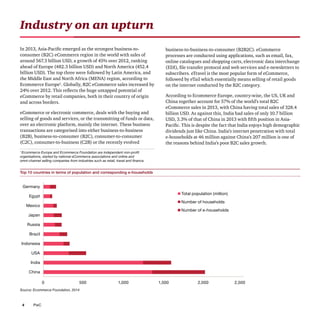

The document discusses the growth of eCommerce in India. Some key points:

- Ecommerce in India grew 34% annually from 2009-2014 to reach $16.4 billion, and is expected to reach $21.3 billion in 2015.

- Online retail and marketplaces (eTail) have grown the fastest at 56% annually over 2009-2014, reaching $6 billion in 2015. Books, apparel, and electronics are the largest product categories.

- Growth is fueled by India's large population and demographic dividend of young internet users, as well as expanding internet access. However, internet penetration remains low at only 19% currently.

- Major developments in 2014 include mobile becoming