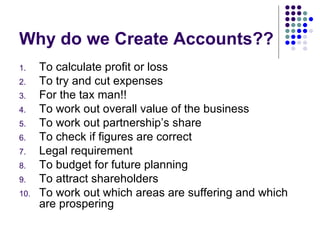

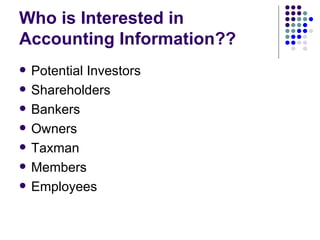

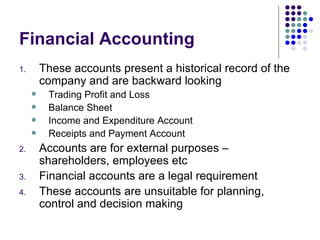

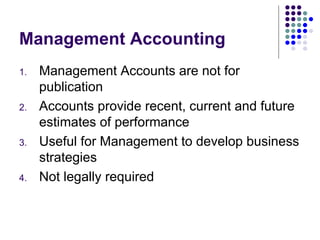

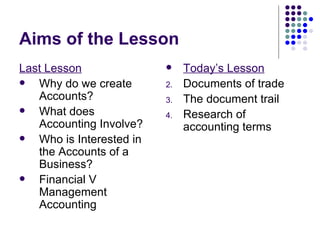

The document discusses accounting concepts including the aims of accounting, what accounting involves, and who is interested in accounting information. Specifically, it notes that accounting aims to calculate profit/loss, cut expenses, and work out the value of a business. Accounting involves identifying, recording, classifying, and measuring financial information. Potential investors, shareholders, bankers, owners, and tax authorities have interest in accounting information. It also distinguishes between financial accounting, which presents historical records for external users, and management accounting, which is used internally for planning and decision making.