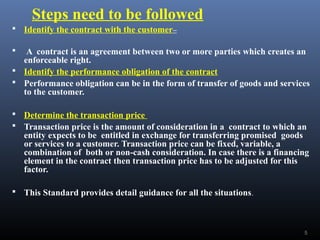

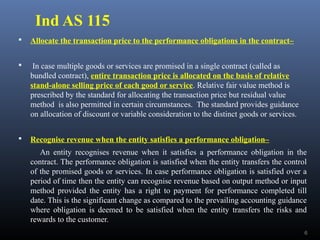

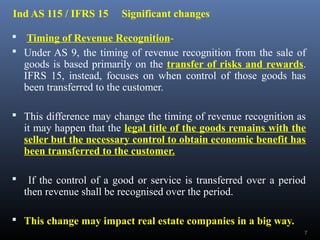

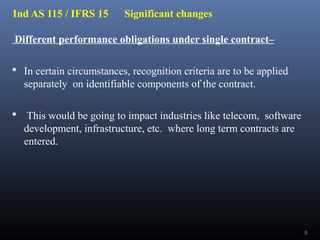

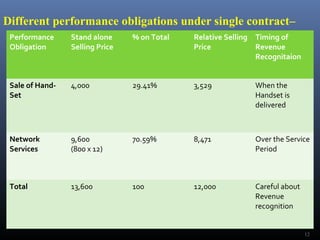

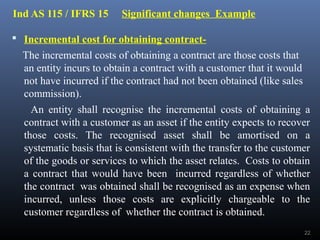

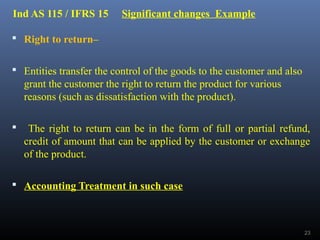

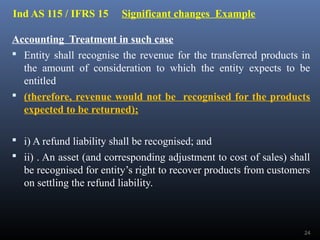

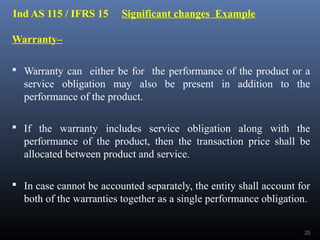

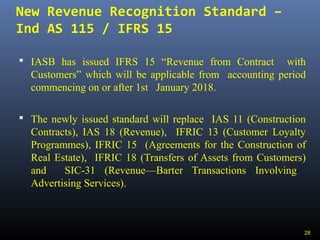

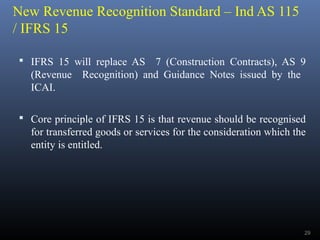

The document discusses the key changes and challenges in implementing the new revenue recognition standard Ind AS 115, which is based on IFRS 15. Some of the significant changes include focusing on control rather than risks and rewards for timing of revenue recognition. It also requires identifying separate performance obligations in contracts and allocating the transaction price to each. This will impact industries like telecom and software development. Other challenges discussed are accounting for contract modifications and transactions containing financing elements.