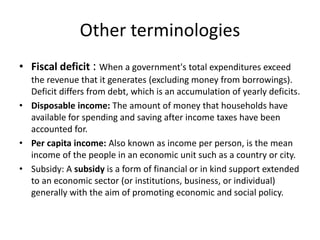

This document provides an introduction to basic macroeconomics terminology and concepts. It defines macroeconomics as focusing on the large picture of the overall economy, while microeconomics examines individual markets and economic actors. Key terms explained include inflation, recession, GDP, fiscal and monetary policy tools, and business cycles. GDP is discussed as a measurement of economic growth, and the relationships between actual, potential, nominal, and real GDP are outlined.