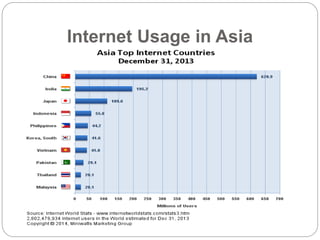

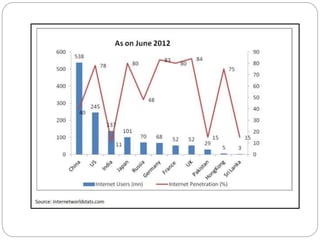

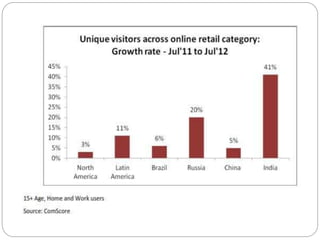

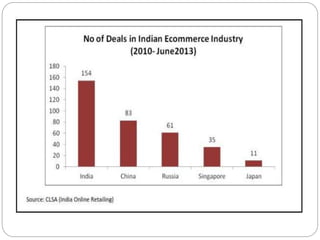

Ecommerce in India has grown rapidly, with the market estimated at Rs. 43,930 crore in 2013. India ranks third globally in internet users after China and the US. While ecommerce has seen strong growth, it still accounts for only about 1.5% of total retail sales due to low internet penetration from poor infrastructure. The industry is dominated by the travel segment at over 70% of transactions, while e-retail accounts for around 12.5%. E-retailing in particular is growing quickly at a 30.5% CAGR but still only makes up 0.2% of total retail sales in India. Allowing foreign direct investment in business-to-consumer ecommerce could provide needed funding