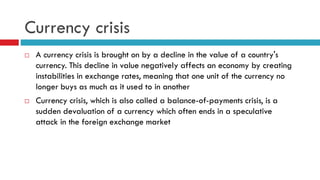

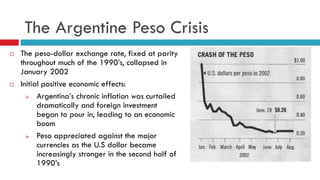

A currency crisis occurs when there is a sudden devaluation of a country's currency. This can be caused by chronic trade deficits, market speculation about a government's ability to back its currency, or a loss of confidence in the currency. A currency crisis often results in a speculative attack where investors rapidly sell the currency. This can force a country to abandon its exchange rate peg. Examples of major currency crises include the Mexican peso crisis in the 1990s and the Asian financial crisis of the late 1990s. The Argentine peso crisis in the early 2000s was caused by a fixed exchange rate that hurt exports and rising debt levels that led to sovereign default.