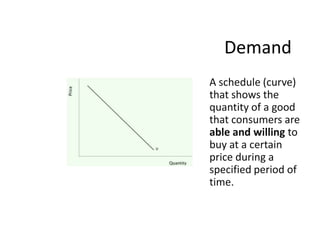

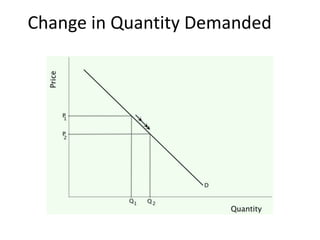

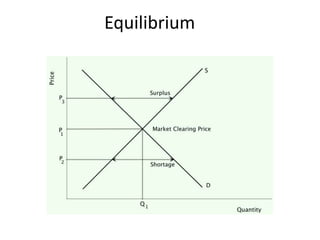

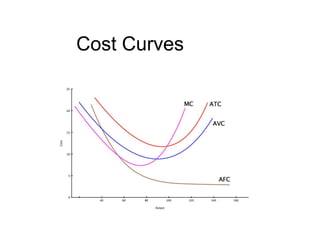

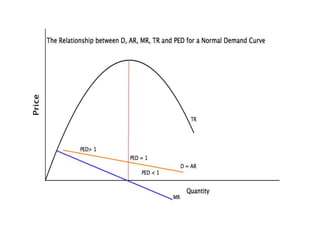

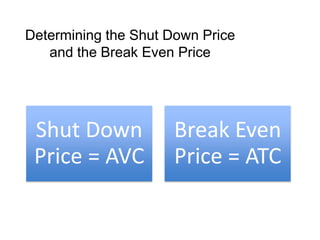

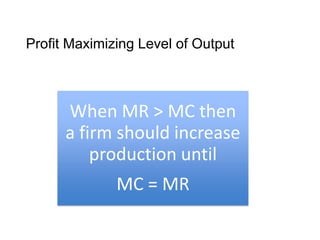

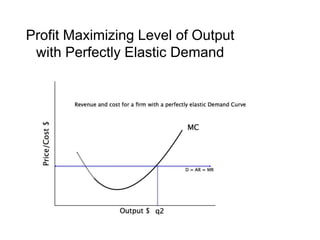

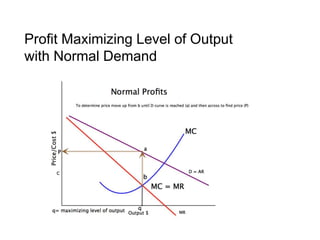

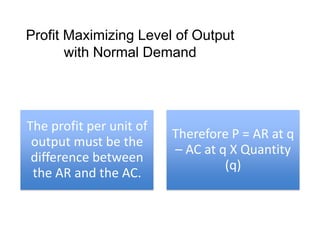

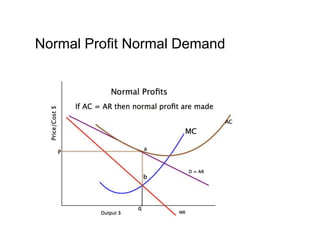

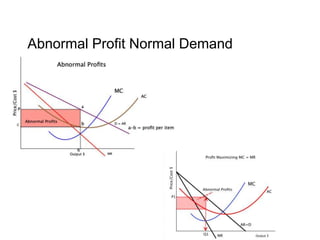

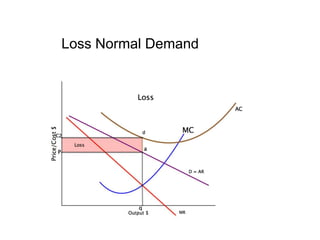

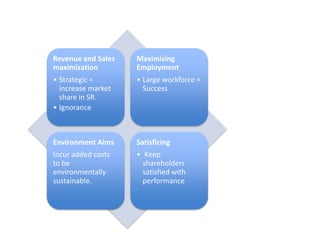

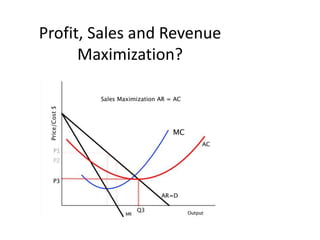

A market enables buyers and sellers to interact and determine prices for goods and services. This interaction allocates resources based on supply and demand. A firm aims to maximize profit by producing at the output level where marginal revenue equals marginal cost. The profit-maximizing level of output depends on the firm's cost structures and the demand for its products. Non-profit maximization goals include revenue or sales maximization, breaking even, or shutting down operations if prices fall below costs.