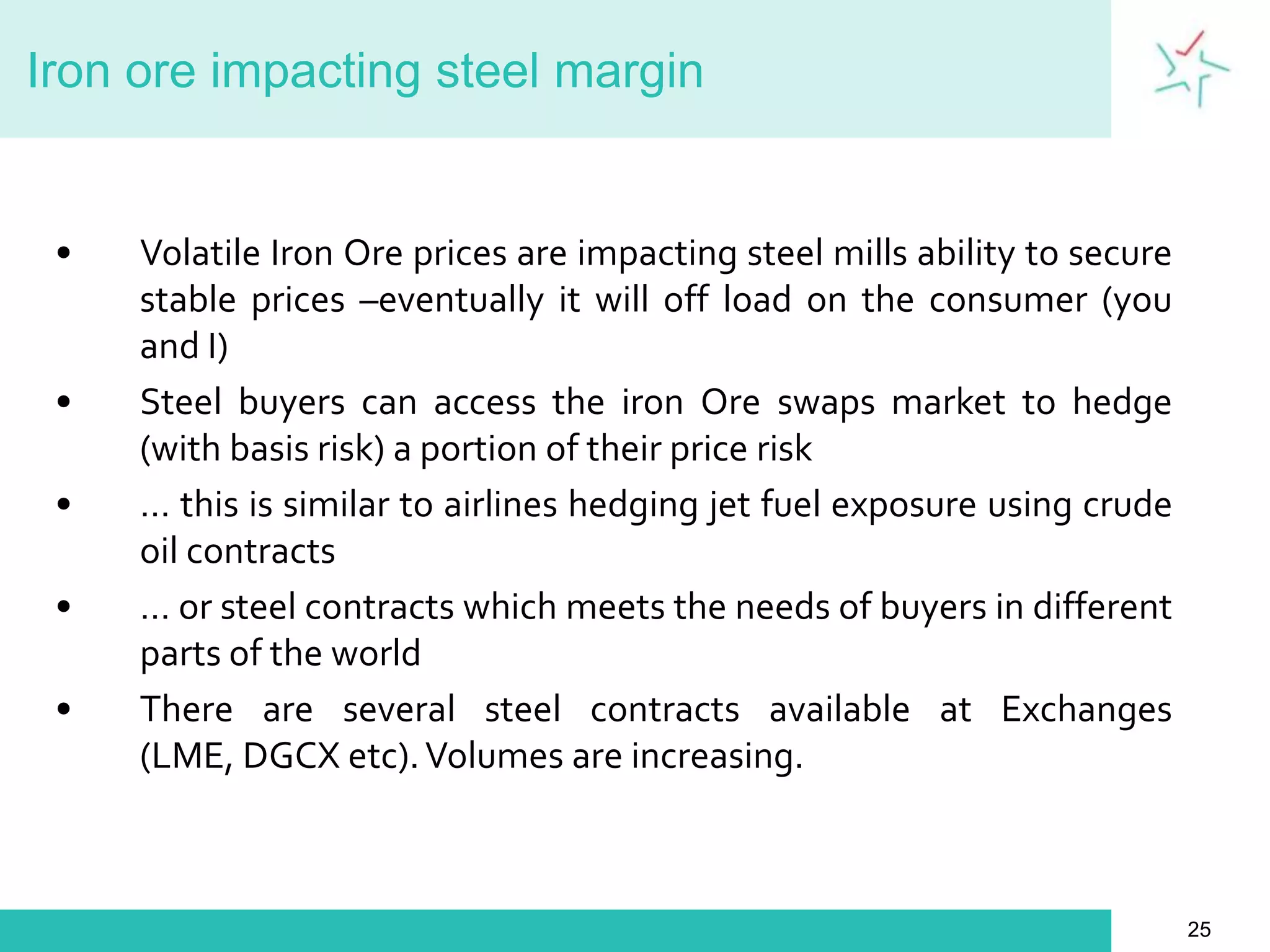

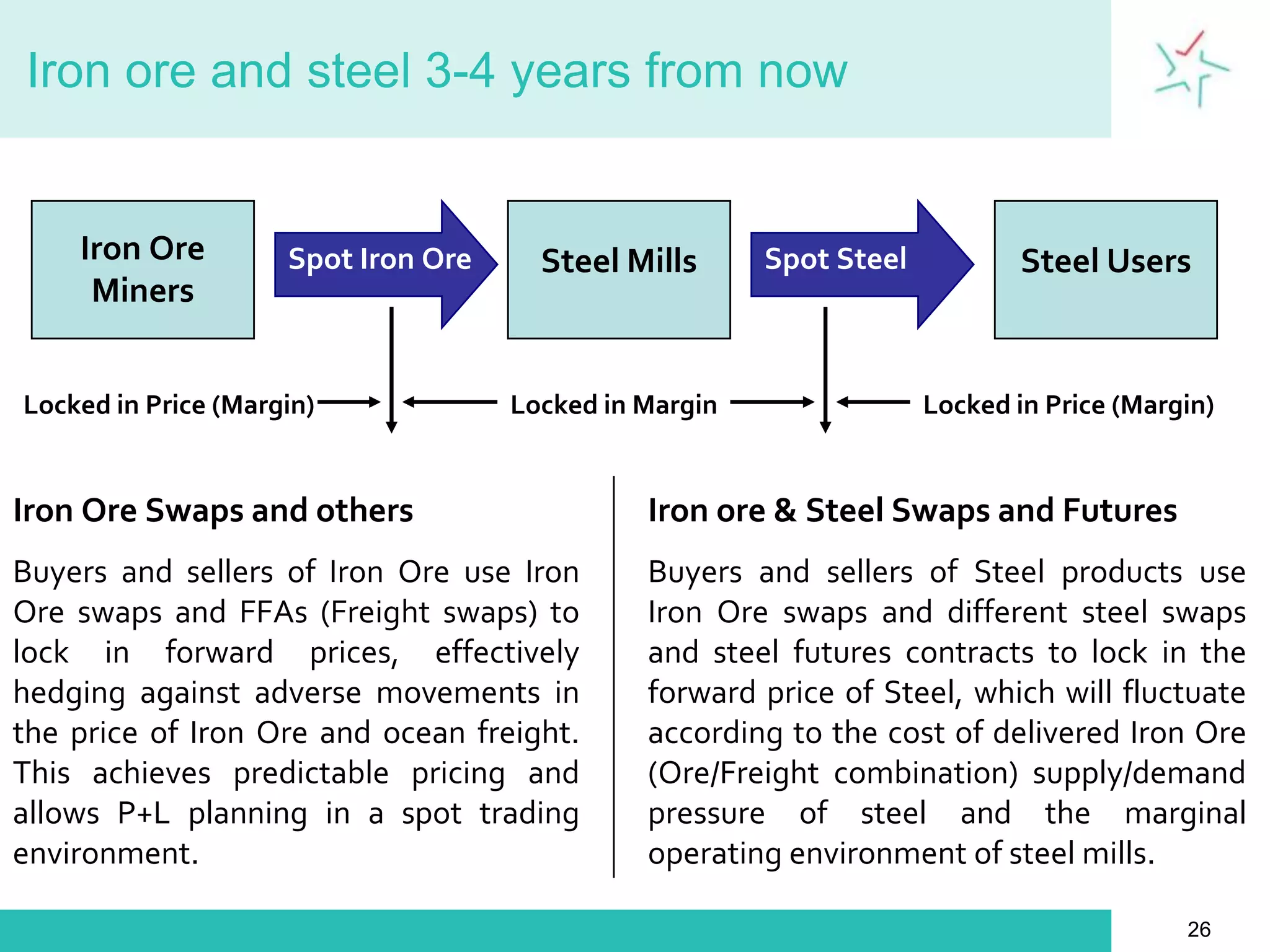

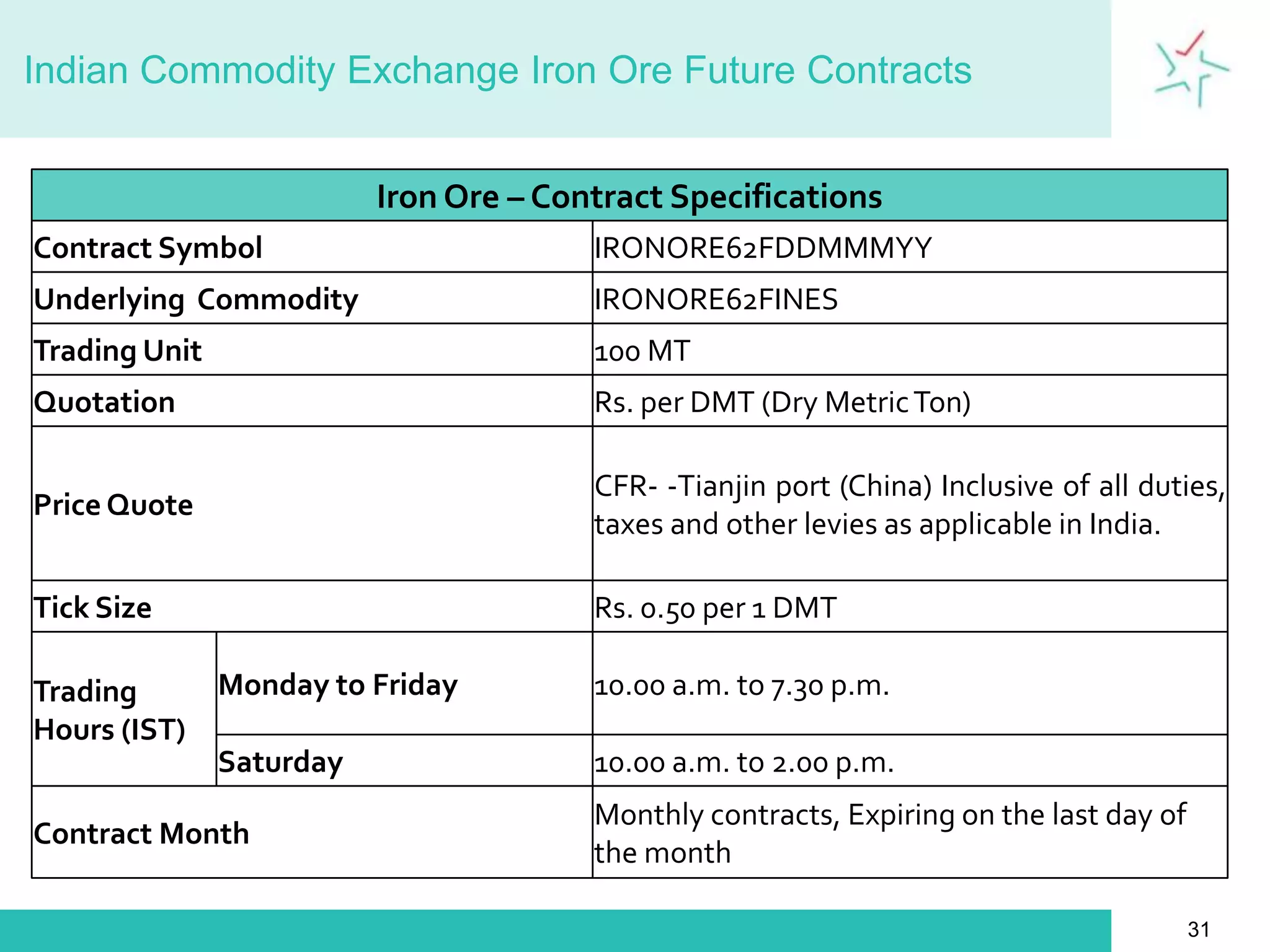

Indian Commodity Exchange Limited is launching iron ore derivative contracts to help market participants manage risks from volatile iron ore prices. Derivatives allow buyers and sellers of iron ore and steel to lock in prices in the future. The presentation discusses how the iron ore market works, factors influencing prices like steel demand from China and supply from major producers. It also outlines benefits of trading iron ore futures contracts like hedging, price discovery and transparency. The exchange aims to provide a platform for efficient price risk management in iron ore, the world's second largest commodity market by volume.

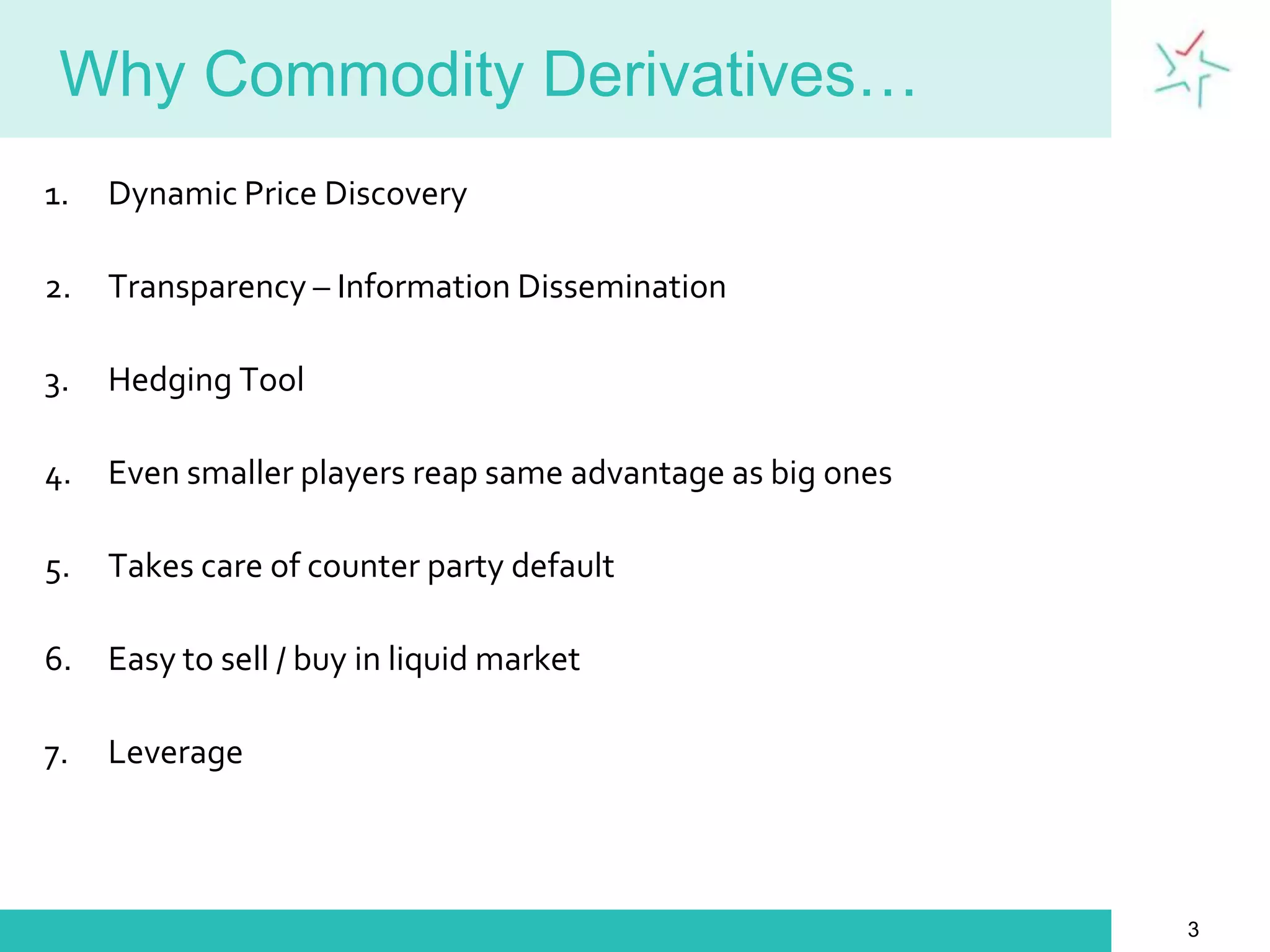

![Hedge ResultBuyer Steel MillerPhysicalEase in cost = $2,62,000[(174.6-169.36)*500*100]FuturesPayoffs = $ 18,000[(169.36-169.00)*500*100]NetP/L = $ 2,80,000[262000+18000]Seller – Iron Ore TraderPhysicalRise in Value = $2,25,000[(109-106)*500*100]FuturesPayoffs = -$2,62,000[(105.5-109)*500*100]NetP/L = -$ 37,500[225000-262000]22](https://image.slidesharecdn.com/ironoreicex-110615042901-phpapp01/75/IRON-ORE-34-2048.jpg)