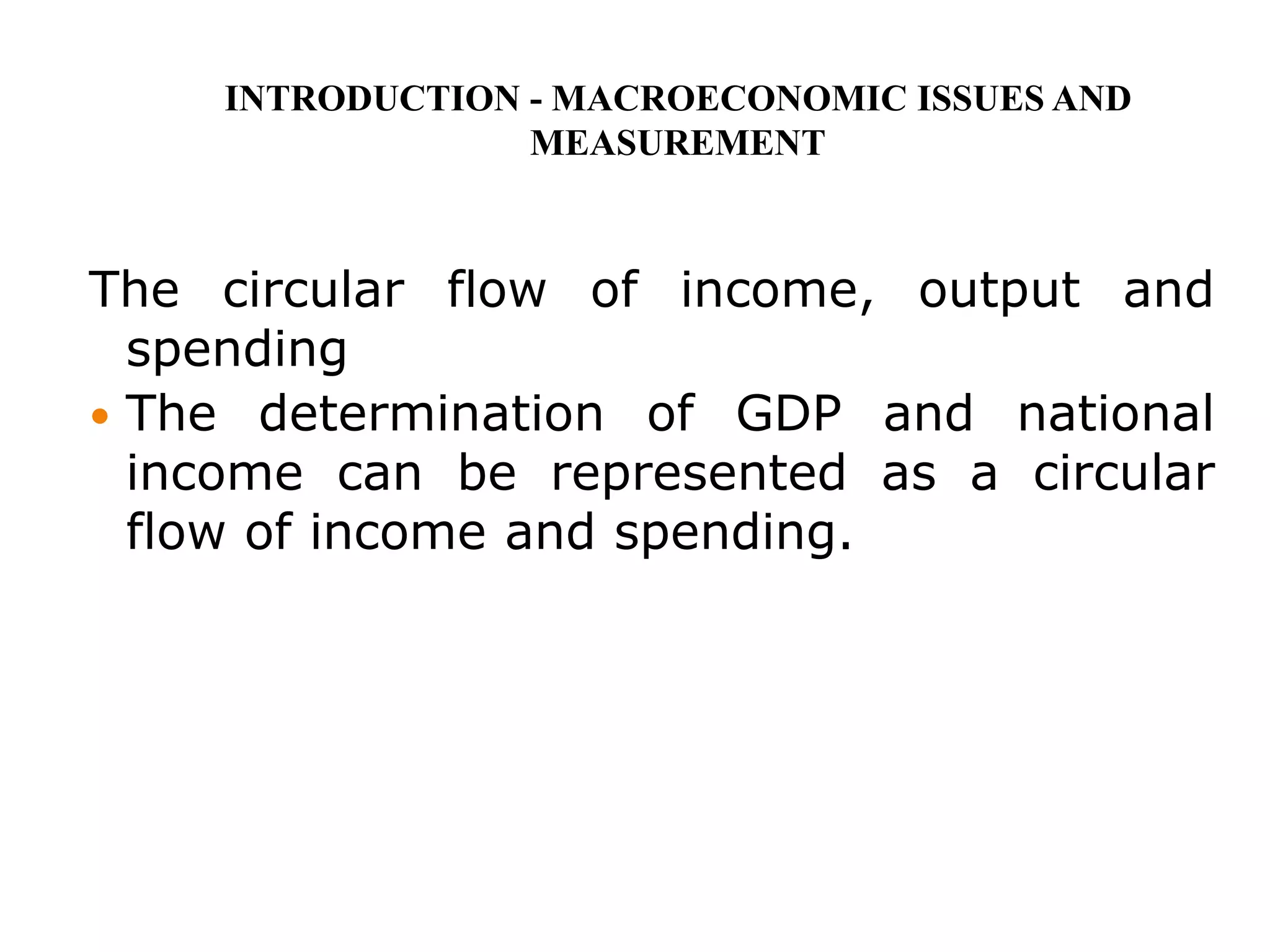

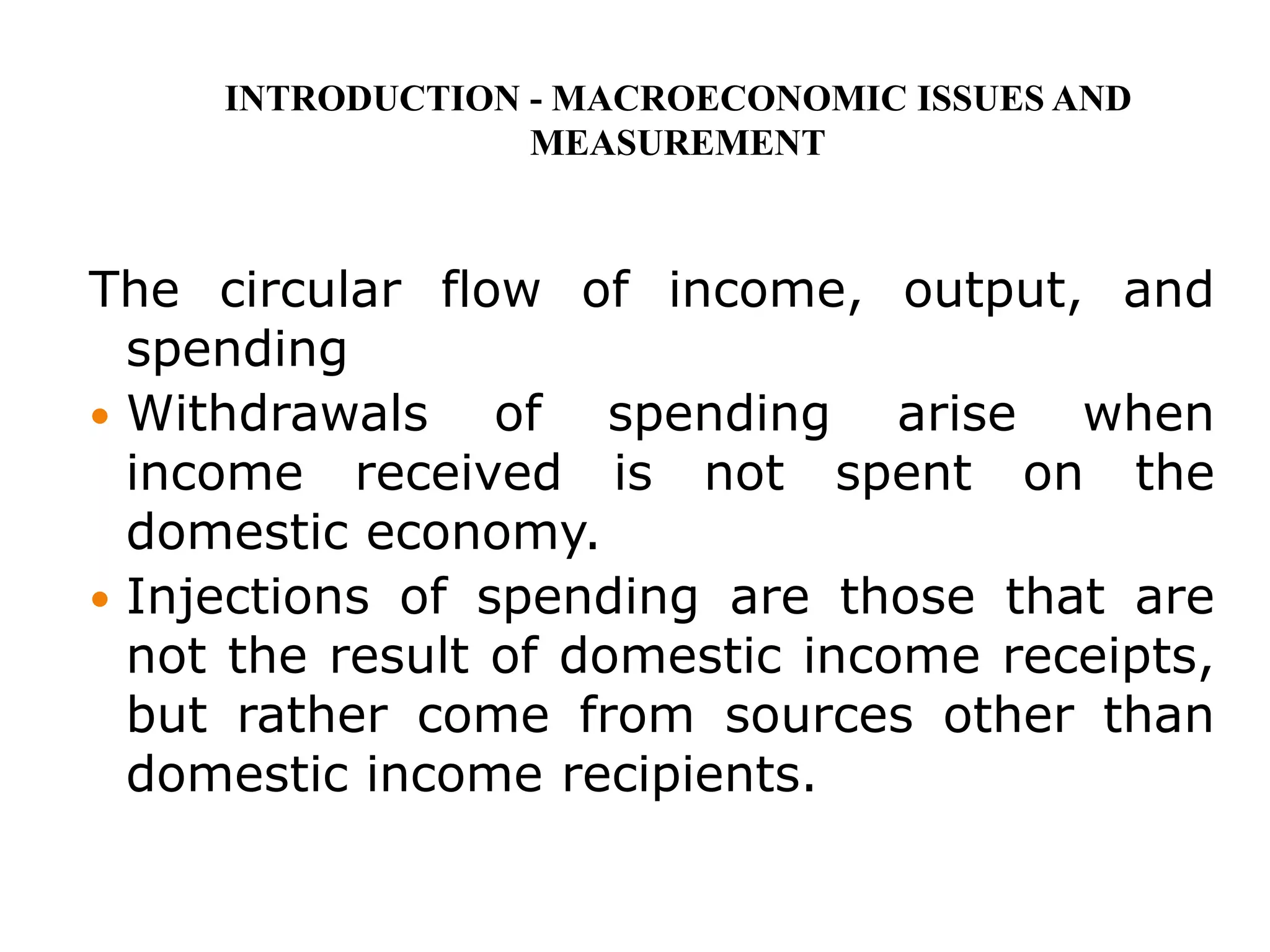

This document discusses key macroeconomic concepts and measurement including:

- GDP can be measured as the sum of value added by all producers, as the sum of income claims generated in production, or as the spending on final goods and services.

- GDP measures domestic production while GNI measures income earned by a country's residents, including income from overseas.

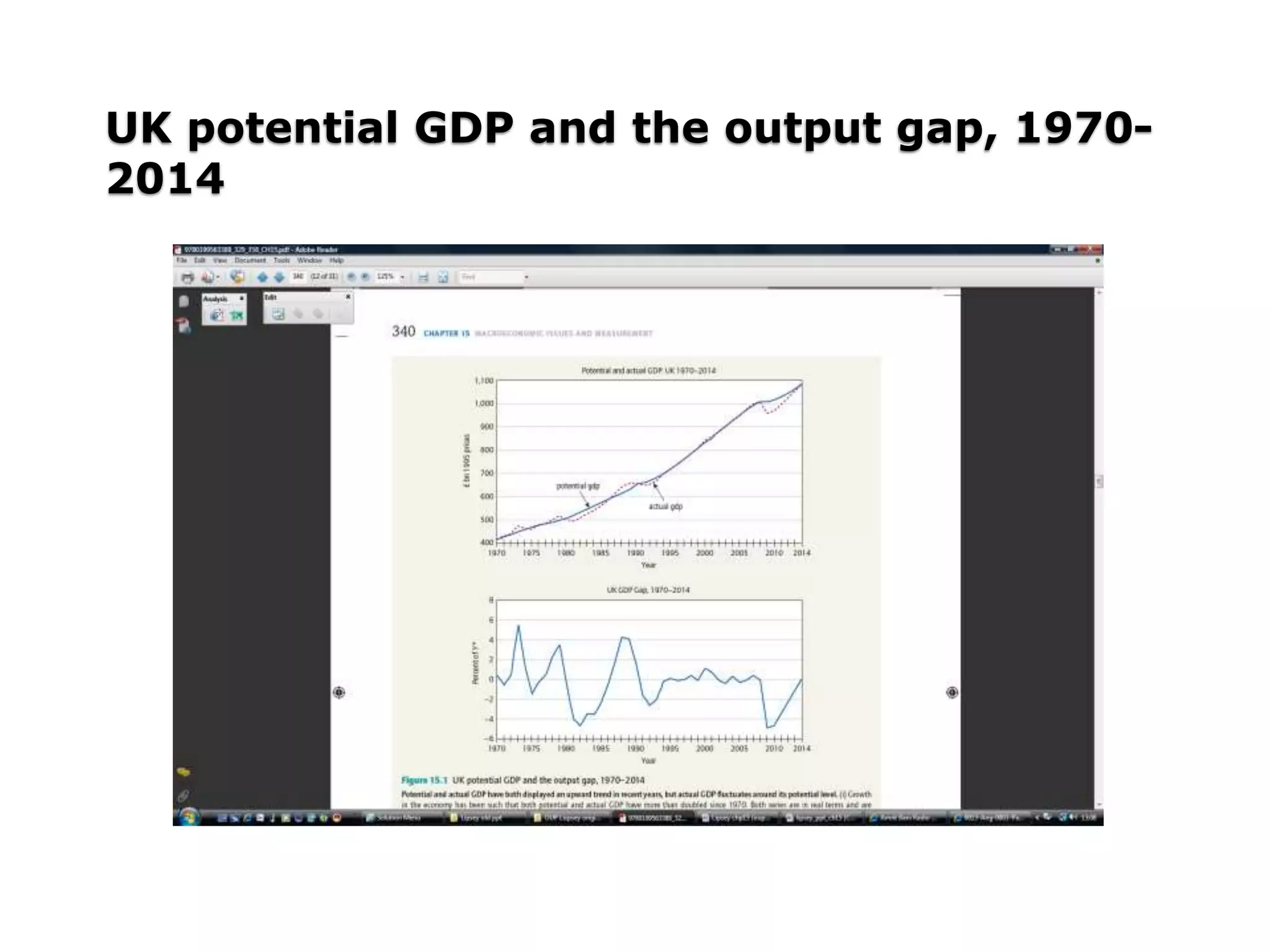

- Potential GDP is the level of output if the economy was at full employment, and the GDP gap is the difference between actual and potential GDP.

![Measurement of National Output

Goods that count as part of the economy’s output

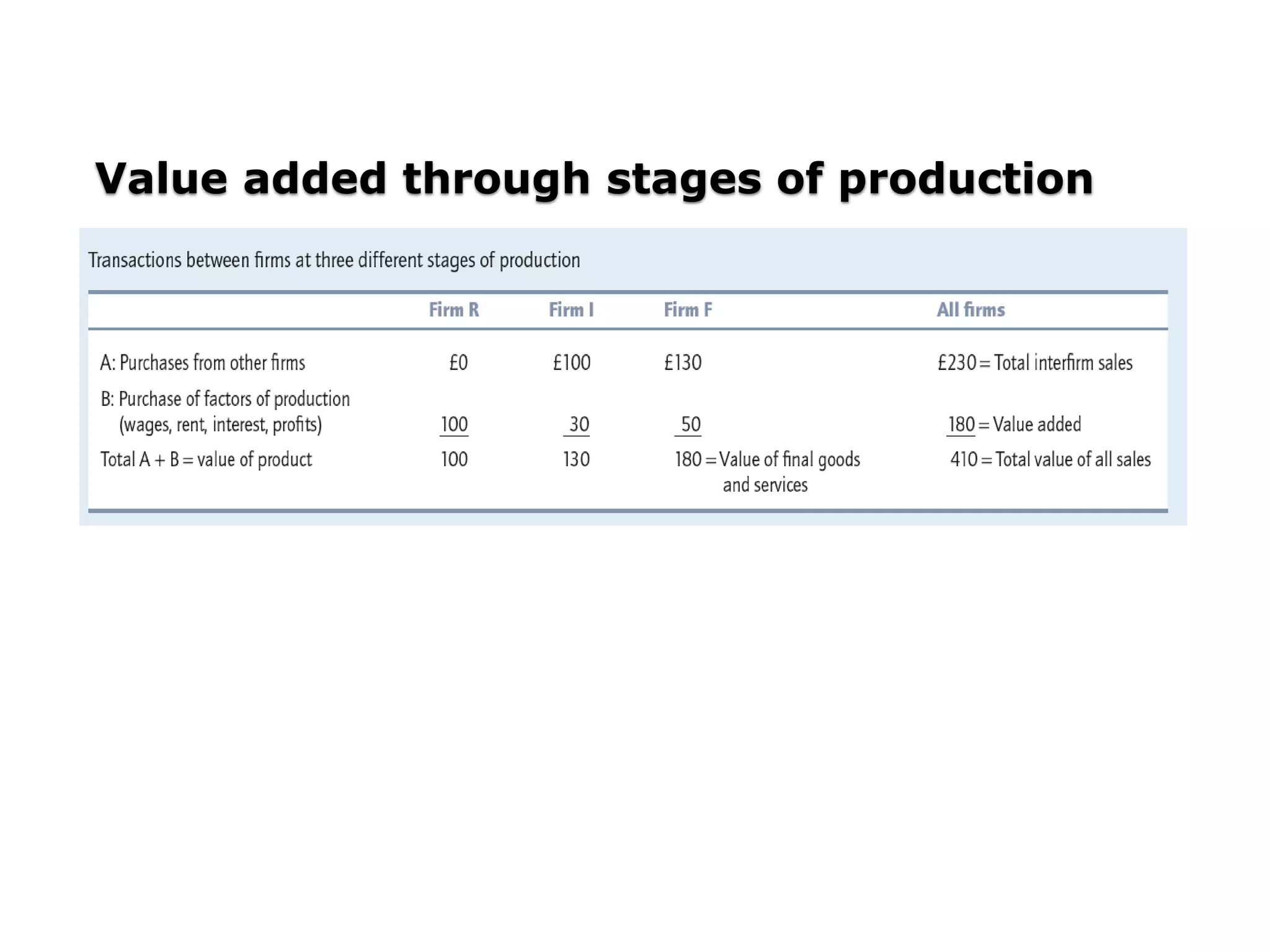

are called final goods; all others are called

intermediate goods.

The sum of all the values added produced in an

economy is called gross value added at basic

prices. Basic prices are the prices received by

producers net of taxes on products [plus

subsidies].

INTRODUCTION - MACROECONOMIC ISSUES AND

MEASUREMENT](https://image.slidesharecdn.com/1macroeconomicissuesandmeasurement-210328121753/75/Macroeconomic-issues-and-measurement-9-2048.jpg)

![GDP, GNI, and GNP

Gross domestic product, [GDP] can be calculated

in three different ways:

◦ [1] as the sum of all values added by all producers of both

intermediate and final goods

◦ [2] as the income claims generated by the total production

of goods and services; and

◦ [3] as the expenditure needed to purchase all final goods

and services produced during the period.

INTRODUCTION - MACROECONOMIC ISSUES AND

MEASUREMENT](https://image.slidesharecdn.com/1macroeconomicissuesandmeasurement-210328121753/75/Macroeconomic-issues-and-measurement-16-2048.jpg)

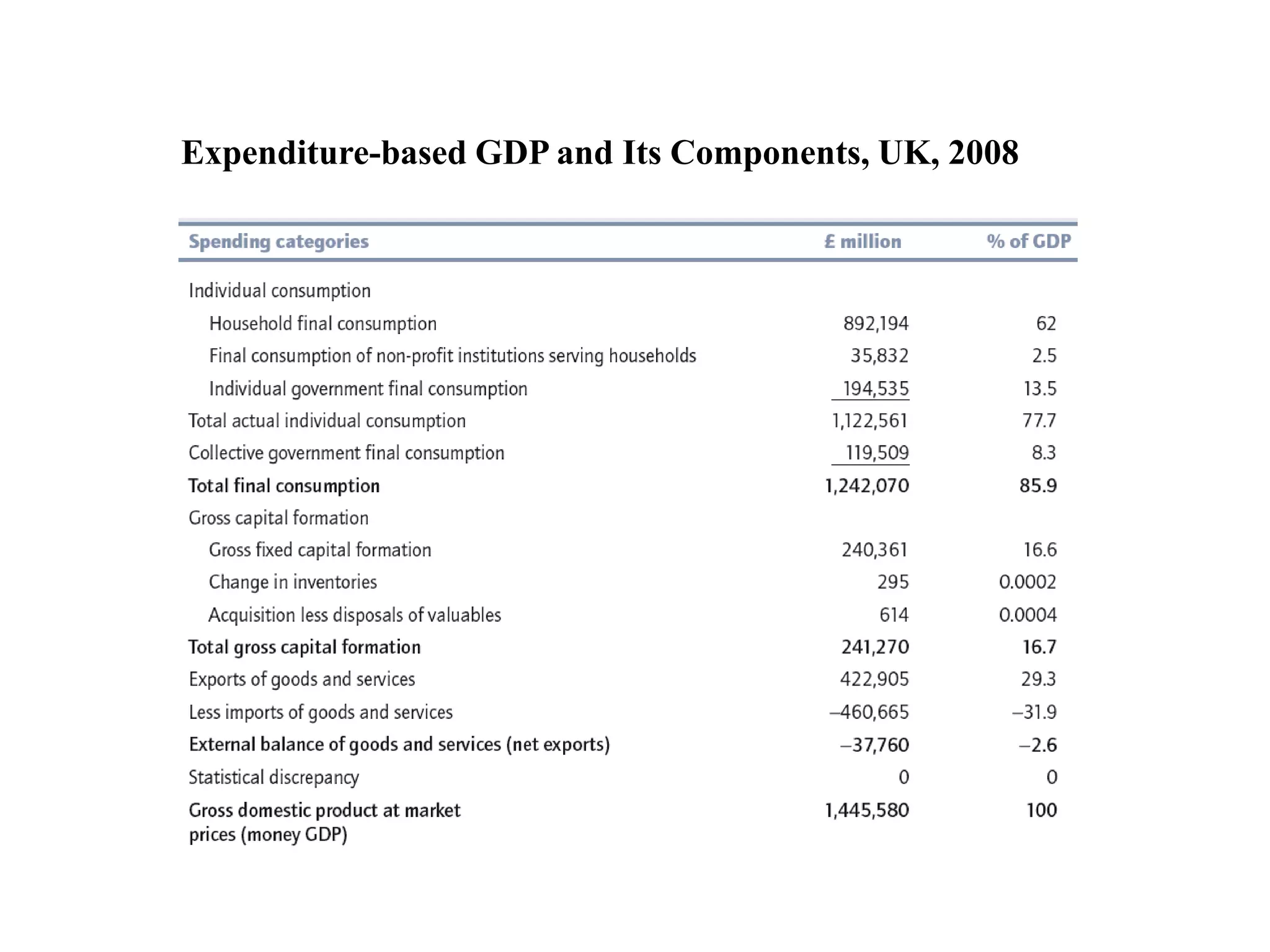

![ From the expenditure side of the national

accounts GDP = Ca + Ia + Ga + [Xa - Ima].

Ca comprises private consumption expenditures.

Ia is investment in fixed capital [including

residential construction], inventories, and

valuables (jewellery, art etc).

Gross investment can be split into replacement

investment [necessary to keep the stock of capital

intact] and net investment [net additions to the

stock of capital].

Ga is government consumption. [Xa -IMa]

represents net exports, or exports minus imports;

it will be negative if imports exceed exports.

INTRODUCTION - MACROECONOMIC ISSUES AND

MEASUREMENT](https://image.slidesharecdn.com/1macroeconomicissuesandmeasurement-210328121753/75/Macroeconomic-issues-and-measurement-17-2048.jpg)

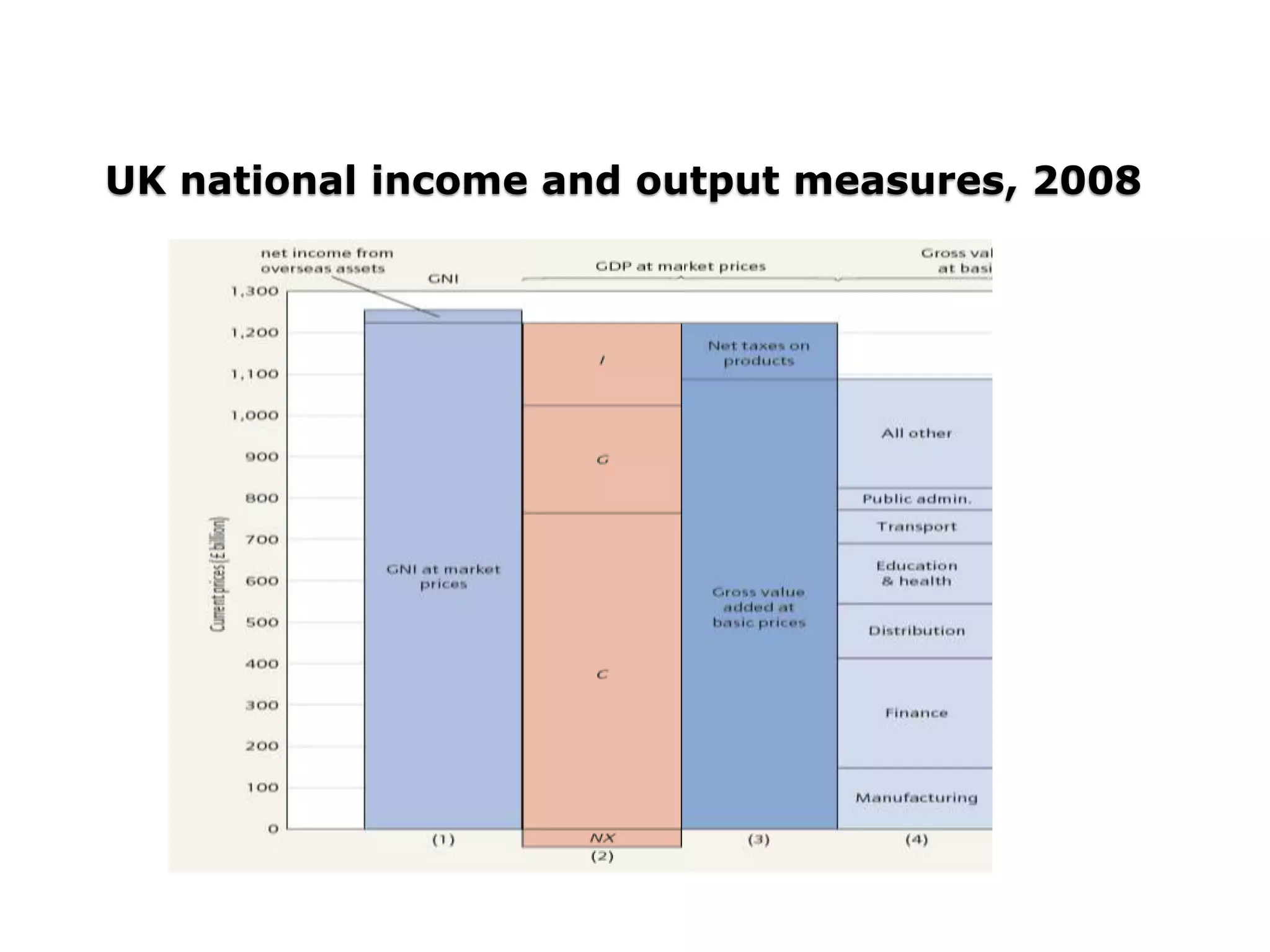

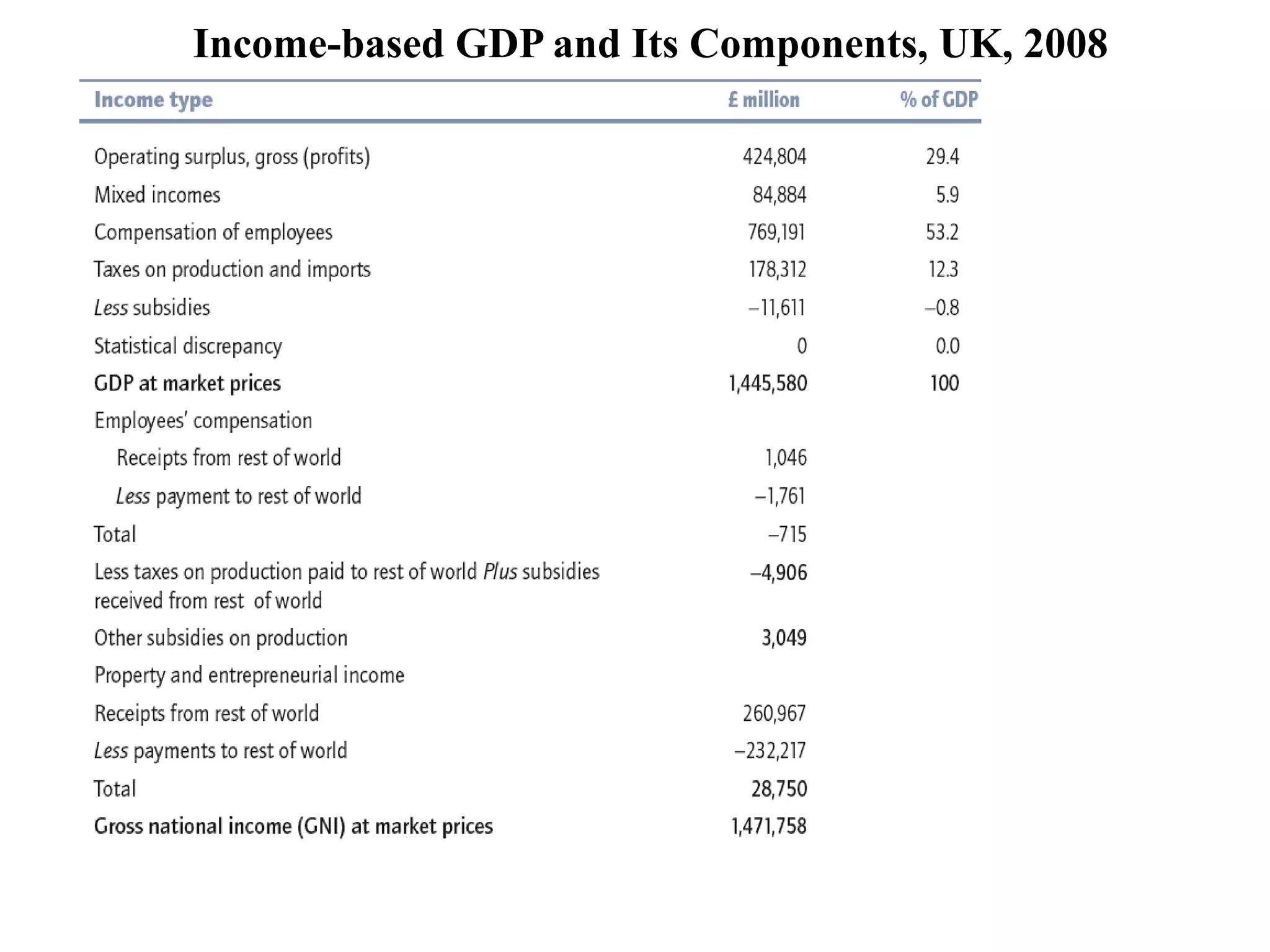

![ Compensation of employees is the payment for

the services of labor inclusive of net salary, taxes

withheld and other deductions made for pension

etc ie wages are measured gross.

UK GDP measures production that is located in

the United kingdom, and UK gross national

income [GNI] measures income accruing to UK

residents.

The difference is due to net income from abroad.

GNI is the same thing as what used to be called

gross national product [GNP].

INTRODUCTION - MACROECONOMIC ISSUES AND

MEASUREMENT](https://image.slidesharecdn.com/1macroeconomicissuesandmeasurement-210328121753/75/Macroeconomic-issues-and-measurement-19-2048.jpg)

![ Real GDP is calculated to reflect changes in real

volumes of output and real income.

Nominal GDP reflects changes in both prices and

quantities.

Any change in nominal GDP [or GNI] can be split

into a change in real GDP and a change due to

prices.

INTRODUCTION - MACROECONOMIC ISSUES AND

MEASUREMENT](https://image.slidesharecdn.com/1macroeconomicissuesandmeasurement-210328121753/75/Macroeconomic-issues-and-measurement-25-2048.jpg)