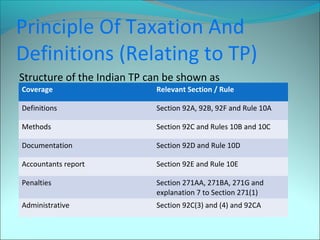

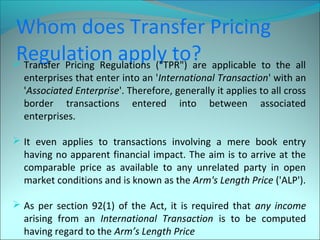

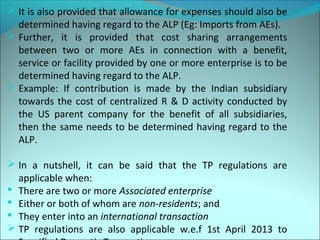

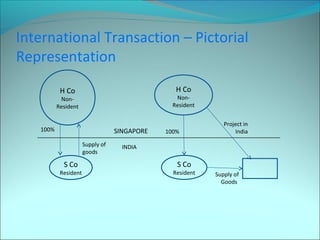

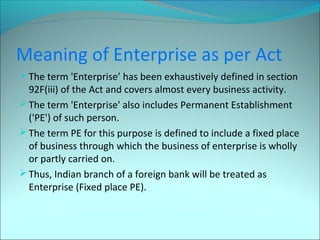

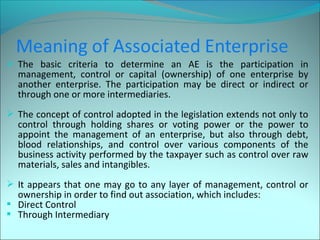

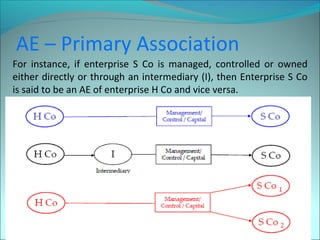

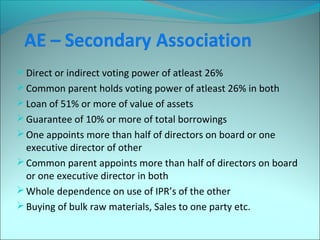

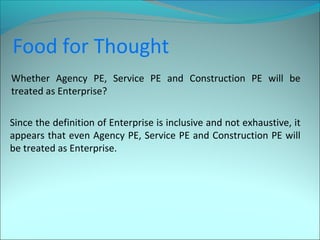

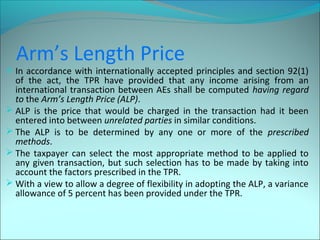

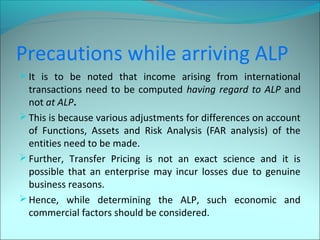

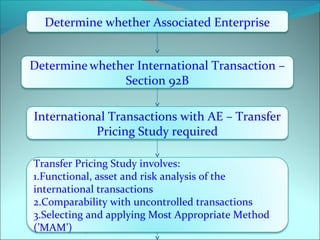

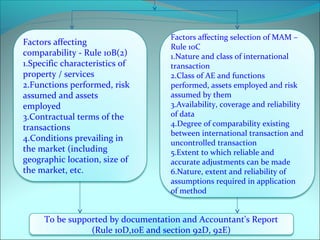

Transfer pricing regulations are needed to prevent tax avoidance through manipulation of transfer prices between associated enterprises. The government of India introduced detailed transfer pricing regulations to prevent Indian companies from avoiding tax by setting artificially low transfer prices for intra-group transactions. The regulations define key terms like international transaction, associated enterprise, and arm's length price to determine appropriate transfer pricing in cross-border deals between related parties.

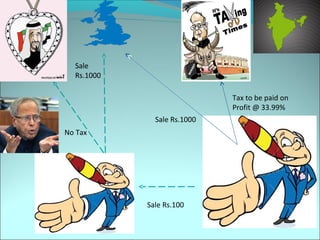

![ Impact if there are no Transfer Pricing Regulations in India:

In respect of sale to Mr. B (AE), taxable income will be Rs. NIL

(Since loss of Rs. 400).

Tax liability = NIL.

When Transfer Pricing Regulations are applied:

ALP = Price charged by A Ltd. to UAE. (Non AE) i.e. Rs.1,000.

Taxable income will be Rs. 500 (i.e. Rs. 1,000 – Rs. 500)

Tax liability = Rs. 170 [500*33.99%]

In absence of TP regulations, tax evasion in India = Rs. 170](https://image.slidesharecdn.com/641d8c3e-f192-4ca1-9f3c-f21c8b305ca9-141201213901-conversion-gate01/85/Ttransfer_pricing-7-320.jpg)