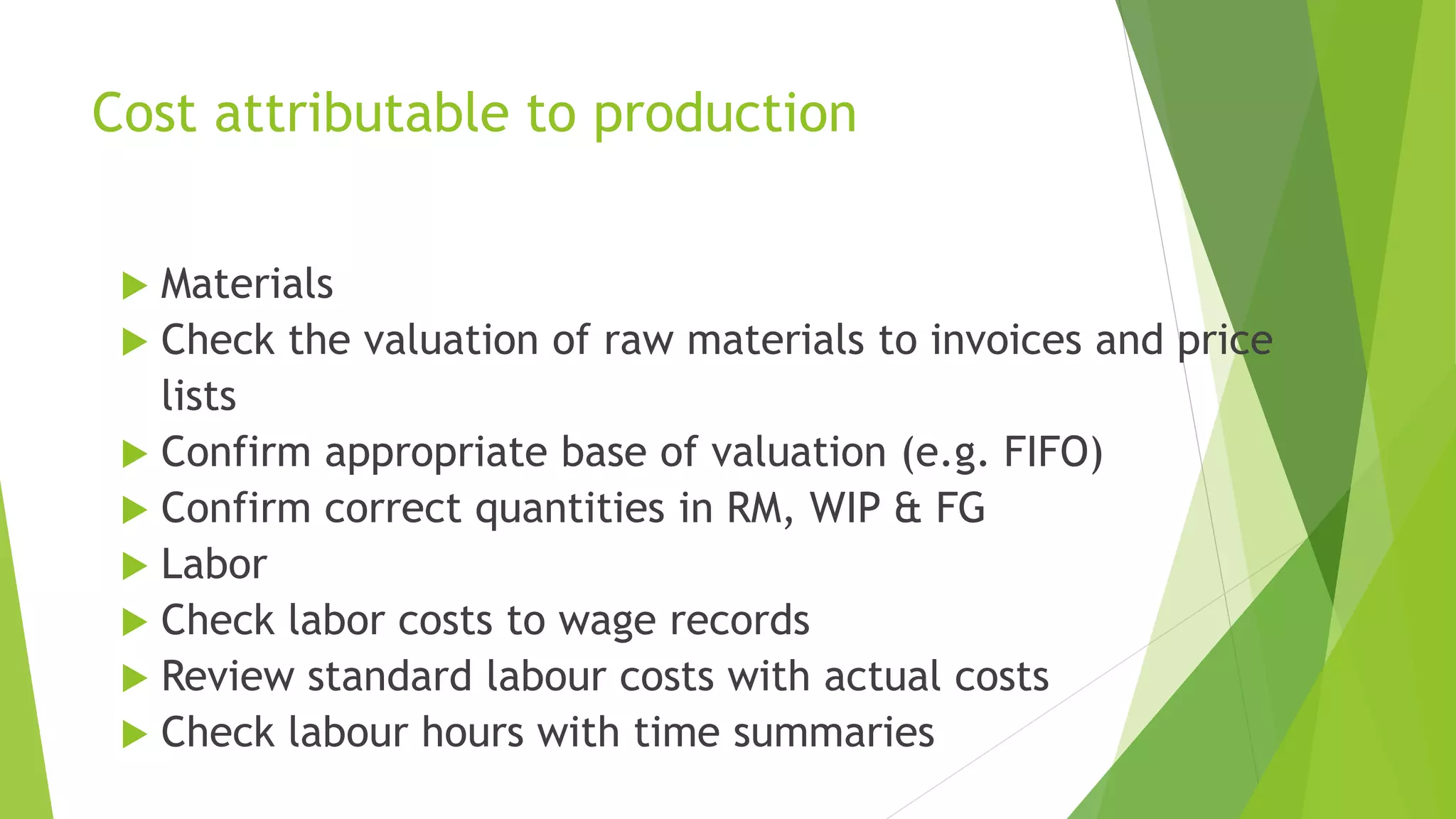

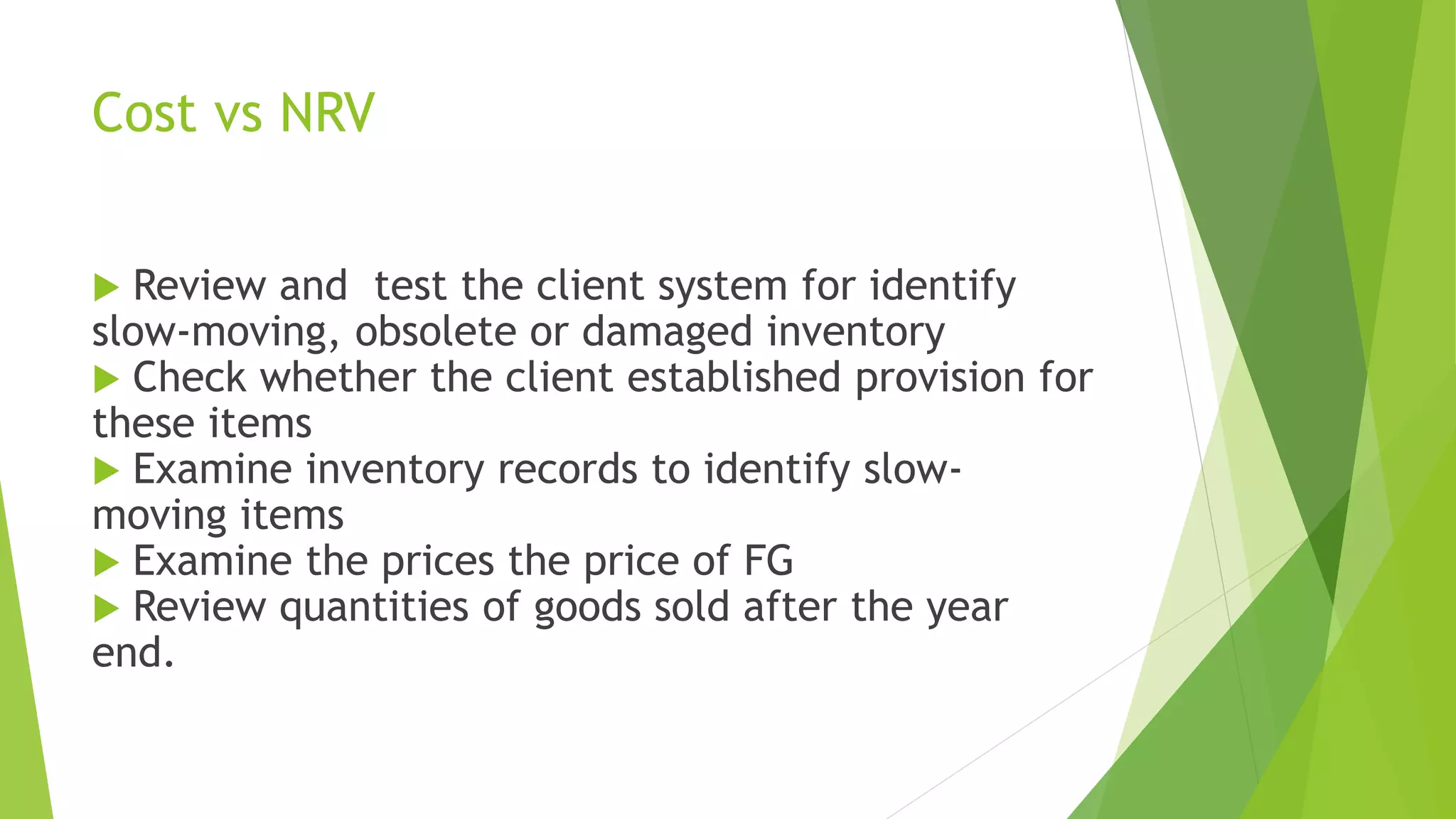

This document discusses inventory auditing. It covers the key elements of inventory auditing including existence, completeness, valuation, and ownership. It describes regulatory requirements under IAS 2 and ISA 501. The document outlines procedures for planning, attending, and following up on the physical inventory count. It also discusses important audit procedures for inventory cut-off, valuation of raw materials, work-in-progress, and finished goods, as well as comparing inventory costs to net realizable value.