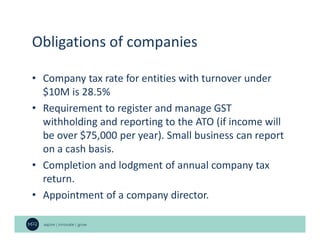

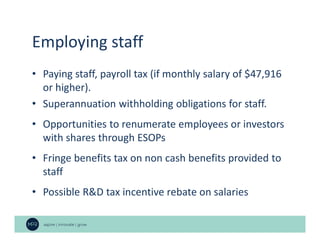

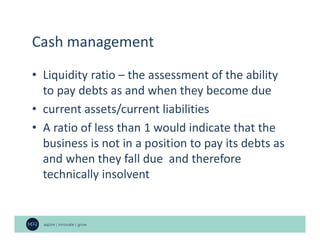

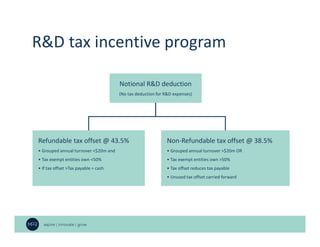

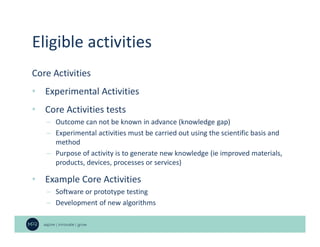

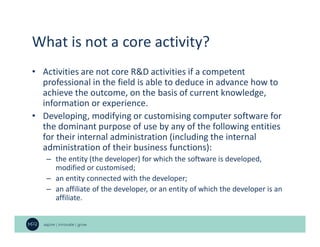

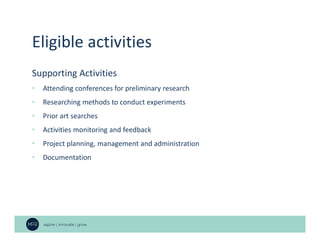

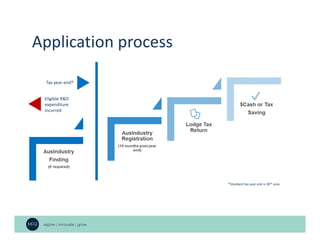

The document provides information for entrepreneurs on business services offered by MPR Group such as accounting, tax compliance, capital raising, and grants. It also outlines key business considerations including employing staff, seeking investors, cash management, R&D tax incentives, and export market development grants. MPR Group is a business accounting and advisory firm located in Southbank, Australia that can assist innovators with various startup needs.