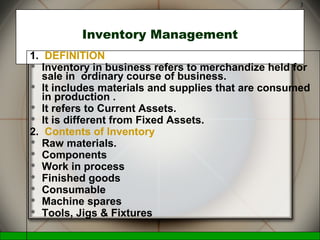

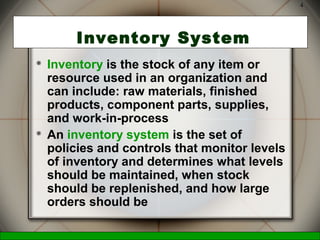

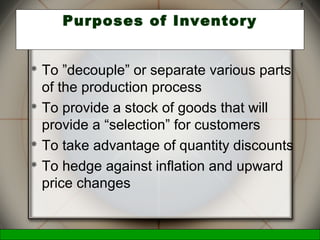

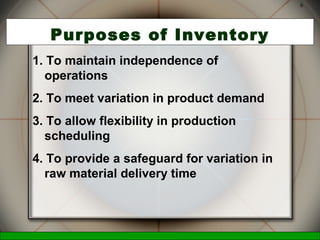

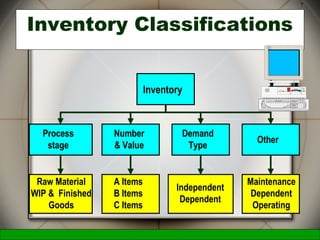

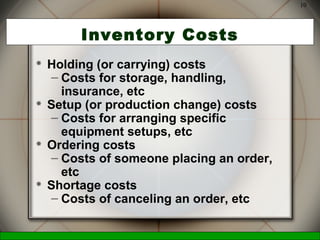

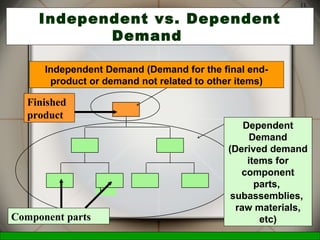

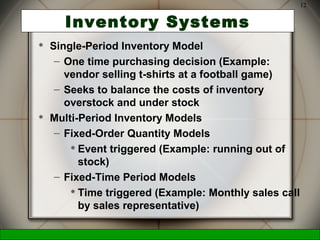

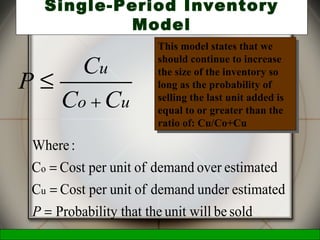

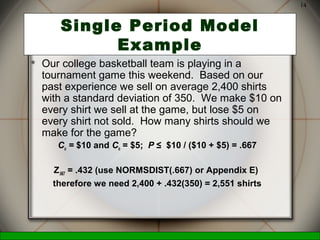

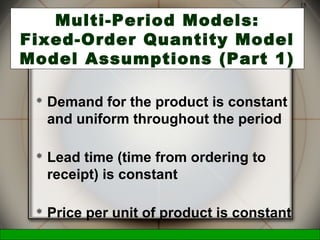

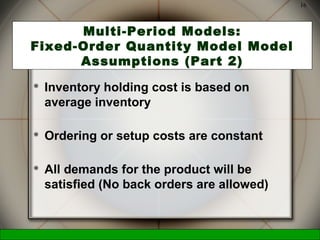

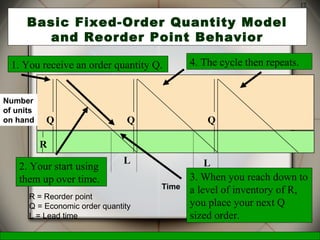

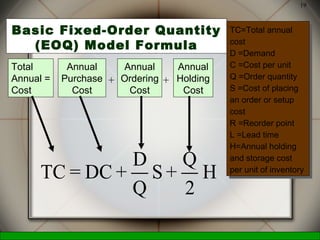

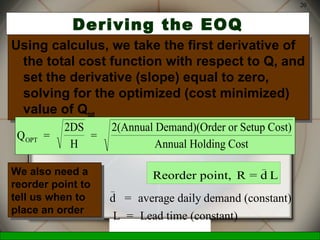

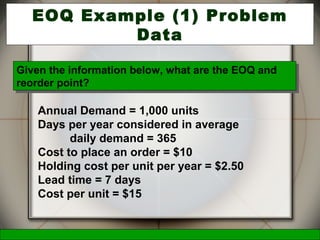

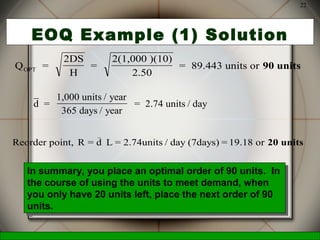

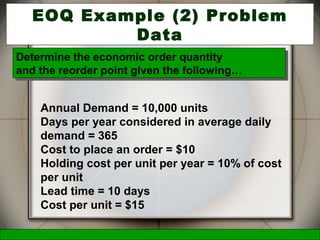

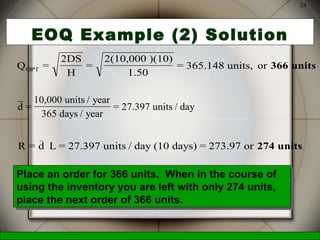

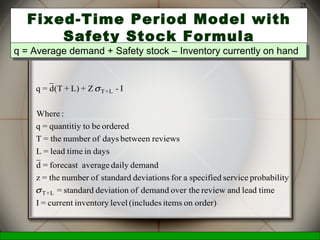

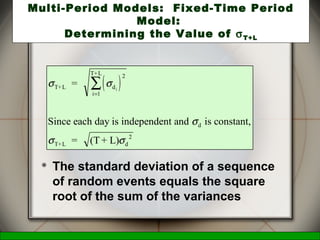

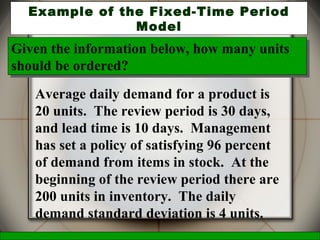

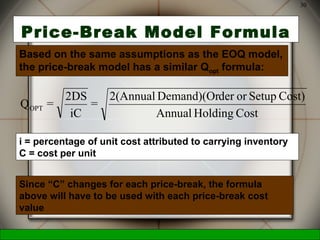

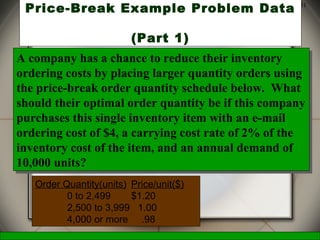

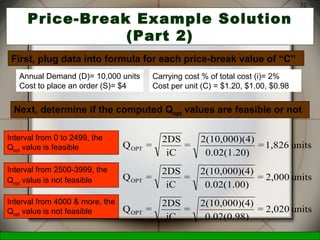

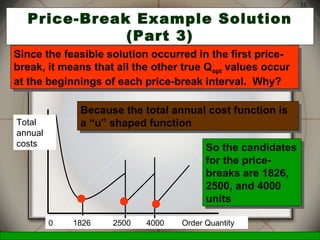

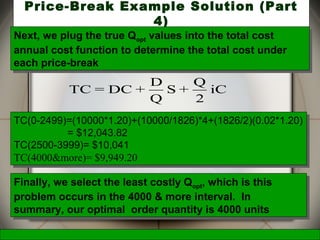

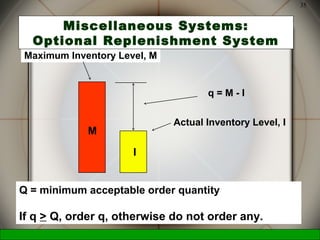

This document discusses inventory management decisions and concepts. It begins by defining inventory and inventory systems. It then discusses inventory costs, classifications, and purposes. The document covers independent and dependent demand. It also covers single-period and multi-period inventory models, including the basic fixed-order quantity model and economic order quantity (EOQ) formula. Examples are provided to demonstrate how to calculate the optimal order quantity and reorder point using the EOQ model.