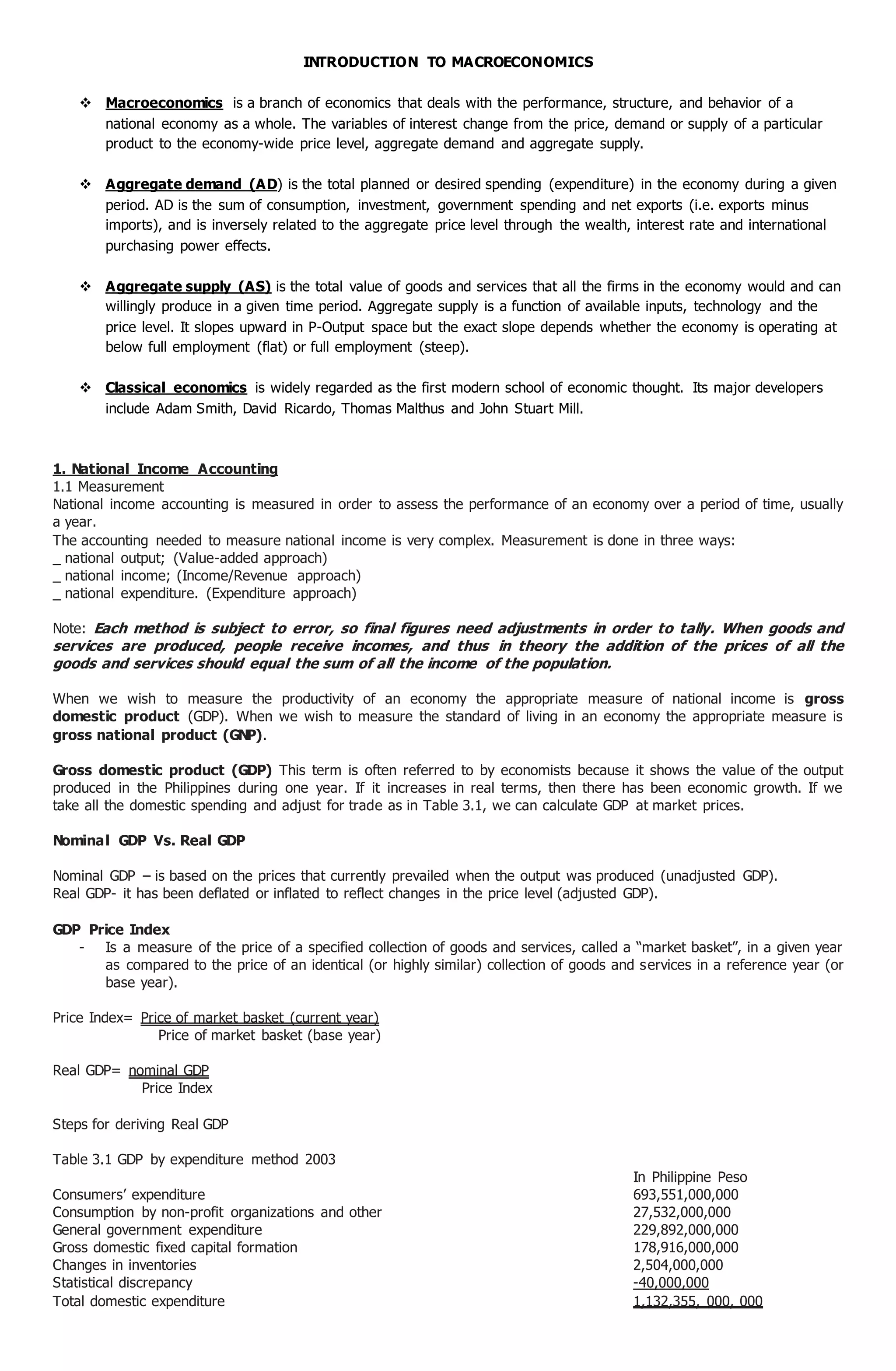

This document provides an introduction to macroeconomics and national income accounting. It defines key macroeconomic variables like aggregate demand, aggregate supply, and discusses how the economy is measured. National income is measured using three approaches: production, income, and expenditure. Real GDP is adjusted for inflation using a price index to measure economic growth. National income deducts capital consumption to estimate sustainable income levels.