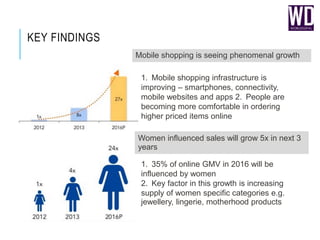

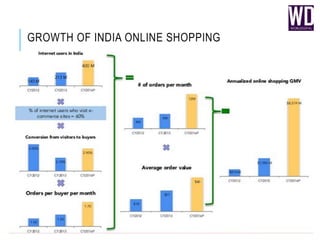

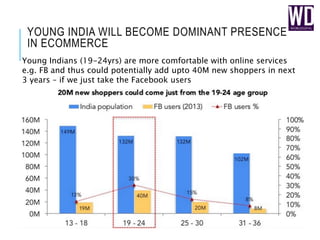

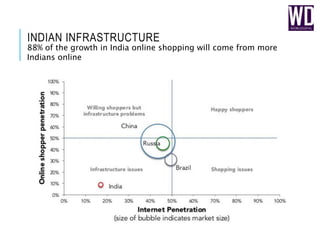

Online shopping of physical goods in India will grow to $8.5 billion in 2016, with the number of online shoppers more than doubling to 40 million. Key factors driving this growth include increased mobile shopping, rising order values, growth of fashion e-commerce, and more online penetration in tier-2 and tier-3 towns. Women will also influence 35% of online sales, up from 7% in the previous year.

![WORLDIGITAL IS A DISRUPTIVE FULL

SERVICE DIGITAL AGENCY. WE BELIEVE THAT

BOTH MEDIA & TECHNOLOGY ARE THE MOST

IMPORTANT FACTORS FOR BUILDING

BUSINESSES AND BRANDS IN THE 21ST

CENTURY.

414, SHIVAI PLAZA,

MAROL COOP INDUSTRIAL AREA

ANDHERI EAST,

MUMBAI - 59

Freephone: [+91-

9167361963]

E-mail: Sheldon@worldigital.in](https://image.slidesharecdn.com/indiaecommercelandscape-150715053202-lva1-app6891/85/India-ecommerce-landscape-25-320.jpg)