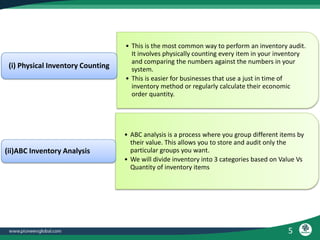

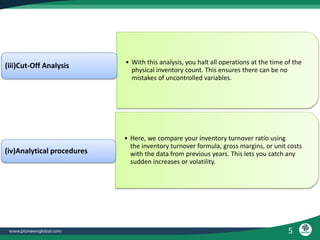

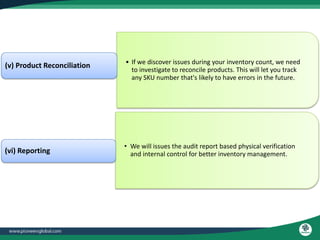

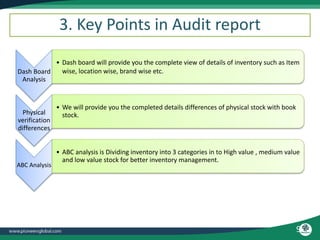

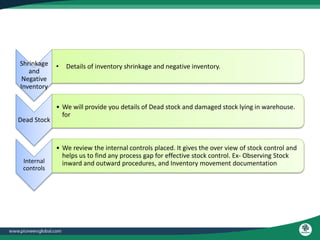

This document discusses the key aspects of conducting an inventory audit. It outlines the audit procedures that will be performed, including physical inventory counting, ABC analysis, cut-off analysis, analytical procedures, and product reconciliation. The inventory audit report will provide a dashboard analysis, details of physical count differences, ABC analysis results, information on shrinkage and negative inventory, identification of dead stock, and a review of internal controls. Conducting regular inventory audits helps businesses know what's missing from their inventory, assess the overall inventory status, and better budget by understanding usage patterns of different inventory items.