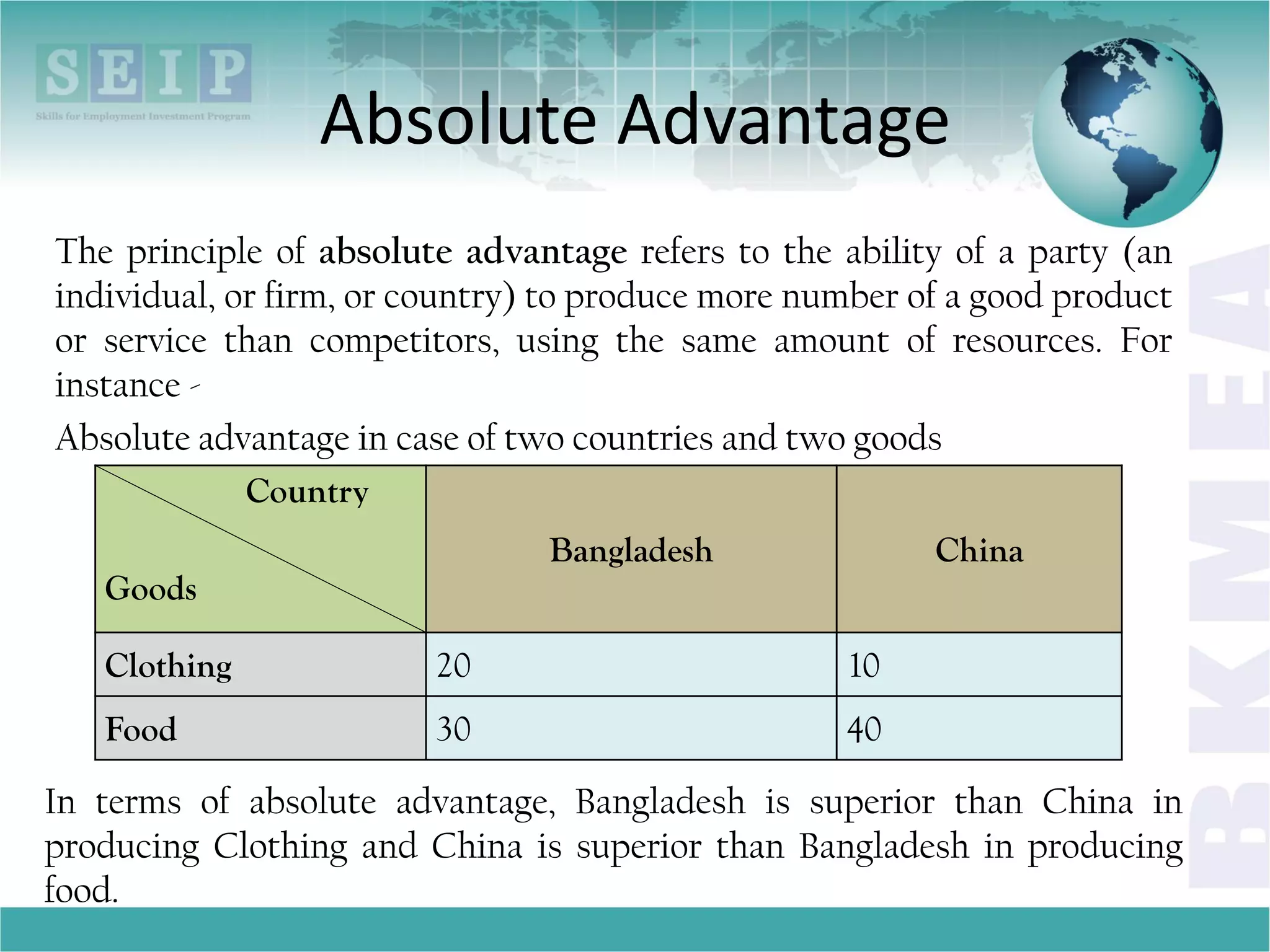

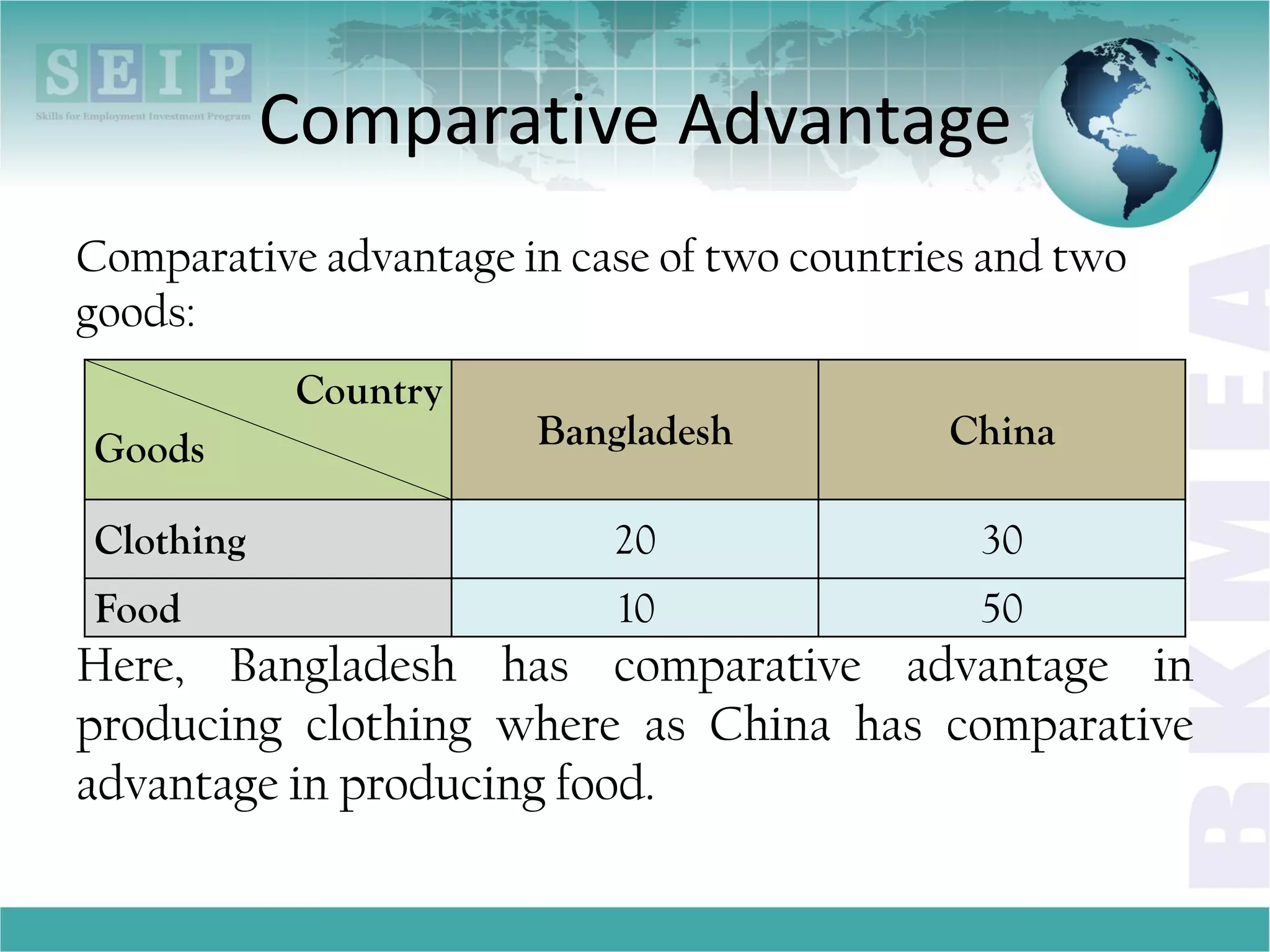

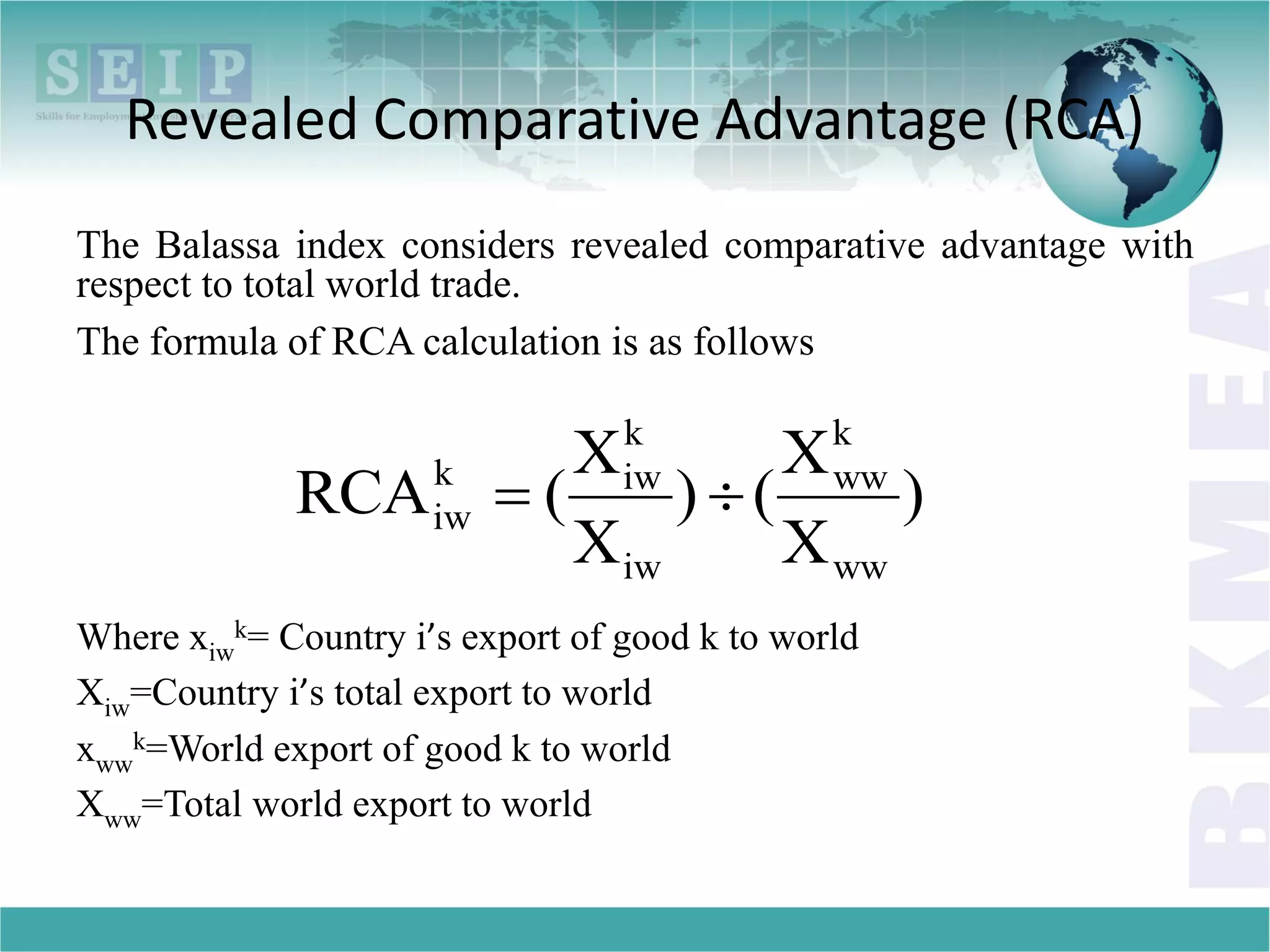

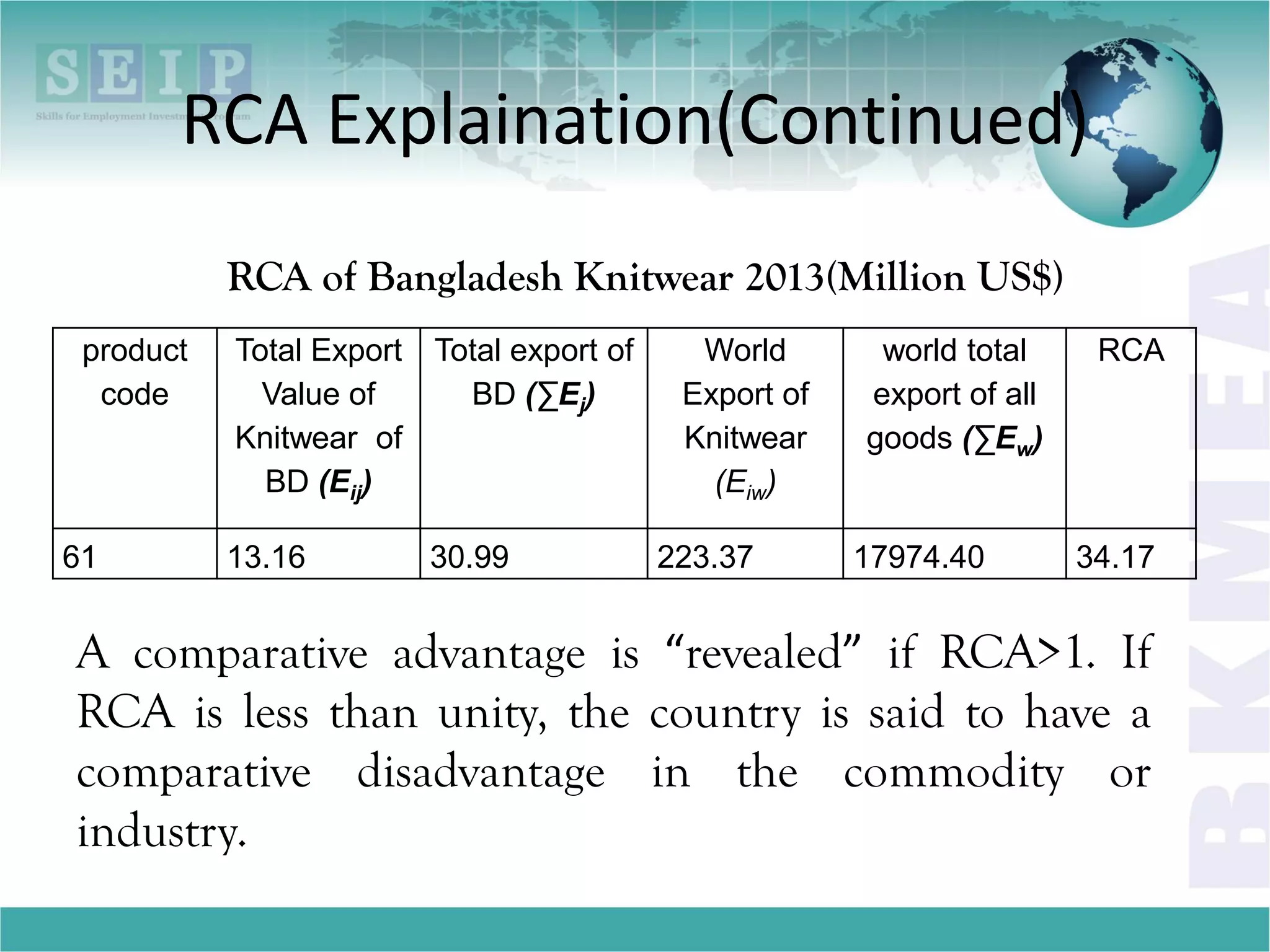

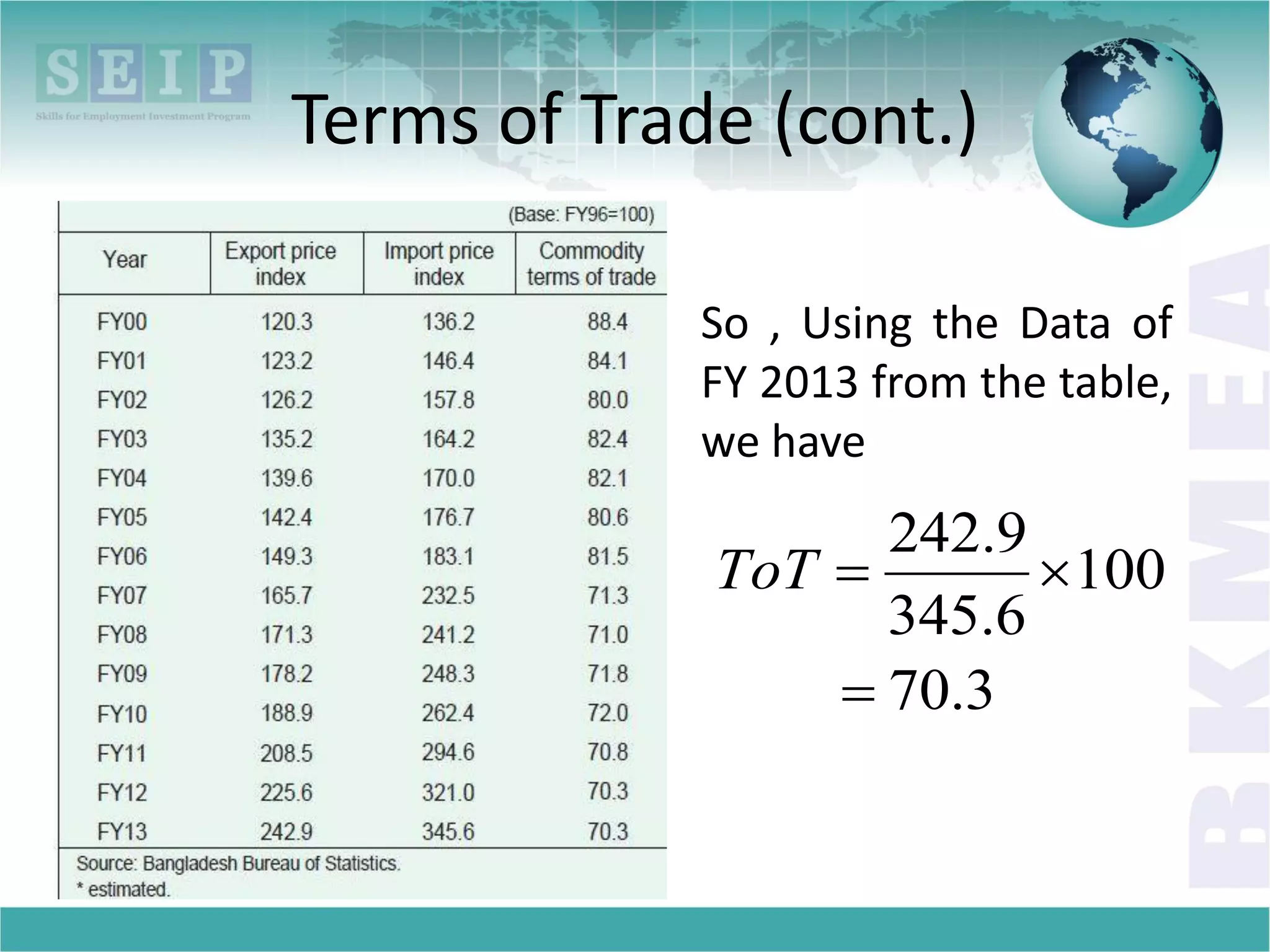

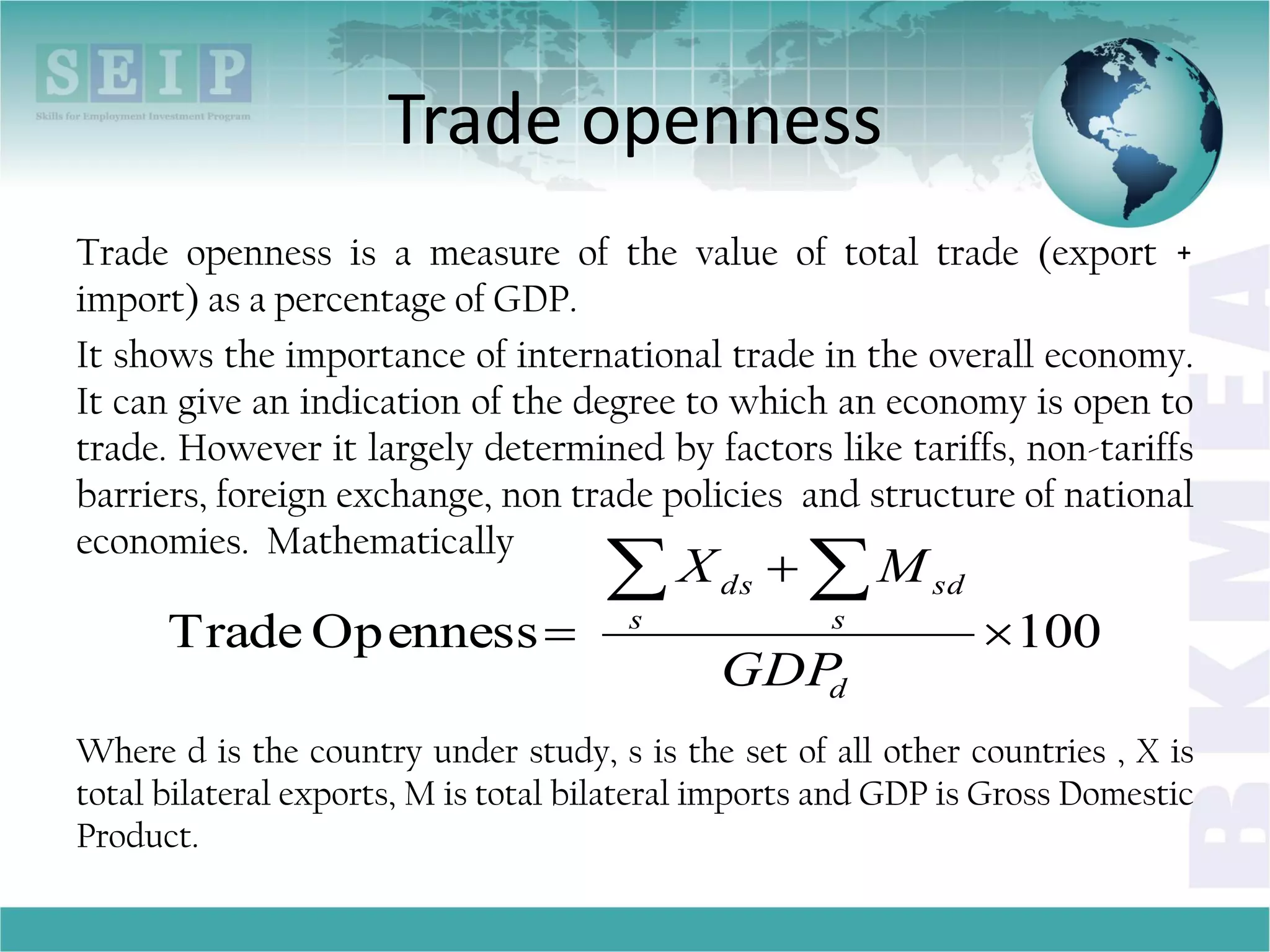

The document outlines the theoretical aspects of international trade, including concepts such as trade barriers, comparative and absolute advantages, and trade theories like the Heckscher-Ohlin model. It also discusses the balance of payments, terms of trade, trade openness, monetary and fiscal policies, and exchange rate regimes. Additionally, it emphasizes the importance of various economic indicators to understand a country's position in the global market.