This document provides an investment analysis of Focume summarizing key points:

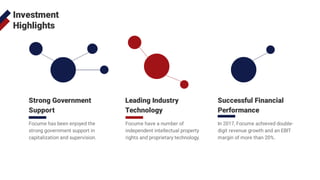

- It analyzes whether investing in Focume would benefit the requesting party and their company. Focume has strong government support, leading industry technology, and achieved double-digit revenue growth and 20% EBIT margins in 2017.

- Focume's leadership team has over 50 years of combined industry experience. The tool allows for easy online creation, customization, and sharing of presentations.

- The return on investment is projected to be 5.94% over 5 years, with Focume's net income increasing 120% in 2018 and expected continued strong economic growth.

- Risks include macroeconomic/political

![Executive

Summary

This is an investment analysis for Focume. It

was made as per request of [Requesting Party].

This investment analysis aims to assess

whether the Focume will be an advantage to

the requester and their company.](https://image.slidesharecdn.com/investmentanalysis-3-190524070355/85/Investment-Analysis-Presentation-Template-2-320.jpg)

![Upstream [industry name] accepts premium limited capacity.

Downstream [industry name] shows the characteristics of

depending on brand, product category concentration. And new

entrants has long been challenged by high technical threshold.

Overall, the statues of industry is in high degree of market

concentration, the top brands occupy the absolutely advantage.

Upstream Midstream

Downstream New Entrants

1 2

3 4

Competitive

Analysis](https://image.slidesharecdn.com/investmentanalysis-3-190524070355/85/Investment-Analysis-Presentation-Template-6-320.jpg)