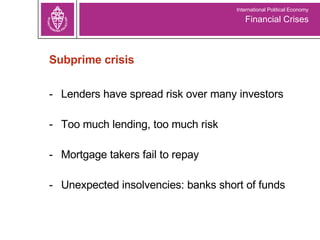

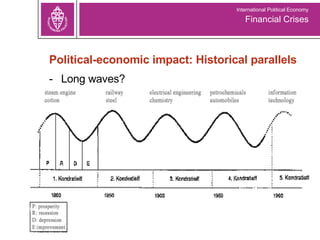

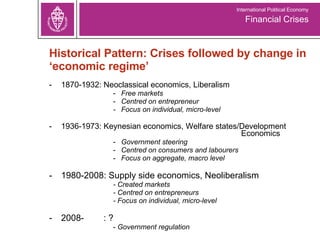

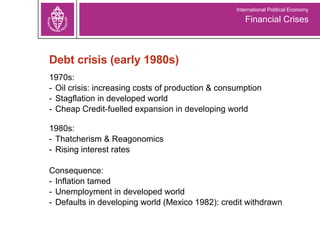

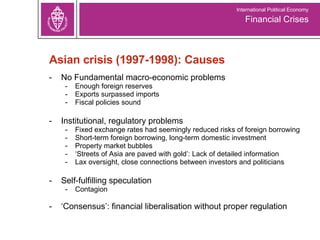

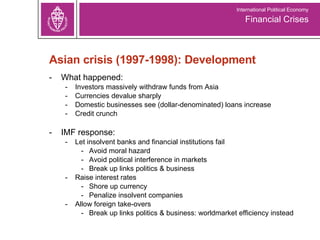

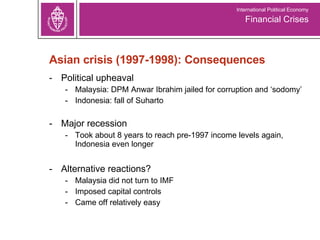

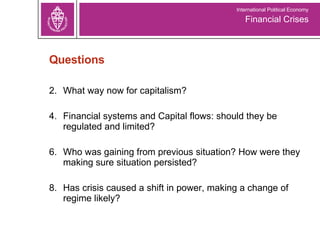

The document discusses several financial crises including the 1980s debt crisis, the 1997-98 Asian crisis, and the current subprime crisis. It analyzes the causes and impacts of these crises from an international political economy perspective. The document also examines historical patterns of economic regimes emerging after financial crises and questions whether the current crisis may lead to a new economic regime.