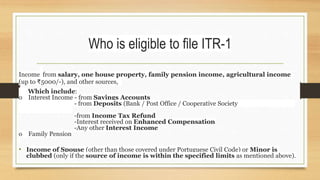

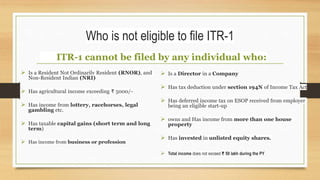

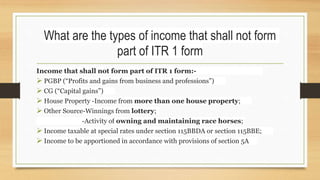

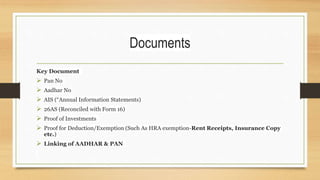

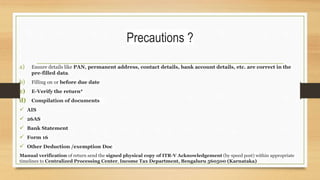

The document outlines the eligibility criteria for filing ITR-1 for the assessment year 2024-25, detailing types of income that qualify, including income from salary, one house property, family pension, and certain agricultural earnings. It specifies individuals who cannot file ITR-1, such as NRIs, those with agricultural income above ₹5000, and individuals with capital gains or business income. Additionally, it lists necessary documents for filing and precautions to be taken to ensure compliance.