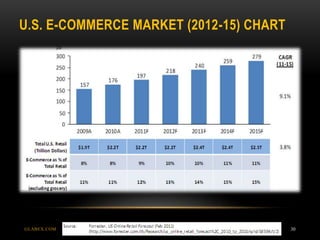

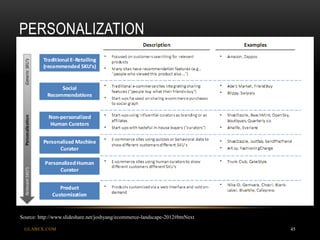

The document discusses various theoretical aspects of e-commerce market research for the US e-commerce market. It covers topics such as the stages of B2C e-commerce, competitive advantages of e-commerce including price competitiveness and timeliness, drivers for e-commerce including cost and flexibility, mobile e-commerce, e-business, electronic data interchange, and the integration of B2B systems. It also discusses recent trends in e-commerce business models such as social commerce, group buying, flash sales, recommendations, personalization, and C2C marketplaces.