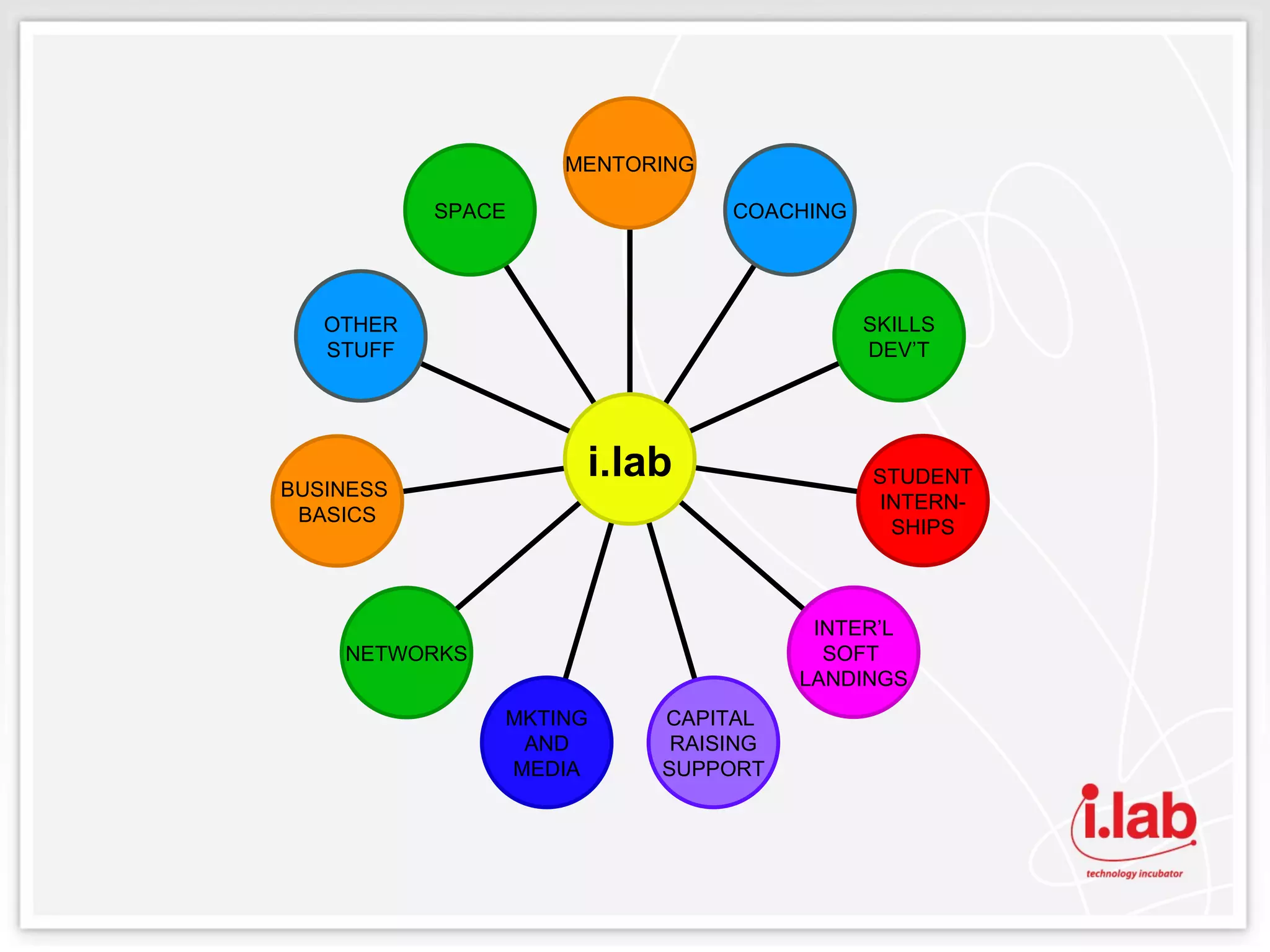

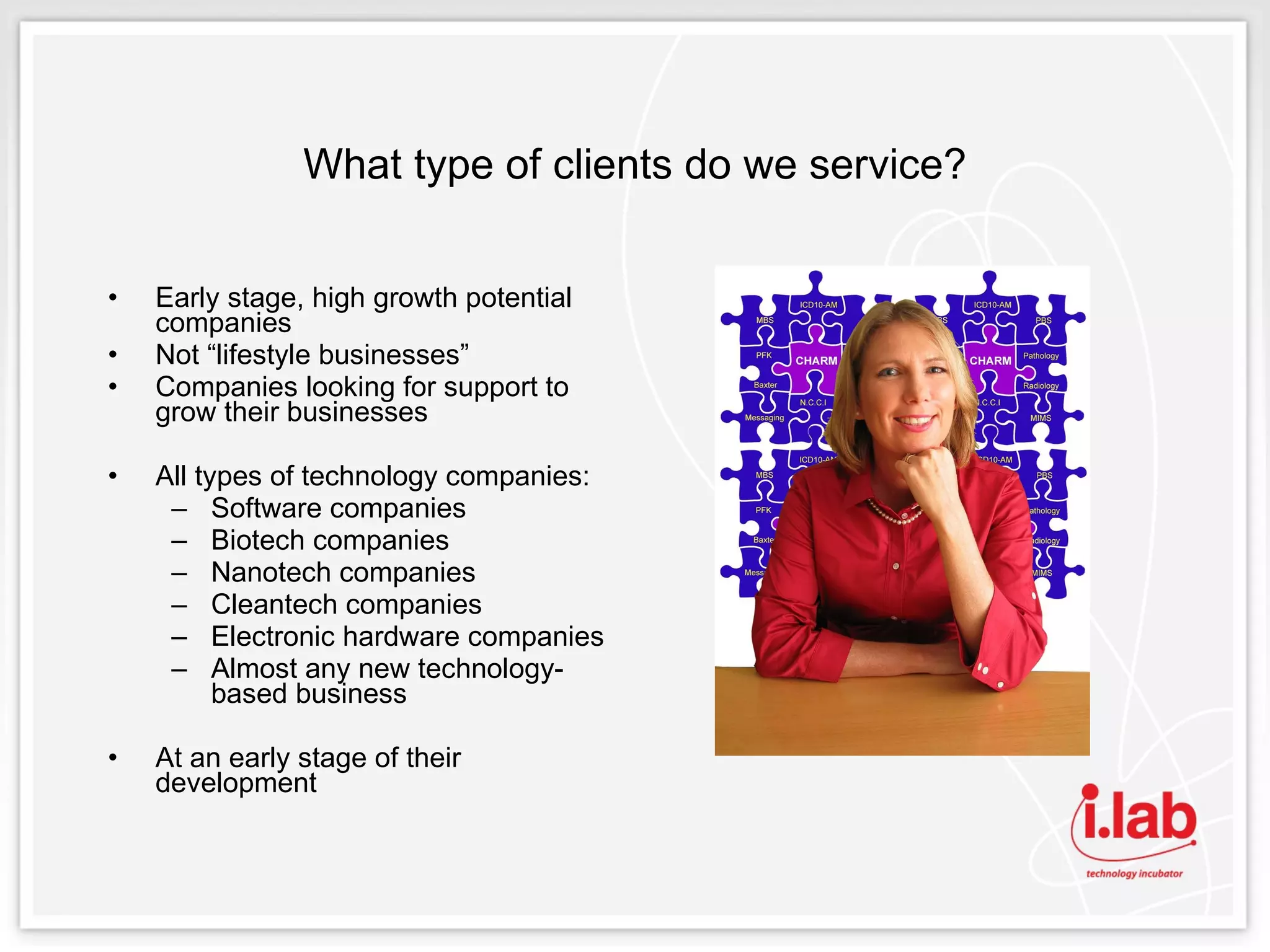

The document summarizes what services the i.lab Technology Incubator can provide for start-up companies. It offers resources and business support services to help early-stage, high-growth potential tech companies succeed. These services include office space, networking opportunities, marketing assistance, capital raising support, coaching, mentoring and more. The incubator aims to accelerate company development and help create sustainable businesses that will generate jobs and economic growth.

![Further reading - other Business Review Weekly Australian Anthill Lipper Current Weekly [email_address] e corner (Stanford University’s Entrepreneurship Corner) Slattery’s Watch Social networking sites Mashable Linked in Startup nation Techcrunch Biznic Young entrepreneur The Funded Cofoundr Perfect Business StartupNation](https://image.slidesharecdn.com/interactivemindsjuly2009nonotes-12601588327296-phpapp02/75/Interactive-Minds-July-2009-No-Notes-21-2048.jpg)