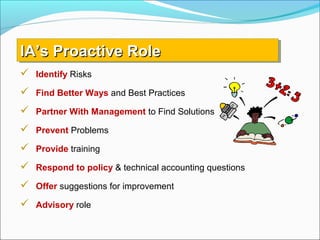

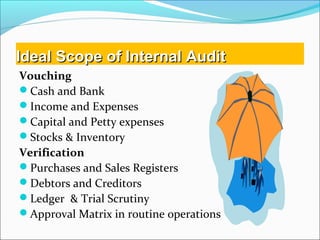

Internal controls should be built into business processes rather than added onto them. Internal auditing helps evaluate risk management, control, and governance processes to improve an organization's operations. It involves analyzing key processes and controls, evaluating control adequacy, testing compliance, and recommending improvements. The benefits of internal auditing include correct financial figures, timely work completion, and fraud detection.