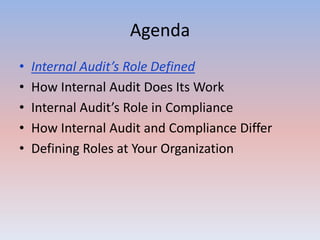

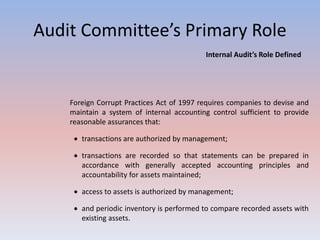

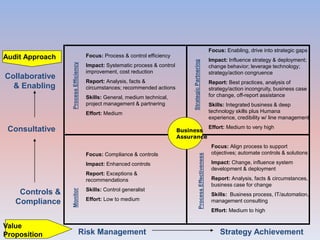

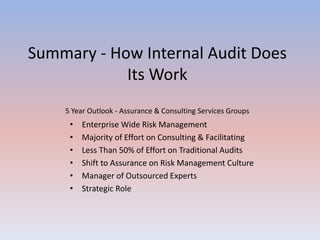

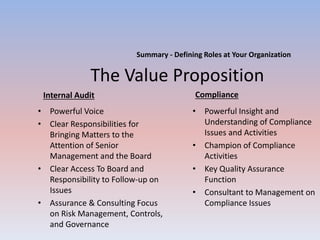

1. Internal audit's role is to support the audit committee by providing assurance on risk management, control, and governance processes.

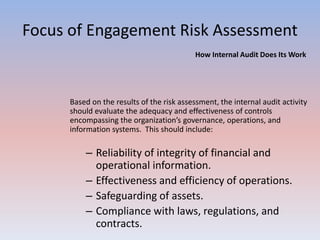

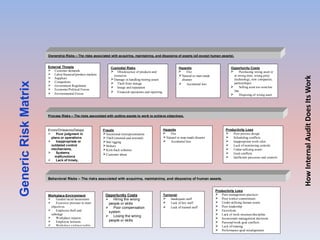

2. Internal audit conducts risk-based engagements by evaluating controls related to financial reporting, operations, and information systems.

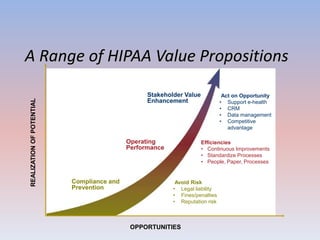

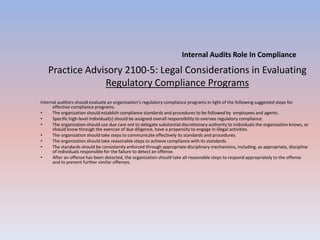

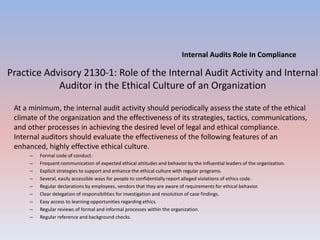

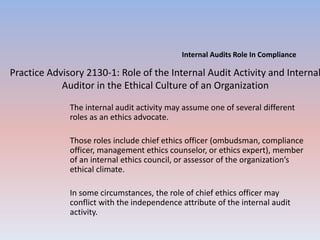

3. Internal audit can take on both assurance and consulting roles related to compliance by evaluating regulatory compliance programs and making recommendations to enhance them.