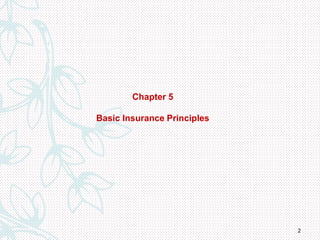

This document outlines several key legal principles of insurance:

1) Insurable interest requires that an insured benefit from or be prejudiced by the subject matter insured.

2) Utmost good faith requires honesty between the insurer and insured in negotiating and performing the insurance contract.

3) Indemnity means the insured will be fully but not over compensated for losses covered by the insurance policy.

4) Proximate cause limits insurer liability to losses directly caused by risks covered by the policy.

5) Contribution allows insurers to share liability when double insurance exists.

6) Subrogation gives insurers legal rights to recover losses paid from responsible third parties.

![4

INSURABLE INTEREST

A person who wishes to obtain insurance must have an insurable interest in the subject

matter to be insured. If there is no insurable interest, the contract is void and is

unenforceable. As a general rule, a person has insurable interest when he stands to

benefit by the existence or safety of the subject matter insured or he may be prejudiced

by its loss or damage thereto.

CASE LAW

Definition of insurable interest

CASE 5-1 Lucena –v- Craufurd 127 E.R. 630

In Lucena -v- Craufurd, Lawrence J. explained at p. 642:

“A man is interested in a thing to whom advantage may arise, or prejudice happen from the

circumstances which may attend to it… [I]nterest does not necessarily imply a right to the

whole, or part of the thing, nor necessarily or exclusively that which may be subject to provation,

but having some relationship to, or concern in the subject of the insurance, which relation or

concern by the happening of the perils insured against may be so affected as to produce a

damage, detriment or prejudice to the person insuring; and where a man is so circumstanced

with respect to matters exposed to certain risks or dangers, as to have a moral certainty of the

advantage or benefit… To be interested in the preservation of a thing, is to be so circumstanced

with respect to it as to have benefit from its existence, prejudice from its destruction.”](https://image.slidesharecdn.com/chapter5principlesofbasicinsurance-230616131035-22157e07/85/Chapter-5-Principles-of-Basic-Insurance-ppt-4-320.jpg)

![6

UTMOST GOOD FAITH

Section 17 of the Marine Insurance Act 1906 states:

Insurance is uberrimae fidei

A contract of marine insurance is a contract based upon utmost good faith, and if the

utmost good faith be not observed by either party, the contract may be avoided by the

other party.

INDEMNITY

The principle of indemnity in insurance law ensures that an insured who has

suffered or incurred loss, damage or liability as a result of the insured peril

happening is fully indemnified or compensated for such loss, damage or liability.

CASE LAW

Principle of indemnity

CASE 5-3 Castellian –v- Preston [1883] 11 Q.B.D. 380

In the case of Castellian –v- Preston, Brett LJ in affirming at p.386 that a marine or fire policy is a contract

of indemnity, reiterated that a contract of indemnity means that the assured shall be fully indemnified,

but shall never be more than fully indemnified in case of a loss against which the policy has been made.

That is the fundamental principle of insurance.](https://image.slidesharecdn.com/chapter5principlesofbasicinsurance-230616131035-22157e07/85/Chapter-5-Principles-of-Basic-Insurance-ppt-6-320.jpg)

![PROXIMATE CAUSE

An insurer is only liable to pay the claim under the policy if the loss was

proximately caused by the risk insured

Disputes on insurance claims before the court are dealt with by firstly ascertaining

the precise scope of the policy.

Secondly, the court will determine whether the loss is caused proximately by the

risk insured based on the facts of the case.

7

CASE LAW

Insured risks – loss of goods

CASE 5-4 Moore –v- Evans [1918] A.C. 185

In the English case of Moore –v- Evans, the plaintiffs, a firm of jewellers insured their stock against the risk of

‘loss and/or damage or misfortune… arising from any cause whatsoever’. Loss by theft or dishonesty was

excluded. A consignment of pearls sent to Belgium and Germany could not be returned to the insured due to the

outbreak of war between Britain and Germany in 1914. The goods in Germany remained in the hands of the

consignees whilst the goods in Belgium were placed in a bank, with the consent of the insured. The insured

made a claim for the loss of the jewellery.

The House of Lords decided that a policy insuring the loss of goods was primarily intended to cover the physical

loss of the goods. It did not cover economic loss or loss of business opportunity. It was held by Lord Atkinson at

p.191 that the detention of the goods abroad may be a misfortune to the plaintiff but it did not constitute loss or

damage to the property.](https://image.slidesharecdn.com/chapter5principlesofbasicinsurance-230616131035-22157e07/85/Chapter-5-Principles-of-Basic-Insurance-ppt-7-320.jpg)