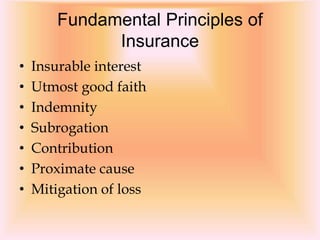

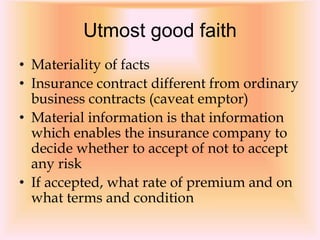

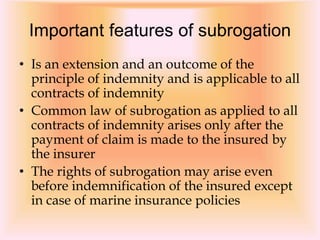

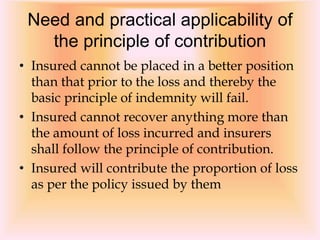

Insurance is a method of sharing and distributing risks among a large number of individuals through a system of pooling of risks. It provides protection from financial losses by allowing individuals to pay a small, regular premium in exchange for the insurer's guarantee to pay a large sum in the event of a specified loss. The key principles of insurance include utmost good faith, indemnity, subrogation, contribution, proximate cause, and mitigation of loss.