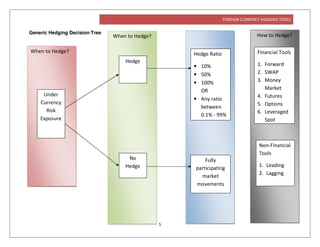

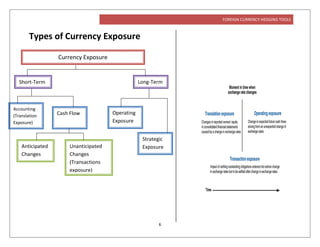

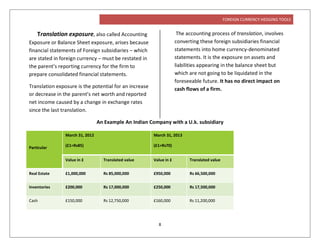

This document discusses various tools for hedging foreign currency risk. It begins by defining hedging as a risk management strategy used to reduce losses from price volatility. The main types of currency exposure are then outlined as transaction, translation, and operating. Various hedging tools are then described in detail, including forwards, futures, options, swaps, money markets, and leveraged spot markets. Specific examples are provided to illustrate how each tool can be used to hedge currency risk for a company conducting international business and trade.