Embed presentation

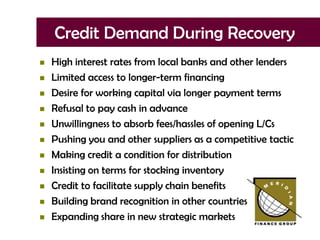

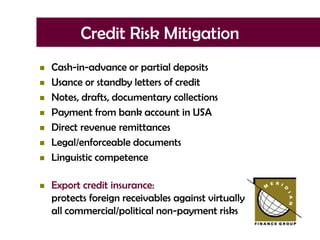

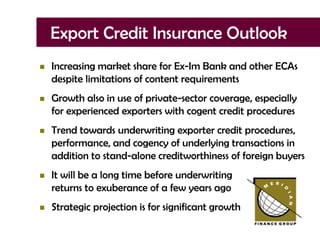

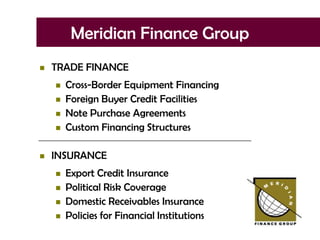

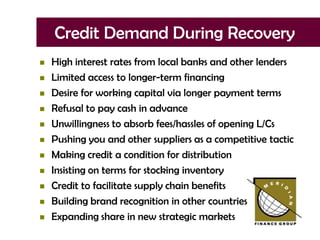

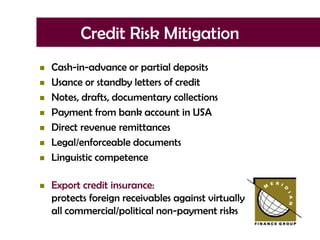

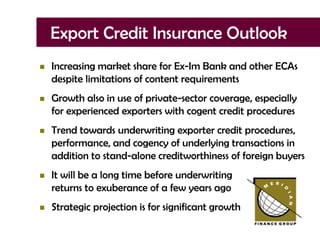

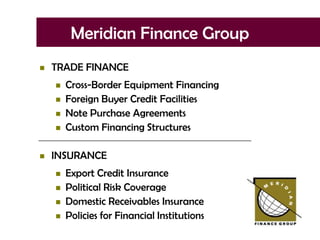

The webinar discusses managing international credit risk amid economic downturns, highlighting growth opportunities in exports despite the global financial crisis. Various challenges such as limited lending, payment delays, and the need for working capital are explored, along with strategies for mitigating credit risks through export credit insurance and financial practices. The document emphasizes the importance of understanding regional economic conditions and leveraging credit information as businesses navigate both downturns and recoveries.